NGM: We are helping the hospitality sector with a 100 billion forint action plan

The government is giving priority to the situation of the hospitality sector, which is one of the most important driving forces of tourism, and is continuously working to make the daily operations of restaurants easier, the Ministry of National Economy (NGM) said in a statement sent to MTI on Friday.

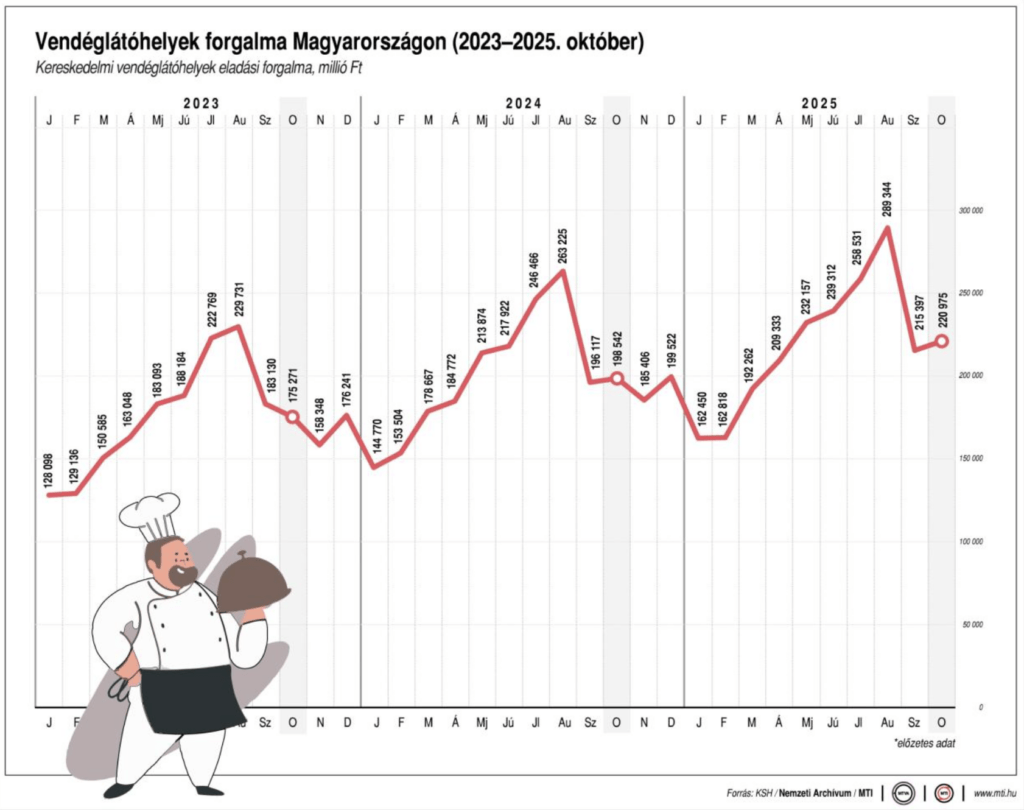

Sales turnover of commercial catering establishments, million HUF

The announcement highlighted that the negative external effects of recent years – the coronavirus epidemic and the increased energy costs due to erroneous decisions in Brussels – have placed a significant burden on the sector. The government has therefore developed an action plan consisting of 5+1 elements, mobilizing a total of approximately 100 billion HUF to help catering businesses. The social consultation of the relevant legislative amendments has begun and will soon be published in the Hungarian Gazette.

The ministry explains that the government is building a peace economy instead of a war economy: Hungary is not using its resources to finance the war and Ukraine, but to support Hungarian families and businesses. The action plan to help restaurants also proves that the government is supporting the strategic sectors of the Hungarian economy with decisive, tangible measures.

The aim of the action plan is to improve the liquidity situation of the hospitality sector, temporarily relieve it, reduce undeclared work, and help retain and attract the workforce back into commercial hospitality. To this end, the government decided on 5+1 measures.

First, entertainment related to restaurant consumption will become tax-free. Businesses can deduct entertainment related to restaurant consumption tax-free up to 1 percent of their sales revenue, but not more than 100 million forints per year. The discount exempts the allowance from personal income tax and social contribution tax, thereby encouraging the use of restaurant services for entertainment purposes. Businesses operating according to the normal business year can take advantage of the opportunity as early as January 2026.

According to the second measure, the amount of the tourism development contribution will be halved. In the case of restaurant catering services, the tourism development contribution rate will be reduced from 4 percent to 2 percent. The discount will be applied for the first time from the return including February 1, in accordance with the VAT return.

Thirdly: the possibility of applying a service charge will be expanded. Restaurants will be given the opportunity to distribute up to 20 percent of the sales revenue serving as the basis for the service charge (in practice, the revenue from food and beverage consumption including VAT) as a service charge among their employees, even if the given restaurant does not charge a service charge. The preferential payment cannot replace the minimum wage or the guaranteed minimum wage; preferential taxation can only be applied to benefits above these levels up to a specified amount. The payment is exempt from personal income tax and social security contribution tax, only 18.5 percent social security contribution is deducted.

The new rule does not change the appearance of the receipt given to the guest, and a maximum of 15 percent service charge can still be included on it. The previously applied service charge rules remain unchanged, with the exception that a larger portion of the sales revenue can be calculated and paid according to the service charge rules. The relief will be applicable from February 2026, first for wages paid in March.

According to the fourth measure, the Kisfaludy Tourism Credit Center’s schemes will be expanded. In addition to the existing favorable loan products, new schemes combined with non-refundable support will become available to restaurants. In the case of taking out a loan of up to 5 million forints under the KTH Start program, an additional loan of up to 5 million forints will be available.

Related news

Richárd Szabados: the Széchenyi Card multifunctional product package provides businesses with a solution for their specific life situations

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >France remains the world’s number one tourist destination

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Loading, Please Wait!

This may take a second or two.