Hungary’s agri-food export has passed the magical 8 billion-euro threshold once again

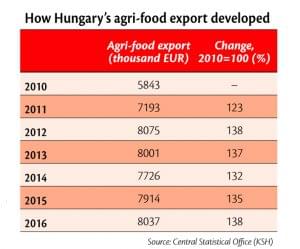

After a 2-year period when its performance wasn’t as good as before, in 2016 Hungary’s agri-food export went above EUR 8 billion again. Agri-food export increased by 1.6 percent to reach EUR 8,037 million, contributing to the nation’s total export with 8.6 percent. Behind this excellent performance we find record-level yields in the case of certain crops; however, it is also true that the 2016 export performance of some crops wasn’t influenced by these record levels as they were harvested late. Consequently, we can say that in the 2016 export it is the performance of the earlier period of the year that is most reflected.

Dr. Jenő Szabó

agricultural economist

Although import grew faster, by 6.3 percent, than export, this didn’t do harm to the strong position of Hungary’s foreign trade balance. The balance suffered a EUR 180-millon reduction, but the agri-food sector contributed EUR 2.9 billion, 29 percent to the nation’s foreign trade surplus. In 2016 Hungary’s agri-food export was 38 percent bigger than in 2010 and neared the record level of 2012.

Drinks and oilseeds were the main drivers of the export growth

Behind Hungary’s increased agri-food export sales we find the better export performance of several unprocessed and processed agricultural products.

Our oilseed export represents a value of almost EUR 500 million and the export growth in this category was 14 percent. As for our EUR 277-million vegetable export, export jumped 6 percent, while there was a nearly 10-percent rise in Hungary’s EUR 337-million livestock export.

Food products of primary and secondary processing provided for the majority of our export surplus in 2016. In this category the biggest product group is meat and slaughter by-products, export sales of which augmented by 6 percent; poultry meat’s export rose 7 percent and calculated together with sausages and salamis, meat product export was up 13 percent. Hungary’s drink export surged by 19 percent – the 25-percent expansion in our ethyl alcohol export contributed to this growth the most. Instant soup, sauces and ice cream products belong to the group called ‘various edible products’, export sales of which improved by 4.5 percent, while the export performance of meat and fish foods got 13.2 percent better. The biggest contributors to the export growth of unprocessed agricultural products were oilseeds, livestock and vegetables.

Weaker position for cereals

The reduction was the biggest in the export of cereals – in both value and volume. As the corn yield was low in 2015, Hungary’s sales revenue from cereal export dropped 14 percent, by EUR 197 million.About 40 percent less corn was exported, which means that 1.7 million tons less Hungarian corn found new markets abroad. Luckily, thanks to higher sales prices, the decrease was smaller in terms of value: the decline in our corn export was ‘only’ 26 percent in this respect. Hungary also exported less animal feed, fruits and mill products.

Taking a look at the share of cereals in our export, we can see that their positions somewhat weakened as they used to constitute the No.1 product group. Cereals’ weight in our export reduced from 17.7 percentage points to 15 percentage points. Food industry by-products make up the second most important product group and their positions weakened as well: their share dropped from 10.8 percent to 9.8 percent. Shares of other product groups in Hungary’s agri-food export in 2016: meat and slaughter by-products – 12.6 percent, drinks – 7.3 percent, oilseeds – 7 percent, various edible products – 6.8 percent, canned fruits and vegetables – 6 percent, fats of animal and vegetable origin, oils – 5.9 percent, dairy products – 4.7 percent, livestock – 4.2 percent.

Although this article isn’t long enough to introduce the changes item by item, the shift in the main proportions of within our export’s structure indicates that in the agri-food segment the proportion of unprocessed products reduced in the last four years, while that of processed products increased. Formerly the weight of unprocessed products used to be around 37-38 percent, but by 2016 this proportion fell to 31 percent. On the contrary, the proportion of highly processed products grew from the 35 percent in 2013 to 39 percent in 2016, while the share of products of primary processing remained 30 percent. (Source: Agricultural Economics Research Institute – AKI, 2016.)

We are still focusing on EU markets, but…

The bulk of Hungary’s agri-food export, 83.6 percent was sold in the markets of the European Union. Compared with 2015, our position weakened by 1.3 percentage points in the markets of the EU-28, but there was a little export expansion.

As for the markets outside of the European Union, Hungary’s positions definitely strengthened. In 2015 non-EU countries constituted the market for 15.1 percent of our agri-food export, but by 2016 this share grew to 16.4 percent. Hungary’s traditional non-EU European markets such as Turkey, Serbia, Switzerland, Ukraine and Russia improved their positions the most outside of the union. In addition to these, Asia’s positions – especially those of Japan and China – strengthened considerably and the continent’s share is now already 5.7 percent from Hungary’s agri-food export.

Germany is Hungary’s biggest export market in the European Union: it is here that 15.2 percent of our total export is sold and Germany’s share in our export to the EU is 18.1 percent (EUR 1.2 billion).Romania is our second biggest market, representing 11.5 percent of our total agri-food export market; in the third place we find the Italian market with a 9.5-percent share. Other important markets include Austria (8.9 percent), Slovakia (5.9 percent), Poland (4.8 percent), the Netherlands (4.7 percent) and the Czech Republic (4.1 percent). These eight European markets absorbed 65 percent of our agri-food export in 2016.

Hungary exported more to Italy (+4.3 percent), Austria (+1.5 percent), Slovakia (+3.6 percent), the Czech Republic (+4.2 percent) and Poland (+14 percent). The size of the expansion is noteworthy if the 1.6-percent annual growth of Hungary’s total agri-food export is considered. We must also mention that Hungary’s export performance got 10.5 percent better in France, but our export growth was also considerable in Serbia, Russia, Ukraine and Japan. In Serbia 13.3 percent more Hungarian agri-food products were sold and our Ukrainian market expanded by 7.5 percent. Despite the embargo we performed 7.1 percent better in Russia and Japan, our most important overseas market, bought 7.3 percent more agri-food products from us.

We don’t wish to play down the importance of the market expansions mentioned above, but it is worth noting that in 2016 there was no outstanding market expansion in Europe for us, while such a phenomenon occurred outside of Europe, namely in Turkey (if we consider Turkey to be a non-European country). In the Turkish market – due to the revitalising of our live cattle export – our agri-food products performed 61 percent better. China was another country outside Europe where a spectacular (yet smaller than before) 60-percent market expansion took place in 2016. //

Related news

More people work in Hungarian agriculture than at the time of the system change

More people work in Hungarian agriculture than at the time…

Read more >Hungarian agricultural exports increased dynamically in the first half of the year

The measures taken to renew the Hungarian agriculture and food…

Read more >Results and developments in the new era of Hungarian agriculture

The Orbán government reversed the degradation of the countryside and…

Read more >Related news

Most major grocery chains will keep their stores open until noon on December 24th

Most of the large grocery chains will keep their stores…

Read more >Viktor Orbán: Economic recovery and historic opportunities for 2025

On Friday morning, Prime Minister Viktor Orbán presented the Hungarian…

Read more >Recognition of Consumer Protection Excellence: Honoring the Best of 2024

This year’s outstanding consumer protection officers and special award recipients…

Read more >