K&H: Many people find their shoes too tight

Although middle-aged people have enough savings for seven months on average, 33 percent of them could only support themselves for one month if they had no income, K&H reported based on the results of the Secure Future survey, which also draws attention to the importance of self-care. According to the survey, the proportion of vulnerable people is higher among women and those living in rural areas. At the same time, the number of those who have enough savings for at least six months is increasing.

The good news is that middle-aged people could finance their own lives for seven months on average if they did not have a penny of income, but based on the details, the picture is much more nuanced – this is what the K&H Secure Future survey, which assessed the financial situation of 30-59 year-olds in the second quarter of this year, found.

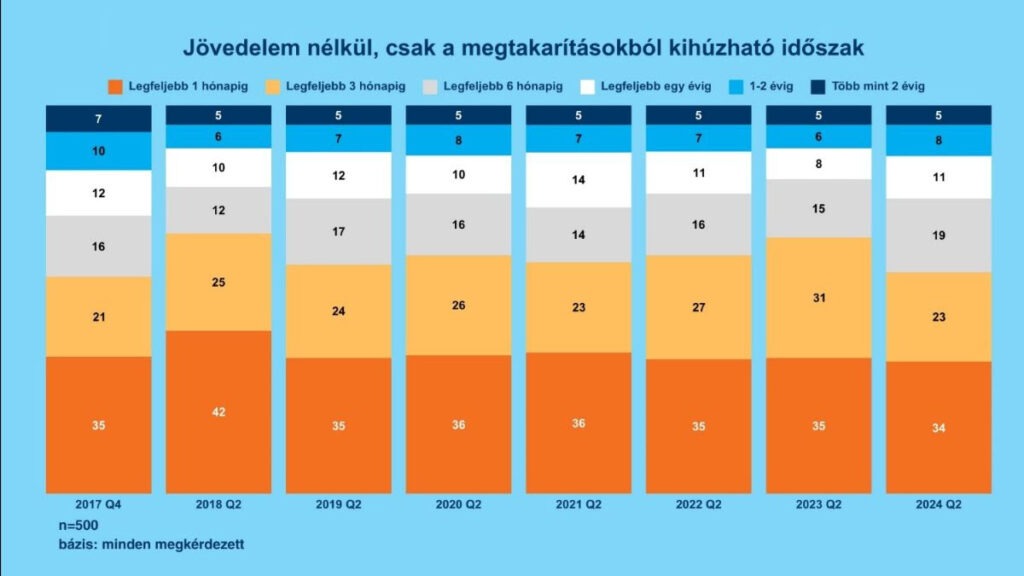

“The seven-month average hides significant differences: namely, that 33 percent of respondents reported that they only have enough savings for one month at most. This rate is similar to the data measured in previous years, even if it has now reached its lowest value in terms of numbers. In comparison, we have only measured a significantly different result once, in 2018, of 42 percent. However, in the same period of 2021, their rate was 36 percent, and in the survey conducted in 2022 and 2023, it was 35 percent each. However, the rate of those who could live on their savings for a maximum of 3 months has reduced from 31 percent last year to 24 percent, typical of previous years. This indicates that the rate of those who could live on their accumulated reserves for a very short time has decreased somewhat. However, looking at the previous data of the research, it is also clear that there was an example of a more favorable situation before the epidemic. In 2017, the affected age group had an average of eight months of reserves”

– explained the detailed data by Székely Pálma, head of K&H’s sales and life insurance business.

The expert highlighted that the proportion of those with sufficient reserves for a longer period of time has increased in parallel. In the second quarter of this year, 43 percent of those surveyed were in a position to be able to support themselves for at least six months from their savings if they had no other income. This value shows an increase compared to previous years, as between 2018 and 2023, results between 33-41 percent were achieved. The trend reflects a slight improvement in the financial stability of the population. “This may be due to the fact that average wages have increased significantly this year, and at the same time, real wages have also increased due to falling inflation,” added Székely Pálma.

Related news

Corporate leaders’ commitment to sustainability at record level

According to the latest data from the K&H Sustainability Index,…

Read more >GKI analysis: Why do Hungarian households live more poorly than anyone else in the EU?

Imagine that the residents of every EU country shop in…

Read more >K&H Analyst Commentary: The forint is on the rise

The forint, the Polish zloty and the Czech koruna are…

Read more >Related news

Corporate leaders’ commitment to sustainability at record level

According to the latest data from the K&H Sustainability Index,…

Read more >FAO food price index rose slightly in June due to higher prices of meat, dairy products and vegetable oils

The Food and Agriculture Organization of the United Nations (FAO)…

Read more >What can cause the price of a wine to increase tenfold?

There are fewer of them worldwide than the number of…

Read more >