Non-food discounters target Central Europe

Non-food discounters are rapidly transforming European retail: Action, Woolworth and Tedi are expanding rapidly in Central and Southeast Europe.

This article is available for reading in Trade magazin 2025/6-7.

Guest writer:

Sebastian Rennack

international retail analyst

Aletos Retail

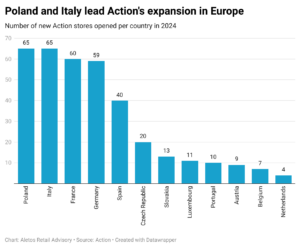

The market leader is Action, whose net sales grew by 22% to EUR 13.8bn in 2024, with like-for-like growth bigger than 10%. After entering Slovakia in 2022, Action is going into Romania this year, with Croatia and Slovenia in the pipeline for 2026.

Action already operates nearly 600 stores in Germany, having expanded its network by 200 stores in the last four years.

Woolworth’s net sales in Germany are estimated to have surpassed EUR 1bn last year. The retailer wishes to double the number of its stores from the current 800 to 1,500 by 2030.

Tedi already has 2,000 stores in Germany and expects the number of Polish stores to go over 300 this year.

Small players may be squeezed out

The rapid expansion of non-food discounters is the engine of consolidation in the sector. The three biggest players in Germany are now present in shopping streets, often competing directly with medium-sized players in the channel, who are struggling to keep up with the cost advantages of discounters. At the end of last year German home furnishings retailer Depot announced that it would close around 30 of its 300 stores in Germany. Discounters are actively exploiting their pricing power to gain an advantage over their competitors. Last year Woolworth launched a price comparison campaign aimed directly at Depot, with the goal of emphasising its own price advantage.

Three discounters, three different concepts

In spite of their market dominance, Action, Woolworth and Tedi aren’t direct competitors. Their different business models make it possible to coexist.

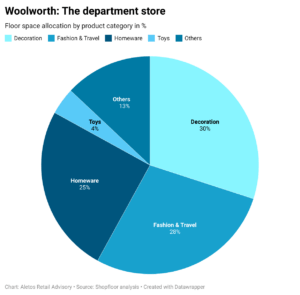

Woolworth positions itself as the discount equivalent of traditional department stores, offering a large selection of non-food products and putting a great emphasis on clothing and home textiles. The retailer has around 10,000 SKUs in its standard offering, which is supplemented by a further 8,000 seasonal products.

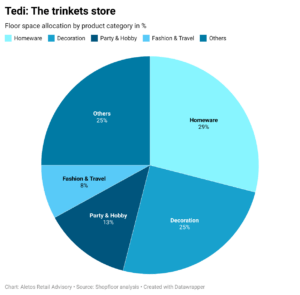

Tedi concentrates on small, low-priced products that encourage trial and impulse buying. Tedi specialises in novelties and surprises. Small handicrafts and party supplies make up 13% of the product range and are placed near the store entrance because of their appeal. Household goods and home textiles account for 29% of the assortment.

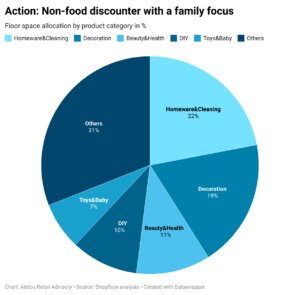

Action’s concept is based on strict category management and a customer-centric layout, which is otherwise typical of discount supermarkets. Unlike its competitors, the retailer has a separate section at the entrance for weekly special offers, which isn’t found in Woolworth and Tedi stores. 19% of the sales space is dedicated to decoration and 22% to household goods and cleaning products.

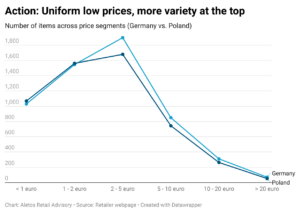

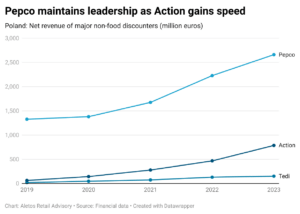

Pepco: ally rather than competitor

Their different business models explain why these non-food discounters often operate near Pepco stores in Poland. With net sales of EUR 2.7bn in 2023, Pepco focuses mainly on clothing and home textiles, with women’s and children’s clothing having more than 70% of store space. This has allowed the retailer to position itself in a different category from Woolworths, Tedi and Action, enabling them to coexist without becoming direct competitors. Inflation is also putting pressure on the pricing strategies of non-food discounters and forcing them to rethink their marketing messages. For instance Action – which previously promised to offer 1,500 items for 1 euro or less – now advertises two-thirds of its products at prices below 2 euros.

There is still potential for growth – despite the Chinese challenge

Besides inflation, competition from Chinese online retailers also poses a threat to non-food discounters. Temu and Shein are the 2nd and 4th most downloaded shopping apps in Germany and the 1st and 7th in Poland.

In spite of the strengthening presence of online competitors, physical discounters still have significant advantages. Their store networks make it possible for them to take market share from struggling medium-sized players in the channel, while their immediate availability also gives them an advantage over Chinese e-commerce platforms with their long delivery times. Although inflation and digital competition are serious challenges for Action, Woolworth and Tedi, they don’t give up on aggressive expansion, taking advantage of their distinctive business models and their ability to offer lower prices in the category.

Related news

From the shopfloor: What the Mere format reveals about retail concentration

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Mere in Lithuania: Rapid growth and a hard discount niche left open by Lidl

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >From the shopfloor: How to create customer loyalty beyond price competition

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >