Harder times, softer candies

This article is available for reading in Trade magazin 2024/4

Viktor Nyitrai

commercial director

Bergland Hungária

“This difficult period is certain to continue this year, so we are focusing more on preserving our values, the results we have achieved so far and thinking together with our partners”,

says Viktor Nyitrai, commercial director of Bergland Hungária Kft.

The company’s perception is that consumers have turned towards cheaper, more affordable products. Hard candies have been stagnating for some time, because the market has started going in the direction of softer products, such as gummy candy or soft caramel.

Vitamin sells

Fruit flavours – be it dextrose tablet or hard candy – make up a large part of Bergland’s product selection. Their other main product category is sugar-free candies, which are increasingly popular, especially among active health-conscious consumer. In the healthy category it is important for the products to contain vitamins, as few allergens as possible (e.g. gluten, milk, lactose, etc.) and to be made from natural ingredients. The company is launching a Bergland sour candy, in mixed packaging with pineapple and mango flavours. A new addition to the DEXTREM dextrose tablet range will be a pineapple + vitamin variant.

The market has shifted towards softer products, with a decreasing preference for menthol and an increasing preference for fruit flavours

Functionality isn’t enough

I.D.C. Hungária markets a wide range of candies. There are many different Verbena candies available: these filled hard candies can now be bought in 9 flavours, sugar-free in 3 flavours and gummy candies in 2 flavours.

“Almost everyone knows Verbena herbal candies for their functionality, but more and more people are also consuming them for their delicious taste. Consumer demand shows that functionality isn’t enough, as consumers are always looking for new flavours”,

informs Katalin Gyenese, marketing manager of I.D.C. Hungária Zrt.

The company’s latest innovation is Verbena Echinacea candy, which isn’t only very tasty, but its echinacea extract and the vitamin C and D it contains also contribute to the proper functioning of the immune system. //

Sugar shock: grandma really has some hard candy

In 2023 a decrease in volume sales and an increase in value sales characterised the confectionery market – this statement is true for candy, chocolate and chewing gum alike. While the volume of candy sold had reduced by 5.7% from 2021 to 2022, there was a 2.7% drop from 2022 to 2023.

Guest writer:

István Márk Szabó

products specialist

Consumer Panel Services

In contrast, the sum spent on candy increased by 11.1% from 2021 to 2022 and by 28.5% from 2022 to 2023. Back in 2022 the average price of candy was HUF 2,941/kg, but by 2023 the category became 32% more expensive to reach the HUF 3,883/kg average price. The number of buyers hasn’t changed significantly over the last two years, nor has the frequency of purchase, but the basket size has become smaller (-4.9%).

Gummy candies and traditional hard candies (filled and unfilled) account for 61.3% of the volume and 58.6% of the value of candies purchased in 2023. Looking at the socio-demographic background of candy-buying households, it is striking that pensioners aged 65 and over are over-represented not only among traditional hard candy buyers but also among jelly bean buyers. Households’ number one place for buying candy has been discount supermarkets in the last 3 years, but the share of this channel has been decreasing year on year. //

Multisensory experiences and interactive sweets

A wide range of unique innovations were showcased by the brands participating in the ISM trade fair in Cologne this January, which integrated multisensory experiences that appeal to multiple senses.

by Andrea Tisza

Music to the ear – an audio experience filled into candies

The “silent disco” lollipop from Chinese brand Amos plays music only the user hears: TastySounds audio lollipop works using the bone conduction technology. It can play up to 60 minutes of audio, which can be pre-recorded music or individually recorded personal messages, and the style of the pre-recorded music varies depending on the flavour.

The „silent disco” lollipop from Chinese Amos plays music only the user hears

You can also play with food now, thanks to Amos 4D gummy candies, which offer a 360-degree shape experience. The innovation allows the brand to make building blocks of the gummy candies that can be assembled, so the product also acts as a real toy before consumption. (Amos 4D building block gummy candies are now available in Hungary.)

Amos candies act as a real toy before consumption

East meets West

Asian flavours have also conquered the confectionery industry in recent years – just think of the popularity of matcha. This trend is set to continue in 2024, Innova Market Insights forecasts. A good example of this cultural fusion is the mochi flavour presented by Royal Family: as the traditional flavour of sticky rice flour sweets with red beans isn’t very popular in Europe, the Taiwanese company is making its products in Western flavours such as maple syrup pancakes, mint chocolate chip, strawberry cheesecake and tiramisu. Austrian company Esarom represented the mystery flavour trend at this year’s ISM, who invited visitors to a mystery tasting where they had to guess what the gummy candies in their mouths tasted like.

Good examples of the fusion of cultures are the mochi flavours presented by Royal Family

Personalisation in the spirit of caring

Given that the confectionery category is particularly well adapted to celebrations and gifting, it is an excellent field for experimenting with personalisation. With Pez MyHead consumers can create a customisable candy dispenser head by using an app. What is more, in a premium version the consumer doesn’t have to bother with editing the photo in the app themselves, but can connect with a 3D artist instead, who helps perfect the “head”. On the platform shoppers can also order the head as a physical object.

M&M’s 2024 Valentine Day’s gift guide helped gift givers personalize the experience provided by the products

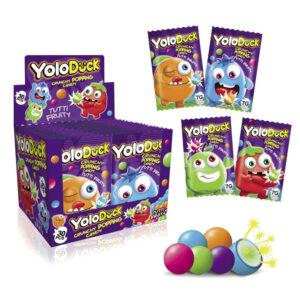

Other candies that are set to make a big splash in 2024 include Striking Popping Candy: the Hong Kong-based company differentiates itself from other popping candies with an extra-strong popping effect.

Striking Popping Candy have extra-strong popping effect

//

Related news

Planteneers Presents Clean-Label System for Plant-Based Ice Creams at ISM Ingredients

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New Product Showcase Award 2026 honours creative new products in the sweets and snacks industry

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Sweet euphoria in Cologne

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home or parcel machine? It’s been revealed how Hungarians order and what they fear most about delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Frost, cost shock, generational change: the pálinka sector is cornered on several fronts at once

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >