NGM analysis: Hungarians spend abroad and on online marketplaces

In the first half of 2024, the consumption habits of the Hungarian population underwent significant changes, which were primarily shaped by the inflationary crisis and the war environment. Despite the moderation of inflation and the growth of real wages, the caution of households is only slowly dissolving, and this determines their consumption decisions. In recent months, the willingness to save has strengthened, while the increase in retail consumption has taken place more in foreign markets and online platforms. Based on the analysis of the experts of the Ministry of National Economy, Gergely Suppan and Tamás Kisfaludy, the following trends can be observed in the economic behavior of Hungarian households.

Although real wages started to grow significantly in 2024, instead of a strong expansion of consumption among the Hungarian population, increasing savings came to the fore. Caution is only slowly easing, which is well reflected in the financial behavior of households. The aim of the population is to restore the real value of the savings that were reduced in previous years, which is clearly reflected both in the increase in deposits and in the increase in securities transactions. Despite the decrease in inflation, the role of financial instruments offering high yields as an incentive to save remained strong.

According to data from the Ministry of National Economy, the savings rate at the beginning of 2024 rose to a level not seen for decades, to nearly 16%. At the same time, the net financing capacity of households, i.e. their financial savings, expanded to a record extent: in the first half of 2024, it amounted to HUF 4,250 billion, which is HUF 847 billion more than in the same period of the previous year. This amount represents 47% of the total retail turnover in the same period, which clearly shows the prioritization of savings over consumption.

Related news

Eurozone economic growth accelerated in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

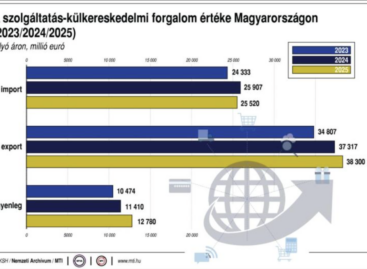

Read more >KSH: The foreign trade surplus in services was 3.1 billion euros in the fourth quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How does the forint exchange rate affect consumer prices?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

MBH Analysis Center: The Hungarian economy may accelerate again in 2026, but the Iranian war carries serious risks

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >SPAR is preparing for an Easter rush: it is filling its stores with 570 tons of smoked meat products

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Focus on the domestic fishing sector at SIRHA Budapest

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >