Bittersweet

This article is available for reading in Trade magazin 2024/11

Dávid Gábor Kovács

marketing director

Zwack

“We see a growing trend in the bitter market, where we have been able to achieve growth with our flagship brand Unicum, maintaining our position as Hungary’s leading bitter liqueur. Volume sales are typically coming from the retail channel, but the relevance of HoReCa isn’t negligible, as this is where consumers meet the product and first taste it. As consumers enjoy bitter flavours more as they age, we target our communication to a more mature audience than our competitors”,

says Dávid Gábor Kovács, marketing director of Zwack.

Ádám Somogyvári

senior brand manager

Jägermeister/Roust

“Our company has the Jägermeister portfolio and apart from the main variant, ginger version Scharf and super-premium Manifest are also available in Hungary. The gap between HoReCa and off-trade has continued to grow, we see consumption shifting from pubs to shops, with discounters and hyper- and supermarkets showing steady growth”,

says Ádám Somogyvári, senior brand manager of Jägermeister, distributed by Roust.

Macro trends

László Nagy

CEO

Kunság-Szesz

László Nagy, CEO of Kunság-Szesz Zrt.:

“According to the 2023 retail index, the growth in value was 7% as sales increased to HUF 41bn, but the volume sold decreased by 6%. We are also experiencing this duality in our own sales. The premium category has strengthened and this is in line with the general change in the culture of alcohol consumption at the beginning of the 21st century. Our premium bitter Mátyás Bitter Liqueur is now available in plum, sour cherry and coffee flavours too. Pilvax Coffee Liqueur is a reinterpretation of a contemporary recipe.

Erika Rónyai

brand manager

Várda-Drink

“Várda-Drink Zrt. offers a variety of bitter drinks, including classic herbal bitters and more modern, flavoured versions. Várda Liqueur, Plum, Coffee and our premium product Jubileum are particularly popular, and sales of these have grown steadily in recent years, thanks to increasing consumer interest in special flavoured bitter drinks”,

informs Erika Rónyai, brand manager of Várdadrink.

Quality and flavours

Dávid Gábor Kovács adds that they were the first to enter the super-premium bitter segment with Unicum Riserva, and this year they reached another milestone in Zwack Unicum’s more than 230-year history: the company created Unicum Trezor XO, a limited-edition, exclusive herbal liqueur, which makes Zwack the first Hungarian beverage brand to enter the luxury segment. Unicum Trezor XO is aged in oak barrels for 10 years, as indicated by the XO or “Extra Old” mark, which is used in cognac production. After this 10-year period the liqueur is further aged in French wine casks for several years, giving it a special character.

Ádám Somogyvári explains that consumption habits are changing, so the target audience and the ways of reaching it must also change. Consumers are becoming more conscious of what they drink. This is also evident on store shelves: there are more spirit flavours available and shoppers are more interested in the composition of products.

The gap between HoReCa and off-trade has widened further, with consumption increasingly shifting from restaurants to grocery stores

Marketing work is necessary

László Nagy reports that they do marketing work on their products mainly through beverage wholesalers and trade networks. As for HoReCa partners, Kunság-Szesz offers specific promotions, tasting sessions, special offers, prize draws and gifts. They occasionally organise promotional events with the involvement of influencers. The Várda Liqueur range is particularly popular with 25-40 year olds, says Erika Rónyai, who are keen to try special flavoured drinks such as Várda Coffee. Their product range is actively shaped by market trends, so the introduction of new flavours is a priority. Várda-Drink supports HoReCa partners with promotions, tasting events and programmes that give them the opportunity to get to know the products better. //

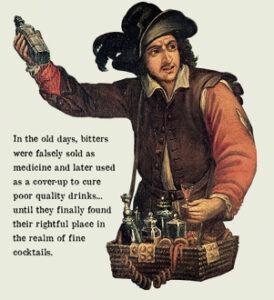

Bitter, amaro…

Both words mean bitter, but they don’t necessarily mean the same thing in the world of drinks – what they have in common is that they are alcoholic drinks (with a few exceptions they are ABV 5-50%) and are flavoured mainly with herbs and spices, but nowadays also with coffee and fruit extracts. Cocktail bitters represent a small but key ingredient in mixed drinks. Their alcohol content is minimum 15%, but most of them contain 40-50% alcohol.

The growing diversity of spirits used as cocktail ingredients is also leading to a widening range of cocktail bitters

Previous generations of mixologists treated them as a spice in cocktails. Obviously, bitters shouldn’t take the lead in a drink: their taste ought to fade after consumption and shouldn’t affect the aftertaste. Angostura has long been dominating the world of cocktail bitters, but the emergence of new drinking occasions and alternative producers is creating a more dynamic market.

Italian bitters are getting more and more popular across the world

Still, it is a constant challenge for new brands to find their way onto the shelves behind the bar. What do we need to know about amaros? They are different kinds of liqueurs, their name comes from their taste – they are bitter – and in principle Italians drink them as a digestive. It may come as a shock to traditionalists, but nowadays amaros are also combined with Campari, Aperol and the like in cocktails. //

Related news

Pálinka, my love…

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The taste of luxury

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >One in three people are too busy to meet friends during the holiday season

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

MBH Analysis Center: The Hungarian economy may accelerate again in 2026, but the Iranian war carries serious risks

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >SPAR is preparing for an Easter rush: it is filling its stores with 570 tons of smoked meat products

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Focus on the domestic fishing sector at SIRHA Budapest

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >