MBH Bank analysis: Overall, this year’s annual inflation rate could be 4.1%

The last time the rate of price increase was at a similar low level was in August 2021. The change compared to the previous month was +0.7%, which reflects a more restrained revaluation dynamics at the beginning of the year than we have seen in the last two years.

The fact that core inflation decreased from 6.1% to 5.1% indicates easing inflationary pressure. The process was helped by the base effect, but the increase in the price of food products representing significant weight also moderated beyond expectations. Despite the fuel price increase recorded for the month under review, the price increase in the “other articles and fuels” category also fell short of our expectations. Decreasing inflation was also supported by the fact that, despite the annual weakening of the forint, the price of consumer durables continued to fall, and a more moderate rate of price increase was also experienced in the case of alcohol and tobacco products and clothing items, at the same time, disinflation is slowed down by the fact that in the case of services, the double-digit , a 10% price increase in February.

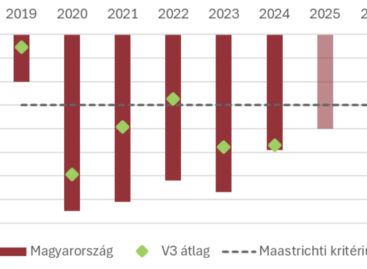

Overall, this year’s annual inflation rate could be 4.1%; while the processes seen in the case of foodstuffs can support disinflation, until then the weakening forint exchange rate, if no positive correction comes, represents an upward inflation risk in addition to the development of wages. In addition, the main issue at the moment is the return to the central bank inflation target after the rapid decline in inflation seen so far, as the central bank inflation target and price stability of slightly below 3% are not expected to be reached until 2025 at the earliest, and even then the annual average inflation may be slightly above the target . February’s inflation data allow the central bank to continue the interest rate cut, however, the expected development of the country’s risk assessment in the next two weeks is also a factor that may influence the rate of interest rate cut.

Related news

MBH Bank: Employment barely improved in May

In May, the number of employed people among the working-age…

Read more >GKI Analysis: This is why the 2026 budget is unsustainable

The Parliament adopted the 2026 “anti-war” budget, which, according to…

Read more >Private Labels Are Quietly Winning Europe’s Grocery Shelves

Private labels are no longer just catching up – they…

Read more >Related news

What makes us add the product to the cart – research

The latest joint research by PwC and Publicis Groupe Hungary…

Read more >Energy drinks are now legal: what every shopkeeper should know

New regulations on the sale of energy drinks came into…

Read more >Tens of millions with one opening tab – the biggest prize draw in XIXO history has started

This summer, XIXO is preparing for a bigger launch than…

Read more >