Lidl shows resilience against Biedronka and Dino

Lidl has taken the lead in revenue growth on same sales areas among Polish top grocers. For the first time the German discounter’s like-for-like figures exceed those of grocery market leader Biedronka and national challenger, local supermarket hero Dino. The fight for price leadership between Lidl and Biedronka and a steep increase in hourly minimum wage from the beginning of the year put pressure on profitability.

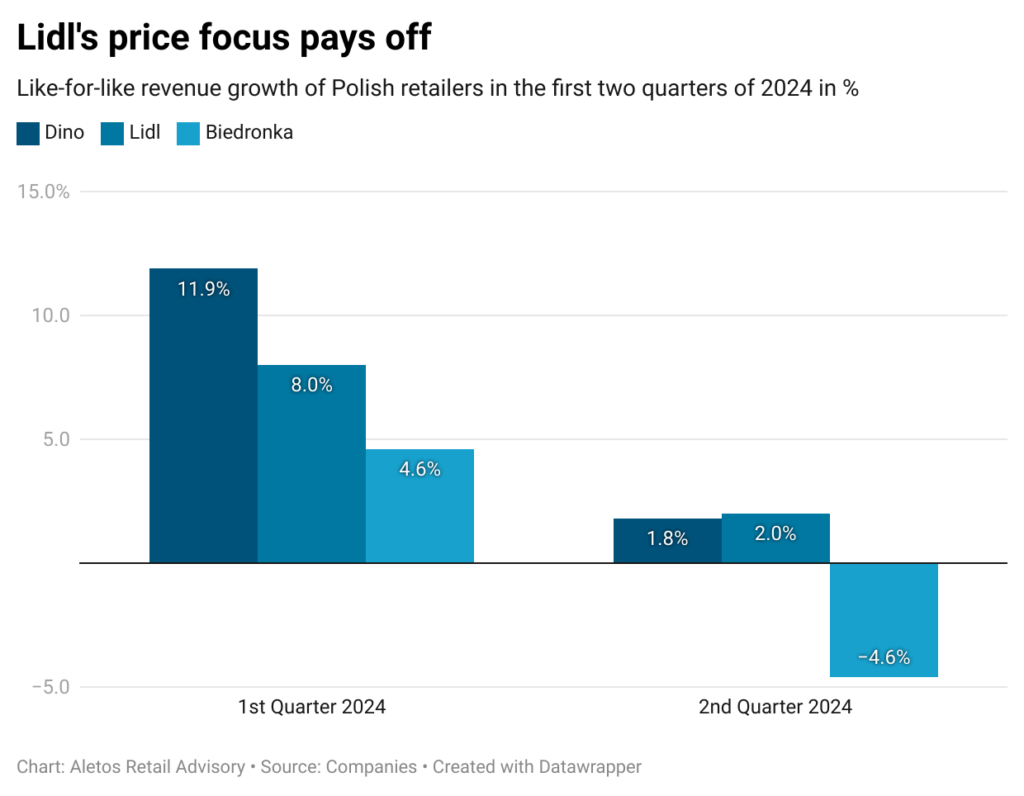

Lidl Poland has outperformed its main rivals in the Polish grocery market – discount leader Biedronka and local supermarket hero Dino – in the second quarter of this year.

In its recently released Q2 figures, Poland’s number four national grocer Dino posted like-for-like (LFL) growth of 1.8% for the three months to July. Although this is still better than the negative LFL of -4.6% previously reported by market leader Biedronka, it is the first time that Dino’s performance indicator has fallen behind that of national number two Lidl. The German discounter announced a LFL figure of ‘more than 2 per cent’ for the second quarter earlier this year. Like-for-like sales do not include sales from new stores opened during the period and are therefore seen as an indicator of a retailer’s competitiveness in the market.

Still in 2022, the year with the latest available balance sheet data for all three retailers, Biedronka (Jeronimo Martins Polska) and Lidl (whose financial year ended at the end of February 2023) were head-to-head in terms of relative revenue growth. Biedronka increased its sales by 24.1% in local currency in 2022, as did Lidl. Like-for-like growth for both retailers is estimated by the author to be 20.5%. Dino, on the other hand, grew its sales far ahead of both rivals, by 48.2%, of which 28.5% came from like-for-like sales.

One reason for Lidl’s positive sales development could be its increased focus on price. Since the beginning of the year, the German discounter has been competing with the market leader Biedronka, which is many times larger, for the crown of price leader in the Polish grocery sector. In almost weekly media campaigns, the two retailers try to undercut each other on food prices.

The renewed focus on price, combined with a slowdown in food inflation and higher staff costs, is putting pressure on profitability. For the first six months, Dino reported a consolidated net profit margin of 4.6% compared to 5.2% in the same period last year. Much of the decline was due to higher sales and marketing costs, which rose from 15.5% of net sales to 16.3%. The net profit margin of Biedronka’s parent company, the Portuguese company Jeronimo Martins, also fell to 1.6% in the first half of this year, from 2.5% in the same period last year. Biedronka’s IFRS16 EBITDA margin in euros fell from 8.5% in the first half of 2023 to 7.6% in the first half of 2024. No data is available for Lidl, but the Polish subsidiary, as a pilot country for Lidl’s international operations, has invested heavily in self-service checkouts and electronic shelf labels, which may have been a preemptive move to keep staff costs under control. From the beginning of this year, the minimum hourly wage in Poland was increased by 17.9% from 23.5 to 27.7 Polish zlotys (5.5 to 6.5 euros).

Related news

Lidl Magyarország wins Top Employer award once again

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Carrefour Poland Doubles Retail Media Revenue

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >