Vkusvill challenges Russian market leaders X5 and Magnit

Russian health food retailer Vkusvill is on its way to becoming a formidable force in Russian food retailing. Although market leaders X5 and Magnit dwarf the former niche player when it comes to bricks-and-mortar operations, Vkusvill thanks to its omnichannel ecosystem has overtaken both retail giants in the online sector.

Sebastian Rennack

international retail analyst

Aletos Retail

Vkusvill, the former niche retailer from Moscow that before the pandemic operated only a few hundred dairy shops in Moscow, is emerging as a national heavyweight. With a strong focus on fresh produce, an omnichannel ecosystem system linking offline stores, food e-commerce and ready-to-eat food delivery, the company has become one of the fastest growing online food retailers in the country.

Vkusvill has overtaken X5 and Magnit online

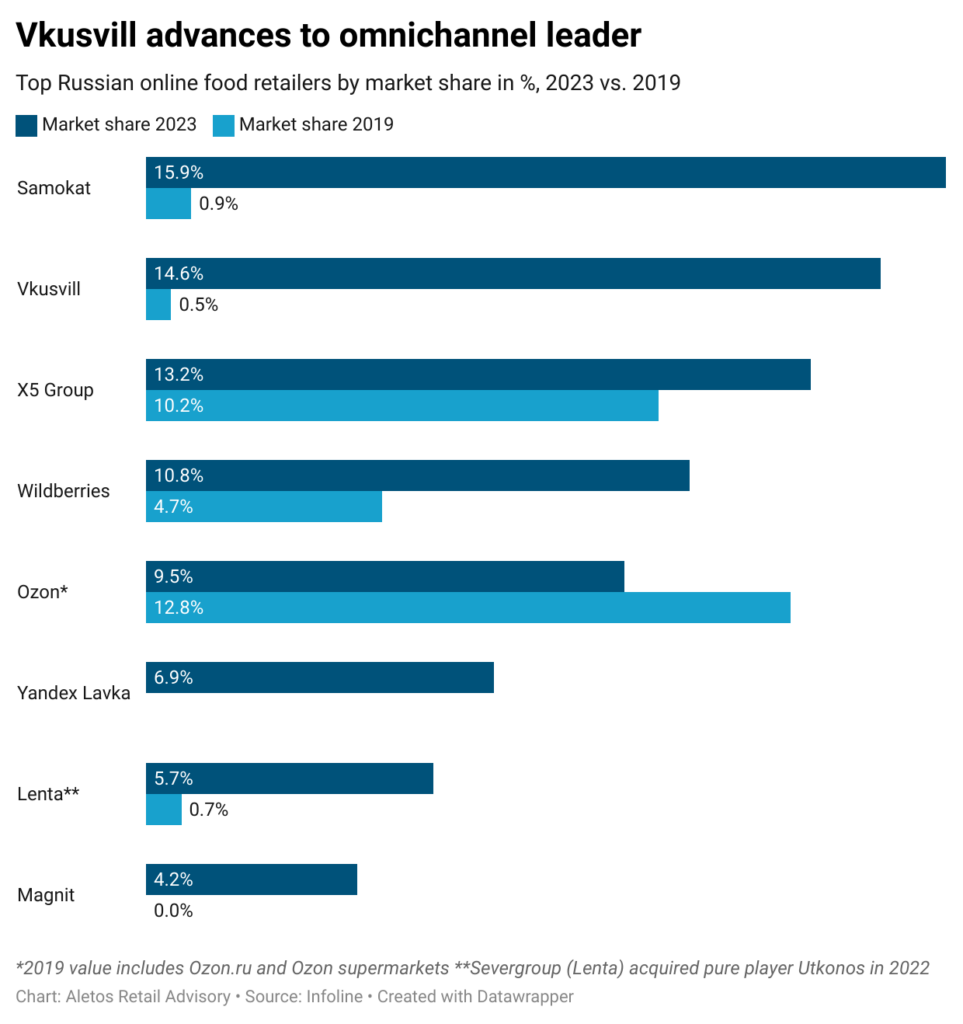

According to data from St Petersburg-based market research firm Infoline, Vkusvill ranked second in the online grocery channel at the end of 2023 with 14.6% of the market segment, overtaking market leader X5 Group, which came to 13.2%. Fourth-largest offline grocer Lenta followed with 5.7% and Russia’s second-largest retailer Magnit, which only entered online delivery in 2020, trailed with 4.2%. All other top online players – Samokat, Wildberries, Ozon, Yandex Lavka – were pure players (see chart). The size of the online grocery market is estimated by Infoline at more than RUB 900 billion (more than €9 billion) in 2023.

Vkusvill’s online and offline sales for 2023 increased by 27% to a total of 258 billion Russian roubles (€2.7 billion), and although this figure is only a fraction of the total 2023 sales of the market leaders (X5: 3.1 trillion roubles or €32 billion, Magnit: 2.5 trillion roubles or €26 billion), the growth dynamics show a fivefold increase in five years.

E-food grows faster than stationary food business

E-food is emerging as the most promising growth segment for Russian retailers. Infoline expects food e-commerce in Russia to grow by 57% to 1.45 trillion Russian rubles (RUB, €15 billion) by the end of 2024. The Russian food retail market as a whole is forecasted to grow from RUB 21.0 trillion to RUB 22.8 trillion (€228 billion) in 2024, an increase of only 8.1%.

Vkusvill is putting pressure on its online rivals: To capture a large part of the omnichannel customer segment, the retailer does not charge customers for home delivery. Vkusvill’s delivery service is free, regardless of the size of the order. In addition, the retailer recently reduced the delivery time in Moscow from two hours to one hour.

Food service integration

As customers’ habits change from eating out to eating in, Vkusvill has started to integrate food ordering and delivery into its e-commerce business. As the third pillar of its omnichannel ecosystem – alongside bricks-and-mortar stores and grocery delivery – the retailer is expanding dark kitchens adjacent to its dark stores. More than 100 of these production areas offer more than 160 different dishes, which are distributed by the company’s food delivery service, Sgoryacha. Since the second half of last year, Sgoryacha has been integrated into brick-ad-mortar, testing physical food corners under the same brand. Vkusvill also plans to expand its coffee shop business. In 2023 it bought the Anderson coffee shop chain, and in the spring of this year it acquired a majority stake in a cafeteria chain with 120 outlets under the Do.bro Coffee brand. Pilot projects for its own pizzerias are underway.

Related news

How Lidl uses Poland’s new deposit system as a loyalty tool

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >From the shopfloor: What the Mere format reveals about retail concentration

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Mere in Lithuania: Rapid growth and a hard discount niche left open by Lidl

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) A nap mondása

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Péter Sebestyén is Tesco’s new Chief Operating Officer

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >(HU) A nap mondása

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >