Fidelity Kitekintés 2026: Ne becsüljük alá az inflációt!

There are several big decisions to be made in the period ahead. The appointment of the next Fed chairman and the US midterm elections will be key. Meanwhile, Asian exporters will have to decide what to do with their trade surpluses. According to the latest data, they are increasingly preferring non-dollar stores of value, but as the extraordinary rise in gold last year shows, it is not always easy to find alternatives. When interest rates fall, bonds tend to become more attractive. But in today’s environment, selectivity and strategic positioning are key. Bonds have already proven themselves in 2025. According to experts at Fidelity, now we need to figure out how to manage the period ahead.

For those who doubted the wisdom of bond-type investments, consider 2025 as a compelling counterexample. This year, this asset class delivered exactly what it promised – reliable returns and portfolio stability – quietly disproving predictions of its decline. However, experts say that the picture is becoming increasingly nuanced going forward.

For those who doubted the wisdom of bond-type investments, consider 2025 as a compelling counterexample. This year, this asset class delivered exactly what it promised – reliable returns and portfolio stability – quietly disproving predictions of its decline. However, experts say that the picture is becoming increasingly nuanced going forward.

Let’s start with the bond markets

After a long period of quantitative easing, bond markets have returned to their original function and responded strongly to the resurgent inflation and growth. Yields have been impressive thanks to capital appreciation and attractive coupon yields – levels not seen in years. However, the market now faces a series of tests: the uncertainty surrounding the US economy, the policy decisions that shape it and the development of inflation.

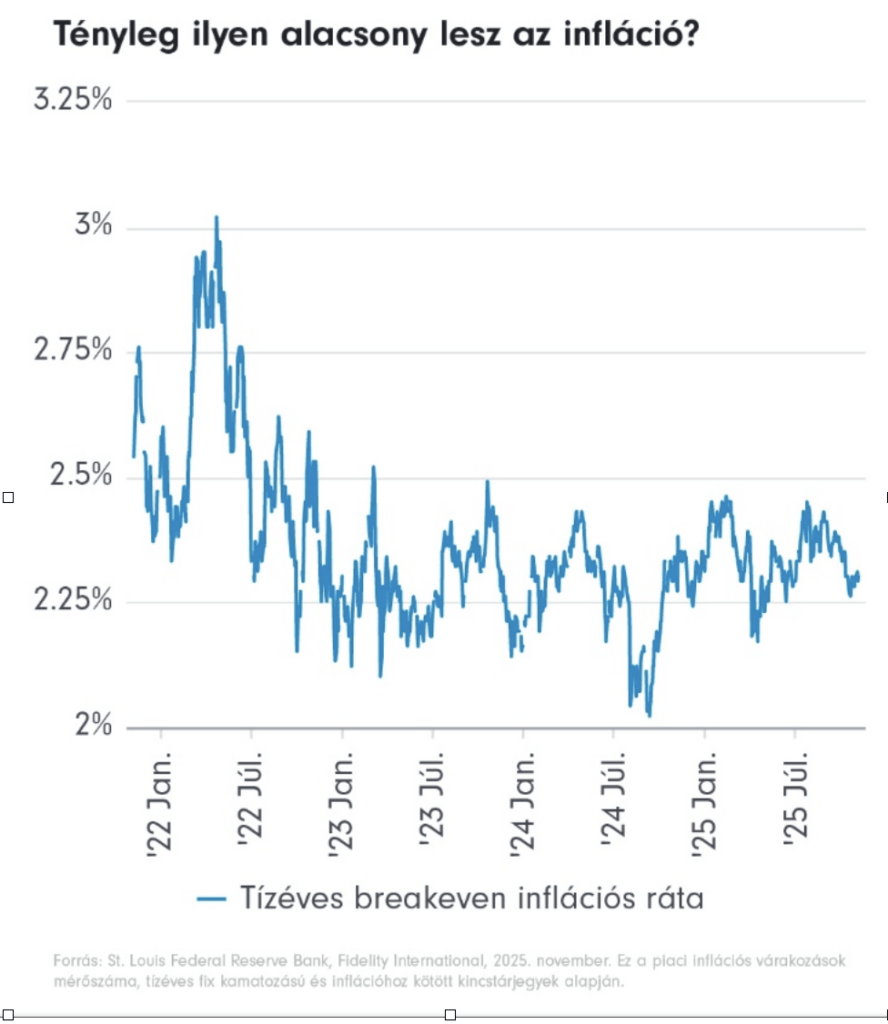

The risk – for some time now – is that these elements may not be properly aligned. Fidelity analysts expect US inflation to exceed market expectations as reflected in the break-even price of inflation-linked bonds, while the economy, while resilient, is slowing. This divergence will have a significant impact on bond markets.

Risk

The collapse of First Brands, a US auto parts manufacturer, in September and the bond markets’ reaction could be a sign of what lies ahead. An economic downturn inevitably affects companies’ fundamentals, and avoiding companies that go bankrupt will be vital to preserving total returns.

Investment-grade spreads are extremely tight, which is a concern, but somewhat understandable. Interest rates are high and demand for bonds from high-quality issuers is strong.

Investor interest is shifting more toward corporate than government bonds, and experts expect this trend to continue in the future. While spreads may widen, high initial yields can protect interest income strategies from a significant downturn.

“Some of our fund managers believe that European investment-grade bonds offer greater value than their US counterparts, bank bonds offer more attractive opportunities than non-financials, and emerging markets offer greater value than developed world government and corporate bond markets,”

added István Al-Hilal, Director of Central and Eastern Europe at Fidelity International.

Monetary policy balance

Government bond markets will be shaped not only by general trends, but also by the finer details of policy. At first glance, the environment seems favorable – interest rates in developed markets are on a downward trend, which supports bond appreciation.

The political balance in the United States is a risk factor. The yield curve has steepened in recent months, reflecting investors’ reluctance to hold long-term bonds due to concerns about issuance volume and inflation risk. A steeper yield curve (buying short-term bonds and selling long-term bonds) seems a logical response to this situation.

Related news

KSH: industrial production in January fell by 2.5 percent compared to the same period of the previous year, and increased by 1.5 percent compared to the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >OTP Deputy CEO: After a strong year, they are successfully progressing with the strategy

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MKIK seeks partnerships with businesses and government

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Research: Coupons don’t determine which brands we stay loyal to

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >