Non-food discounters gain momentum across Central Europe

Action, Woolworth and Tedi drive expansion into Central and Southeast Europe. The three leading non-food discounters are rapidly expanding their store networks, challenging mid-sized category specialists. Differentiated assortment strategies attract different shoppers and create a complementary discount ecosystem. Rising costs challenge the discounters’ low-price promises.

Sebastian Rennack

international retail analyst

Aletos Retail

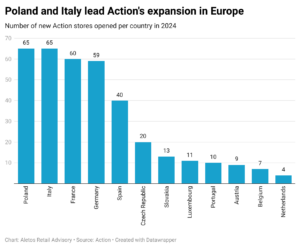

Non-food discounters are rapidly reshaping Europe’s retail landscape, with Action, Woolworth, and Tedi accelerating their footprint across Central and Southeast Europe. Action is the clear market leader, with net sales surging by 22 percent in 2024 to reach 13.8 billion euros and like-for-like growth exceeding ten percent. The retailer continues to scale up in the Central and Southeast European region. After adding Slovakia to its portfolio in 2022, Romania is set to follow this year, while Croatia and Slovenia are planned for 2026.

Germany and Poland remain key expansion markets for the discount segment, with Action nearing 600 stores in Germany after adding 200 locations over the past four years. In Poland, the store count has quadrupled in the same period and is now approaching the 400-store mark. Woolworth and Tedi are also expanding aggressively in these markets. According to estimates, Woolworth surpassed one billion euros in net sales in Germany last year. The company has set an ambitious target of doubling its store network from more than 800 locations to 1,500 by 2030. In Poland, where it launched in 2023, Woolworth sees potential for up to 1,000 stores, while expansion into Czechia and Slovakia is also part of its long-term strategy. Across Europe, the retailer envisions potential for 5,000 locations. Tedi, which already operates 2,000 stores in Germany, expects to exceed 300 locations in Poland this year. At a European level, it aims to more than triple its existing network from 3,300 to 10,000 stores in the medium term.

Discounters Reshape Non-Food Retail, Squeezing Out Smaller Players

The rapid expansion of non-food discounters is driving consolidation in the sector. In Germany, the three leading players are increasingly present in pedestrian high streets, often in direct competition with mid-sized category specialists that struggle to keep up with the discounters’ cost advantages. The difficulties faced by Depot, a German home accessories retailer, illustrate this trend. The company entered insolvency protection in mid-2023 after reporting a net loss of 155 million euros on annual revenue of 492 million euros in 2022. At the end of last year, Depot announced plans to close around 30 of its 300 stores across Germany.

Discounters are actively leveraging their pricing power to gain an edge over competitors. Woolworth launched an aggressive price comparison campaign last year, directly targeting Depot and highlighting its price advantage. Tedi has now emerged as a potential investor for Depot, while at the same time reinforcing its own market position through acquisitions. In March 2025, the company received regulatory approval from the German Federal Cartel Office to acquire more than 80 stores from regional non-food discounter Pfennigpfeiffer, a chain primarily operating in eastern Germany.

Three Discounters, Three Distinct Concepts

Despite their dominance, Action, Woolworth, and Tedi do not compete directly. Their distinctly different business models allow them to co-exist, often within the same retail parks and shopping malls. A shopfloor analysis conducted for this report highlights their differing value propositions and category focuses.

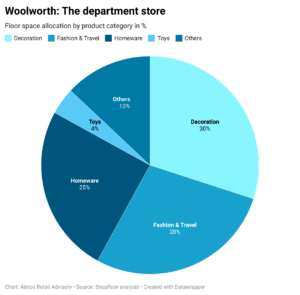

Woolworth positions itself as the discount equivalent of a traditional department store, offering a wide non-food assortment with a strong emphasis on textiles. The retailer carries around 10,000 SKUs in its standard assortment, supplemented by an additional 8,000 seasonal items. Fashion and travel categories account for 28 percent of sales floor space and an estimated 40 percent of Woolworth’s revenue in Germany, with a particular focus on women’s outerwear. Seasonal and year-round decoration jointly take up 30 percent of shelf space, while homeware and textiles, including kitchen, bathroom, storage, and cleaning products, make up another 25 percent. Another four percent of space is dedicated to toys, with the rest of the assortment covering smaller impulse-driven categories such as office supplies, pet care, DIY, and party goods.

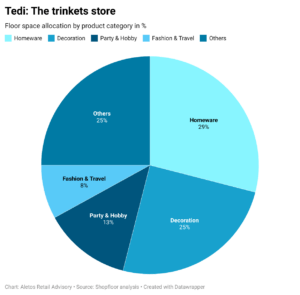

Tedi, in contrast, focuses on small, low-cost items that encourage discovery and impulse purchases. Fashion plays a minor role, occupying less than ten percent of the sales floor. Instead of covering all non-food categories comprehensively, Tedi emphasizes novelty and surprise. Small handicraft items and party articles represent 13 percent of the assortment and are positioned near the store entrance to attract foot traffic. Seasonal and full-year decoration accounts for 25 percent of total shelf space, while homeware and home textiles form the foundation of the assortment at 29 percent. Fashion & travel items take up close to ten percent of space, with all remaining categories are limited to low single-digit shares.

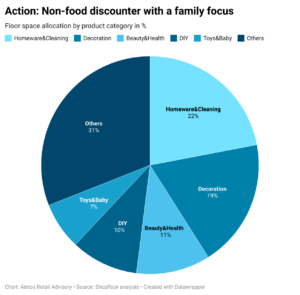

Action’s store concept is structured around strict category management and shopper-centric layouts, reflecting a food discount DNA. Unlike its competitors, the retailer dedicates a section at the front of the store to weekly-changing promotions, a feature absent at Woolworth and Tedi. The first half of the store caters to a broad audience, with 19 percent of space allocated to decoration and 22 percent to homeware and cleaning products. The second half is designed for young families, focusing on categories that remain underdeveloped at its non-food discount peers. Health and beauty products take up 11 percent of shelf space, while toys and baby items account for seven percent. A further seven percent is allocated to food and beverages, a category not prioritized by Woolworth or Tedi. Action also demonstrates greater depth in its DIY assortment, dedicating ten percent of its floor space to the category, surpassing its two main rivals.

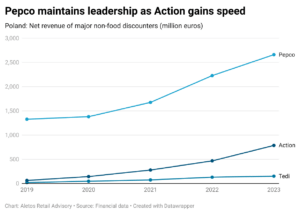

Pepco: An Ally, Not a Competitor

The distinct business models of non-food discounters explain why they often operate alongside Pepco in Poland. With net revenue of 2.7 billion euros in 2023, Pepco focuses predominantly on textiles, with more than 70 percent of its store space dedicated to ladies’ and children’s apparel. This positioning places it in a different category than Woolworth, Tedi, and Action, allowing them to co-exist without direct competition.

Inflation Challenges the Discount Promise

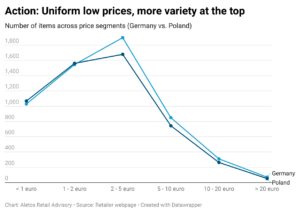

Inflation is putting pressure on the pricing strategies even of non-food discounters, forcing them to adjust their marketing messages. Action, which previously advertised a promise of 1,500 articles priced at one euro or less, has now revised its claim to say that two-thirds of its products are available for under two euros. However, an analysis of the retailer’s German and Polish websites suggests that the reality does not fully align with this statement. The number of products available at one euro or less has fallen to slightly above 1,000 in both markets. Even the two-euro threshold appears compromised, with just 45 percent of the German assortment and 50 percent of the Polish range priced below this level. Nevertheless, Action is actively responding to these challenges, reporting 650 price reductions in the fourth quarter of 2024 to reinforce its low-price positioning. At discount peers Woolworth and Tedi in Germany the price segment ‘for 1 euro’ has been adapted to ‘from 1 euro’.

Room to Grow – Despite the Chinese Challenge

Beyond inflation, competition from Chinese online retailers is emerging as another threat to non-food discounters. In Germany, Temu and Shein rank as the second and fourth most downloaded shopping apps, while in Poland, they occupy the first and seventh positions.

Despite their growing presence, physical discounters still retain significant advantages. Their store networks allow them to absorb market share from struggling mid-sized category specialists, while their immediate availability continues to offer an edge over the lengthy fulfillment times associated with Chinese e-commerce platforms. The in-store shopping experience, particularly the appeal of discovering unexpected bargains, remains difficult to replicate online.

The strength of the physical non-food discount model has also attracted new entrants. Malaysian retailer Mr.DIY, that launched in Poland in late 2023, is expanding its logistics operations to support a potential network of 100 stores. The move underscores the continued growth potential of the segment, even as external pressures mount.

Conclusion: The Future of Non-Food Discounting

While inflation and digital competition present challenges, Action, Woolworth, and Tedi continue to expand aggressively, capitalizing on their differentiated business models and ability to undercut category specialists. With their distinct positioning and growing influence, these three retailers are poised to further consolidate the European non-food market, reinforcing their dominance in the years ahead.

Related news

Nestlé, Planet A Foods team up for cocoa-free brand launch in Germany

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How Lidl uses Poland’s new deposit system as a loyalty tool

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Less meat might be consumed in German-speaking countries

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) A nap mondása

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Péter Sebestyén is Tesco’s new Chief Operating Officer

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >(HU) A nap mondása

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >