Lidl steps up expansion

Lidl has taken its foot off the brake when it comes to expanding its international store network. The German discounter is focusing its store opening program on countries where it faces much larger grocery market leaders. At the same time, the Schwarz Group discounter is determined not to allow Aldi to gain the upper hand. In its home market of Germany, Lidl has optimized its store network.

Sebastian Rennack

international retail analyst

Aletos Retail

Lidl is cautiously accelerating its expansion in international markets. In the current fiscal year 2024/2025 ending in February, the discounter already opened 177 stores worldwide, compared to 163 for the entire previous business year. At the end of August, at half term, Lidl had only 42 net new stores worldwide. Even considering that the majority of store openings traditionally take place in the second half of the calendar year, the current development could mean that Lidl has taken its foot off the brake when it comes to expanding its international store network.

The company had significantly slowed down its store opening program in the previous fiscal year 2023/2024. The net number of new stores opened fell from an average of around 340 in the previous years to almost half of that. The main reasons were rising construction costs and higher financing costs. Over the past two years, Lidl’s international arm, Lidl Stiftung & Co. KG, has seen a massive increase in net interest payments on loans. The figure jumped from around 150 million euros in 2021 to 360 million euros in 2022, and then doubled again to 720 million euros in the last fiscal year ending in February 2024.

Closing the Gap to Local Market Leaders

Lidl’s international business is where the biggest investments are being made to expand its sales area. Lidl is trying to increase its market presence especially in countries where the discounter’s market penetration is still low and where it is competing with strong local heroes. At the same time, Lidl is keeping an eye on its global discount rival Aldi, which is also investing heavily in its international presence.

Poland

Among Lidl’s international country portfolio, Poland leads the way with 38 net store openings to 930 stores in the past 10 months. Here, the Portuguese-led Biedronka posted net sales of 21.6 billion euros in 2023, an increase of 15.3% year-on-year, according to financial data. Lidl in its slightly delayed fiscal year 2023/2024 reached 8.4 billion euros, a plus of 13.8%. As in previous years, the German discounter’s sales development in percentage terms was comparable to that of the Polish local discount giant, but in terms of market share, thanks to its size, Biedronka has continuously widened the gap. Aldi Nord, which has a low single-digit share of the Polish grocery market, has also declared the country one of its priority markets for expansion. The German discount pioneer’s store network counts 362 stores, compared to 305 a year ago. Aldi has repeatedly stressed that it sees a potential of 500 stores in the country in the near future and 1,000 stores in the long term.

Italy

More prominent than in the past on Lidl’s European retail map is Italy as the second expansion country with 34 net store openings to 781 stores. Still in September, the discounter’s management announced plans to invest 400 million euros in a store opening program with 40 new stores within six months. Lidl is keeping its distance from Aldi Süd, which opened the same number of stores in the full fiscal year with 34 new locations, but with a much smaller footprint of now 187 discount stores.

Both players do not yet play a major role in Italian food retailing. National retailers Conad and Selex both posted net sales of just over €20 billion in fiscal 2023, or 15.0% of the sector’s market share. At that time, according to NielsenIQ’s Consumer Goods Guide for the second half of 2023, Lidl ranked 7th among national grocers, with an estimated market share of 6.0%.

Spain

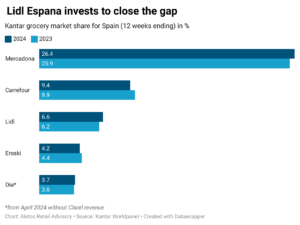

In Spain, Lidl has opened 22 new stores since March 2024, bringing the total number of stores to 700. Meanwhile, Aldi Nord ended the calendar year with more than 470 stores in Spain, 35 more than at the beginning of the year. As in Poland and Italy, the two German discounters are up against a strong market leader, low-price supermarket operator Mercadona.

Although analysts estimate Mercadona’s year-on-year sales growth at 1.9% and Lidl’s at 6.5%, the discounter is outpaced in absolute terms by its competitor, who is four times larger. For the latest available data at the beginning of December, Kantar puts Mercadona’s market share at 26.4% (up 0.5 percentage points year over year) and Lidl’s at 6.6% (up 0.4 percentage points).

United Kingdom

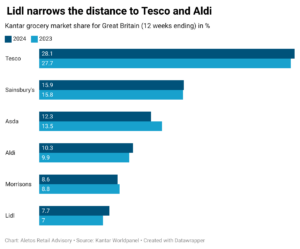

The most fiercely contested market for both, Lidl and Aldi, however, is the United Kingdom, where both are competing neck-and-neck. By the end of December, Lidl had opened 13 new stores in Great Britain and Northern Ireland, reaching a total of 1,018 units. Aldi South ended the year with 1,045 discount stores compared to 1,025 a year earlier. For 2025, Aldi UK announced an investment plan of 650 million pounds (around 790 million euros), including the opening of 30 new stores. Aldi’s long-term goal is to have 1,500 stores in the UK.

In contrast to other expansion markets, where Lidl and Aldi have not yet been able to gain on the respective market leaders, both are steadily improving their positions in Great Britain. According to Kantar, Lidl’s market share in Great Britain was 7.7% at the beginning of December, up 0.7 percentage points year-on-year. Aldi increased its share to 10.3%, up 0.4 percentage points. Tesco also improved its position, albeit could not grow faster than the smaller discount competition and added 0.4 percentage points to 28.1% market share.

Focus in Germany on modernization and rebuilding

In its home market, Lidl optimized its store network for the first time in years. At the end of 2024, the number of stores fell by a net 9 to 3,247. At the Expo Real real estate trade show in October 2024, the discounter still announced a higher pace of expansion and the goal of opening around 100 new locations in Germany. However, these figures do not necessarily represent net store openings. In the discounter’s highly saturated domestic market, Lidl has focused on expanding the selling space of existing stores or demolishing and rebuilding a larger store at the same location.

Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) A nap mondása

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Mere in Lithuania: Rapid growth and a hard discount niche left open by Lidl

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >(HU) A nap mondása

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >