Lidl exports pork ‘Made in Germany’

Lidl introduces its German local origin label for pork as an in-out promotion in its Lithuanian subsidiary. For fresh meat products, the discounter in its international markets has so far relied on locally sourced products. Falling production volumes and significant price increases for pork lead Lidl to fall back on sister-company Kaufland’s meat factories.

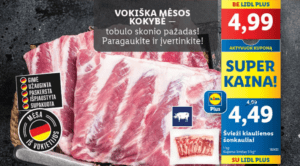

Lidl is extending the ‘Made in Germany’ quality promise of its own brands to its meat range. In the current leaflet of Lidl Lithuania the retailer is offering fresh pork ribs under the slogan ‘German quality meat – the promise of perfect taste – try and judge for yourself’. The advertised product is not locally sourced but imported from Lidl’s home country and marketed under the retailer’s own ‘5xD’ (5 times Germany) quality seal, that the company introduced in its home market in 2022. All animals under this certification have been born, raised, fattened, slaughtered and processed in Germany. In the past, the discounter’s German quality marketing was mainly limited to products from its ambient ranges.

The move could mark a turning point in Lidl’s marketing of fresh produce. Until now, Lidl’s pan-European strategy for chilled ranges, especially meat products, has been to strengthen its local appeal. By using industry-wide recognized national origin labels, such as the ‘Viande Bovine Française’ (French Beef) certification currently used by Lidl in France, the AMA quality label in Austria, the ‘Produkt Polski’ (Polish Product) label in Poland and the ‘Kött från Sverige’ (Meat from Sweden) seal for its Swedish operations the retailer wants to show support for local producers. To strengthen its image as domestic supermarket, Lidl in many other countries uses its own local origin marketing brand, such as ‘Lietuvos Gamintojas’ (Lithuanian Producer) in Lithuania, combined with additional certification from a third parties, such as Eurofins.

In addition to the largely positive connotation of “Made in Germany” in the Baltic States and Central and Eastern Europe, the move is a strategic necessity and could be copied in other countries in the future. With above-average growth rates and rapid market share gains, Lidl needs to secure its supply lines, especially for fresh products, which are prone to fluctuations in volume and quality. Pork production volumes are falling. According to the latest available Eurostat data, the EU produced 22.1 million tons of pig meat in 2022, a decrease of 5.7% compared to 2021 and a drop in production levels to the low of 2009. In Lithuania, too, pig production has steadily decreased from 664,000 animals in 2017 to 574,000 in 2022, according to data from the Lithuanian Statistical Office.

With an inflation rate of 11.7% pork saw the highest price increases in Europe last year, followed by poultry (+8%) and beef (+7.4%). Lidl announced in March this year that it would source part of its meat and sausage range from sister company Kaufland, which operates five of its own meat factories.

Lidl tailors its sourcing strategy to each market. In April, Lidl in the UK announced a long-term investment of 500 million pounds (595 million euros) in the UK pork industry. The open-book model, which includes a fixed margin for farmers, aims to provide planning certainty for local producers while guaranteeing future supply for the retailer. From January this year, the UK introduced new border controls on food imports from the European Union, effectively delaying many deliveries. The UK relies on imports for 49% of its pork, according to the British Meat Processors Association.

Related news

Related news

Hétéves növekedési stratégiát jelentett be az Auchan

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Fidelity: What awaits China in the Year of the Horse?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >