The FMCG retailer ranking for 2019 is out – Lidl takes the second place behind Tesco

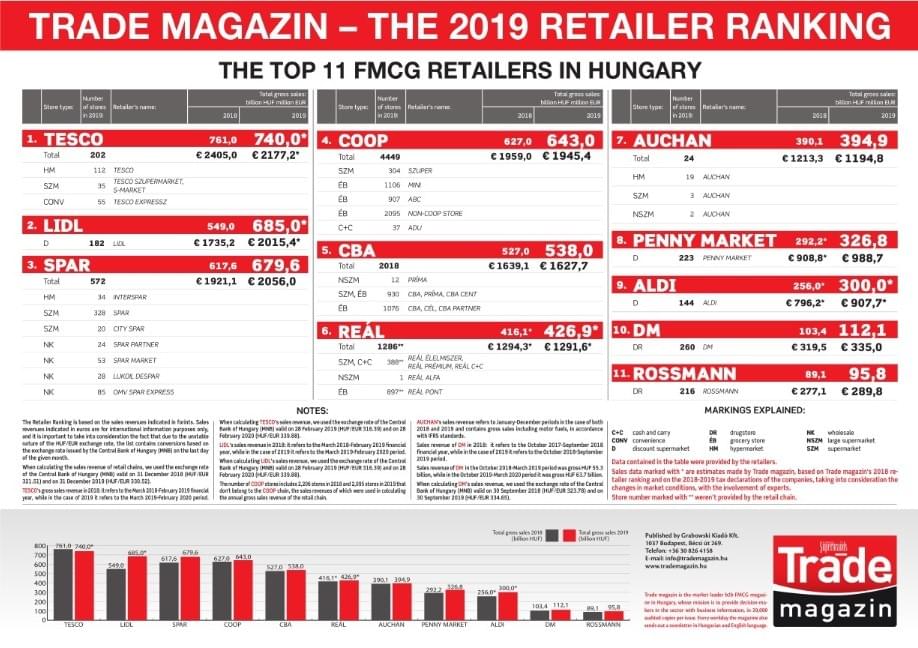

Every year Trade magazin publishes the FMCG retailer ranking of the previous year in the first days of June. The biggest surprise in the 2019 ranking is that Lidl climbed two places to take the second position in terms of sales revenue expressed in forints. SPAR finished third in the ranking and is very close to Lidl.

Thanks to Lidl’s big leap forward, the 4th, 5th and 6th places went to the Hungarian-owned retail chains COOP group, CBA and Reál. In their case it is important to note that although sales only grew by a few percent, this result was achieved by fewer stores than last year, so the sales growth per store was much bigger than the numbers indicate. Just like last year, Auchan is in the 7th place, which indicates a result that corresponds to the market share of hypermarkets. Ranked 8th and 9th, sales by Penny Market and Aldi increased by double digit numbers in 2019. Drugstores chains dm and Rossmann close the list – they continued their expansion with excellent performances last year.

Ms Zsuzsanna Hermann Zsuzsanna, managing director and editor-in-chief of Trade magazin

– For years there has been no change in the Top 3 up until now. We have heard it from experts for a while that discounters are the biggest winners of the market growth, with a 27-28 percent market share in value, but not many people would have thought that a discount supermarket chain finishes 2nd in the 2019 retailer ranking – told Zsuzsanna Hermann, managing director and editor-in-chief of Trade magazin. – The sales growth of the retailers featured in our ranking was around 6 percent, but if we also include those market players that aren’t on the list, the increase in sales can be up at 7 percent.

According to data from the Central Statistical Office (KSH), in 2019 the GDP was 4.9 percent, the inflation rate was 4.7 percent, the level of unemployment was 3.4 percent and real wages increased by 11.4 percent. At approximately 127,000 points of sale – about one third of which are FMCG stores – shoppers spent HUF 12,000 billion, nearly half of this went to FMCG products. Last year consumer prices were up 3.4 percent and sales increased by 6-7 percent. Data on the 17,000 stores audited by Nielsen, the numbers from the 4,000 households GfK monitors and the sales results of the Hungarian-owned chains – they are responsible for more than 40 percent of retail sales (calculated together with those not included in the ranking) – that RetailZoom focuses on basically reveal the same about the FMCG market.

Although shopping frequency was down a little according to data from GfK, the sum spent per occasion was up nearly 8 percent last year. Nielsen’s consumer confidence index also backs the numbers, as the higher the index value is, the more willing the shoppers are to spend – Hungary followed in the footsteps of the 2-point decrease in the European average, as the Hungarian index stopped at 78 points last year. Online retail has had a bigger impact on the FMCG market than before. Last year the total online market got 16 percent bigger and realised gross sales in the value of HUF 625 billion. From this FMCG’s share was about10 percent.

Las year was about major investments and important development projects for almost every retail chain, and this didn’t only mean opening new shops and refurbishing stores, but also modernising store interiors, expanding the private label product selections, making operations more sustainable, and retailers were also busy realising CSR projects.

– We must also mention the progress retail chains made in the field of online services, as those which already had an online shop improved it, while the ones that weren’t doing e-commerce yet launched their online stores. This step came just in time: our world changed completely in mid-March in basically just two weeks – said Zsuzsanna Hermann. – What we can see from the first five months of the year is that the steady development of the market in the last few years has now come to a halt. How much we can save from the market? I will only be able to answer this question one year from now.

Methodology:

The Retailer Ranking is based on the sales revenues indicated in forints. Sales revenues indicated in euros are for international information purposes only, and it is important to take into consideration the fact that due to the unstable nature of the HUF/EUR exchange rate, the list contains conversions based on the exchange rate issued by the Central Bank of Hungary (MNB) on the last day of the given month.

Data contained in the table were provided by the retailers themselves.

Sales data marked with* are estimates made by Trade magazin, based on Trade magazin’s 2018 retailer ranking and on the 2018-2019 tax declarations of the companies, taking into consideration the changes in market conditions, with the involvement of experts.

Related news

EU Commissioner: New regulation strengthens protection for farmers and smaller suppliers in the food chain

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >AMC: Hungarian organic products can be presented in Germany

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Discover the solutions of the future on Startup Island! (Part 1)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >