Aldi aims to extend its international lead over Lidl

Aldi strives to curb Lidl’s international expansion plans. In Lidl’s most important international markets in the US and in the UK Aldi has launched massive investment programmes to expand footprint and market share. Aldi has to counterbalance Lidl’s lead in the highly profitable emerging markets of Central & Eastern Europe as well as in other strategic areas such as customer loyalty or own production of private labels.

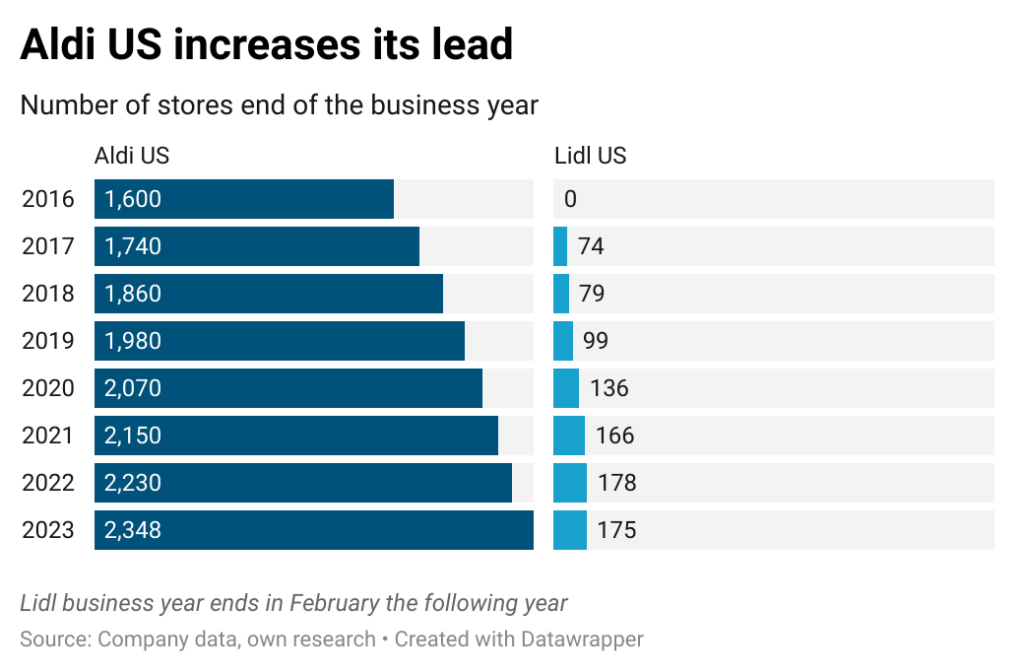

Aldi in the US takes the next step towards a nationwide presence. The company has earmarked 9 billion US-dollars to open an additional 800 to the existing store estate of 2360 locations by the end of 2028. The investment is directed towards 330 new store openings in the current area of presence in the Northeast and Midwest, the conversion of the majority of 400 Winn-Dixie and Harvey supermarkets in the Southeast acquired in August last year as well as towards expanding its footprint into new territories such as California and Phoenix. Also in the UK, where Lidl in terms of market share is close on Aldi’s heels, Aldi has announced a half-billion British pound investment program into the store network for the current business year.

Meanwhile competitor Lidl, who so far has not yet reached the level of traction with American customers as initially expected at the time of its market entry in 2017, strives to better adapt to local market reality. With recent new additions to the executive team, the retailer brings in concentrated US-retail-expertise. Four new executives have joined the American leadership team. At the top, new Executive Vice President of Purchasing and CCO Miguel Paradela brings with him 25 years of experience at Lidl in Spain, where the discounter is positioned against the price-oriented supermarket operator Mercadona several times bigger than the German discounter. All other new managers have a proven track-record in US retail. Moreover, all of them have extensive experience at dollar store competitors, a format that for Lidl in Europe only recently has appeared on the radar. Two of them also have a professional history with Save-A-Lot, the American discount supermarket chain store Kenneth McGrath, current CEO of Lidl international led until summer 2021.

Aldi and Lidl are playing a game of global chess. And high inflation and interest rates are playing in Aldi’s favor – against Lidl. Due to a lesser dependency on external financing Aldi can keep investing into market share in its core markets. Lidl in the past twelve months has stepped on the brakes of its expansion program to be able to invest in price competitiveness.

Aldi needs to curb Lidl’s expansion plans outside of Europe, because the Schwarz-Group discounter in Europe is strategically better positioned than the two Aldis. Lidl has almost fully covered the emerging markets of Central & Eastern Europe and despite the negative economic impact of the war in Ukraine can use this region as cash cow for its other European and international activities. In the long-term, Lidl’s presence in the Baltics and in Poland also might serve as a steppingstone into Ukraine and possibly farther into Eastern Europe. The designated Lidl executive for Ukraine, Adam Miszczyszyn, has been reassigned as the discounter’s CEO for the Czech Republic, a country market in Central Europe that is bridging east and west. So far Aldi Süd’s presence in the US, the United Kingom, in Australia as well as in China has been the counterbalance for Aldi’s comparatively weak presence in these emerging markets of Europe.

At the same time Lidl’s parent company Schwarz Group is vertically integrated into core production areas. Schwarz Produktion, the production arm of the holding, consists of mineral water plants, coffee roasteries as well as factories for chocolate, dried fruit, backed goods as well as ice cream. With the PreZero waste disposal organization, an own cloud and cybersecurity business as well as the Tailwind shipping line Lidl parent company Schwary Group is much farther integrated than Aldi. The two Aldis, in contrast, for the past half century have been operating coffee roasteries and only in 2022 ventured into mineral water production.

Lidl also has an ace up its sleeve thanks to its Lidl Plus customer loyalty program. Although the discounter so far does not offer dedicated individual promotions, in the evolution process towards a stronger personalization Lidl is one step ahead of Aldi. With industry sources hinting at a possible launch of personalized Lidl Plus offers still this year in several countries, the Schwarz discounter will be able to put competitors under pressure without having to invest as heavily in margin as in the past.

This is certainly one reason Aldi Nord and Aldi Süd are pushing the integration of business areas in Germany and on international level. The alignment of private labels, IT systems and business processes all point to a possible reunification of both Aldis in the future. Since the two companies operate in geographically different markets – in Germany as well as internationally – a merger would most likely meet no resistance at competition agencies in charge. The resulting commercial and operational synergies would help strengthen competitiveness against Lidl globally.

Related news

Aldi Ireland Announces €5m Investment In Green Energy Solutions

Aldi Ireland has announced a €5 million investment in green,…

Read more >Sainsbury’s To Launch Unified Retail Media Platform, Nectar360 Pollen

UK retailer Sainsbury’s has announced plans to launch Nectar360 Pollen,…

Read more >New Product Launches In Spain Hit New Low, Study Finds

Innovation in Spain’s FMCG sector is at a record low,…

Read more >Related news

Corporate leaders’ commitment to sustainability at record level

According to the latest data from the K&H Sustainability Index,…

Read more >FAO food price index rose slightly in June due to higher prices of meat, dairy products and vegetable oils

The Food and Agriculture Organization of the United Nations (FAO)…

Read more >What can cause the price of a wine to increase tenfold?

There are fewer of them worldwide than the number of…

Read more >