Action focuses on Central & Eastern Europe

Action plans to increase the pace of expansion. Poland is one of the most important investment countries for the non-food discounter. Despite fierce competition in the segment, the retailer achieved positive results in each Central European country in its first year of operation.

Action sees room for growth in Europe. The fast-growing Dutch non-food discounter plans to open at least 1,300 new stores on the continent by the end of 2026, a 50% increase on its current footprint of around 2,600 locations. Having added more than 250 stores a year since 2019, the retailer is looking to accelerate its pace of expansion to more than 430 stores annually. According to the company, the return to modest economic growth, supported by lower inflation and rising wages, should support Action’s accelerated growth strategy in the near future. Speaking at an investor conference, CEO Hajir Hajji sees ‘huge potential’ in European markets. Poland is one of the countries that the retailer, which at a European level grew by 27.8% last year to reach net sales of 11.3 billion euros, sees as having the greatest potential alongside its more mature markets such as Germany, France and Italy.

Using Action’s key indicator of expansion potential – inhabitants per store – as a yardstick, the emerging market shows promise in the retailer’s country portfolio. For its home market, the Netherlands, the figure is 43,000, for France 85,000, for Germany 159,000 and for Poland 114,000.

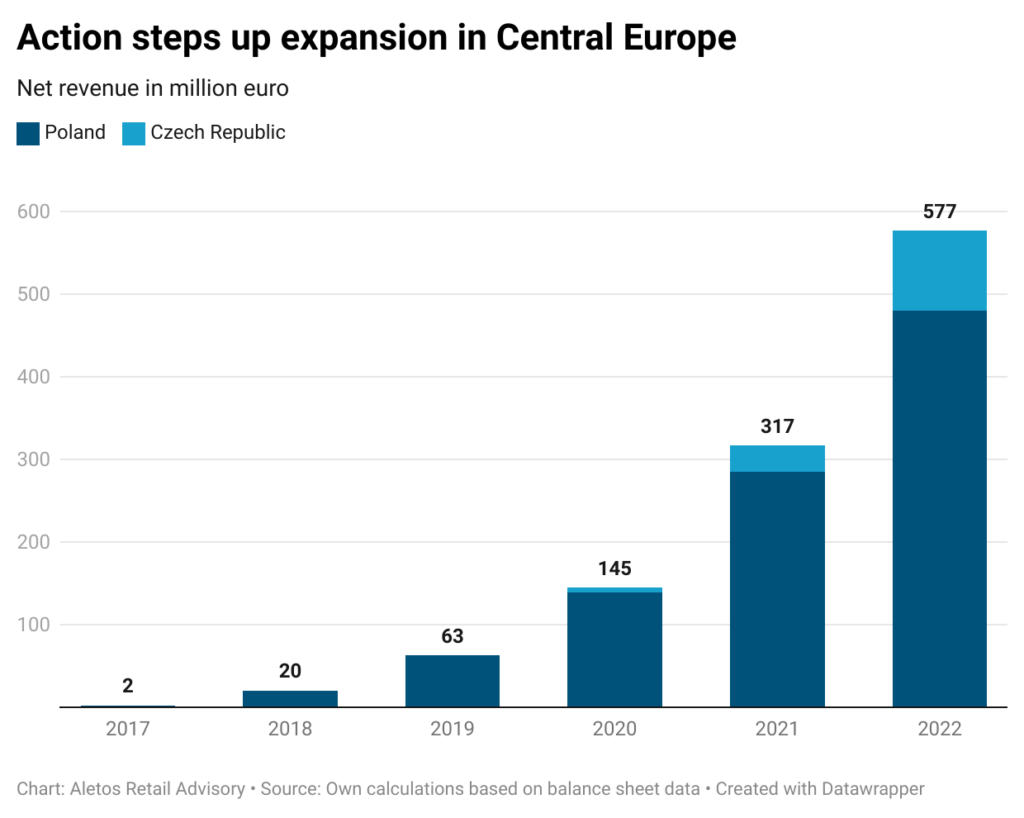

Action’s history in the Central and Eastern European region (CEE) is comparatively short. In 2017, the discounter opened its first store in Poland, followed by the Czech Republic in 2020 and Slovakia in 2023. In 2023, these three countries accounted for a third of the more than 300 store openings in Europe. Within three years, Poland has become the fourth largest market in Action’s portfolio. At the end of last year, the retailer operated 322 stores in Poland, compared to 414 in the Netherlands, 526 in Germany and 799 in France.

Action is doing well despite intense competition in the non-food discount segment. The general merchandise discounters Pepco, Tedi, Kik and Dealz already operate in Poland. Segment leader Pepco achieved a net turnover of 2.2 billion euros in the country in the fiscal year 2021/2022 (end of September) and a pre-tax profit of almost 210 million euros, which translates into a pre-tax margin of 9.5%. Action generated 480 million euros and a pre-tax profit of 15 million euros, equivalent to a pre-tax margin of 3.2%.

Action’s standardized, streamlined business model allows the retailer to reach profitability in the shortest time. As balance sheet data shows, in each of its three nascent markets in CEE the discounter already in the year of launching its first stores wrote black figures. Latest available data for 2022 shows a total retail net revenue for the region of 576 million euros and 18 million euros earnings before taxes, translated to a pre-tax margin of 3.1%.

Related news

Related news

GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Change in Rossmann Hungary’s leadership: Kornél Németh decided to move towards new challenges in 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >