Fidelity Outlook 2025: New paths for stocks

As we approach 2025, it is clear that the macroeconomic and monetary policy environment overall offers a positive backdrop for equity markets. In 2025, the business cycle enters a new phase, but geopolitical events will also have an increasing impact throughout the year. Trends that have driven recent price movements may continue, but we can also expect new directions and an expansion of growth areas in the markets, according to Fidelity analysts, who believe exciting times lie ahead for equity investors.

Global Trends

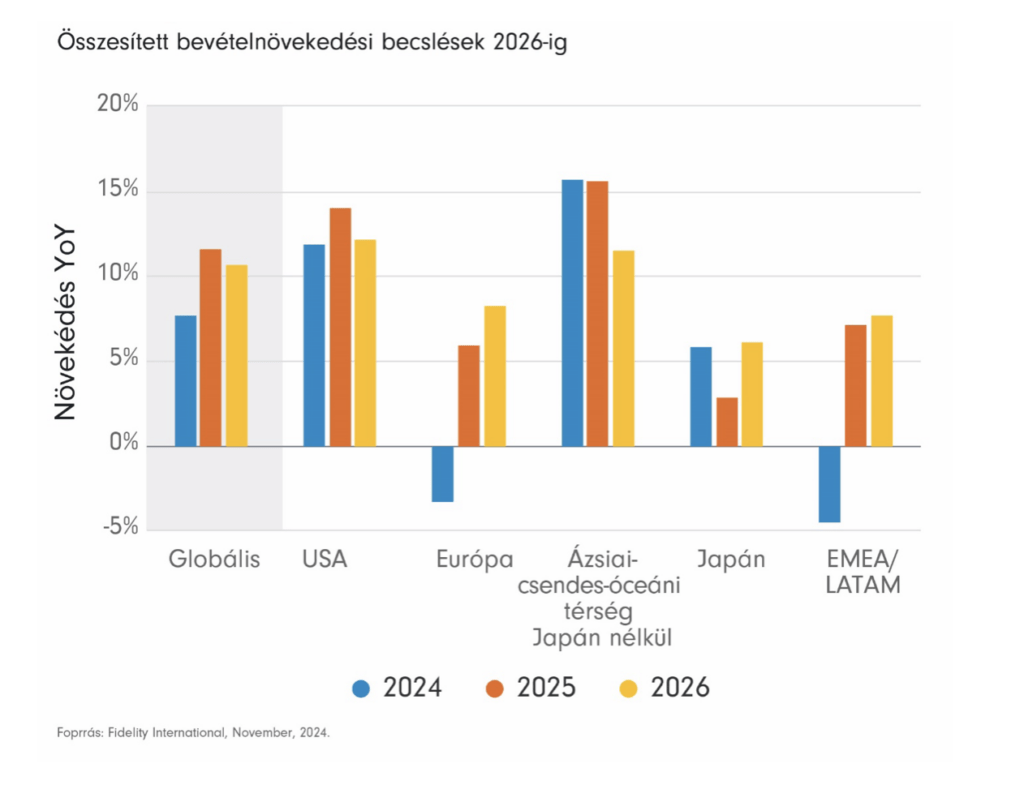

Like it or not, the milestone Republican election victory is likely to reinforce American exceptionalism. Even before the November referendum, it was anticipated that U.S. corporate revenues would grow by 14% in 2025, outpacing most other regions and the global average in growth, return on equity, and net debt levels. The elections fueled market optimism about the coming year being business-, growth-, and innovation-friendly. In some sectors, potential tariffs and further trade frictions between the U.S. and China pose risks, but the anticipated recovery may at least partially boost incomes and alleviate fears stemming from higher corporate valuations.

Nevertheless, investors will need to be much more selective this year. A good example of this is the trend in artificial intelligence. On one hand, there is ongoing debate about the valuations of large tech companies: Nvidia and others are still at record highs, and there may be more room to grow, but we are already watching which companies will be the next to profit from this trend. One group clearly consists of the enablers that facilitate the use of artificial intelligence, but ultimately, many less directly related industries and consumers will benefit. Apple made a fortune with smartphones, but their emergence also drove growth across a broad range of existing and new businesses. Less than one-third of companies have so far incorporated AI and machine learning into their operations, but more than 70% plan to: the economic impact of artificial intelligence will grow. This is an area where the U.S. has an overwhelming and undisputed leadership position.

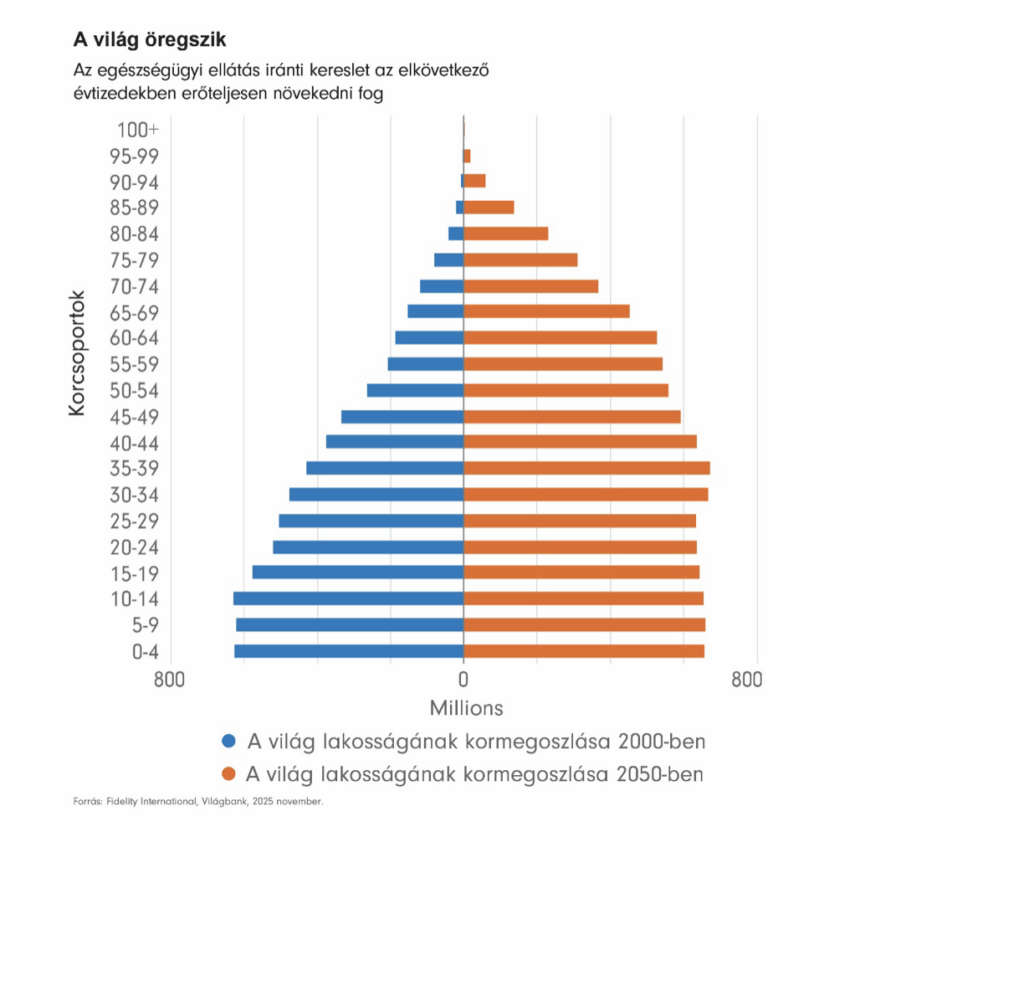

The other major structural trends of the decade will also continue in 2025, making them worth watching. The breakthroughs in anti-obesity drugs are significant, but like AI, medications such as Ozempic are likely to induce major changes beyond the currently profitable businesses listed in healthcare indices. Ripple effects on how hospitals and gyms are used are already being discussed, but other examples are also emerging. Another important structural driver in healthcare is demographic: the population aged 65 and over will double by 2050, and the share of our income spent on maintaining our health will continue to increase.

Related news

Related news

II. Green Gastronomy – Marketing Communication Workshop organized by the MMSZ HoReCa and Green Section

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Nearly 140 domestic suppliers, 60% growth – SPAR Regions Treasures program accelerates with AI solutions

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >