Fidelity survey: Investors defy general uncertainty

With the restructuring of global systems, investors must navigate an environment where traditional assumptions – including those related to government policy, interest rates, and market stability – are becoming increasingly uncertain. According to Fidelity’s 2025 European Investor Sentiment Survey, investors remain optimistic about their long-term goals; however, actual investment activity reflects heightened caution. Investment principles such as holding investments during volatile periods, maintaining diversification, and actively managing opportunities remain essential to achieving long-term results.

The Glass Is Half Full

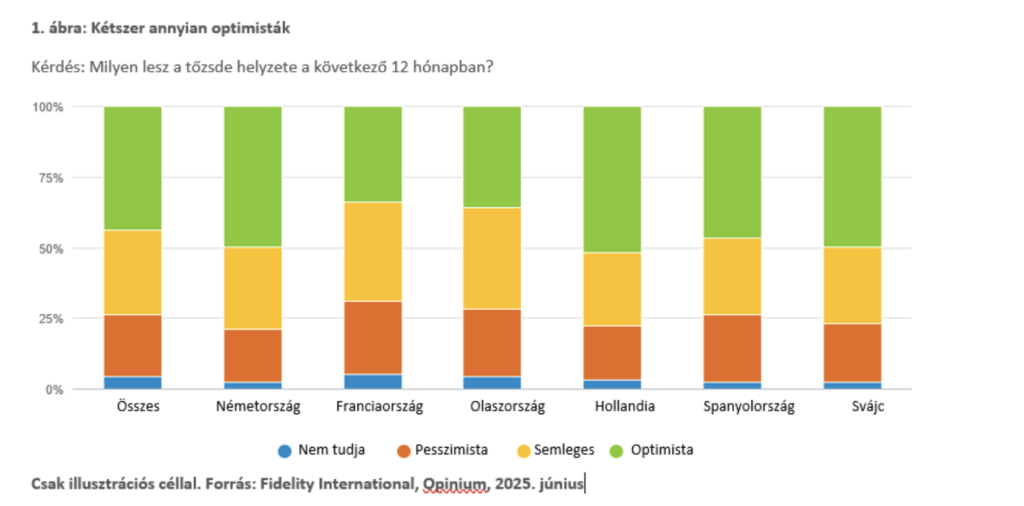

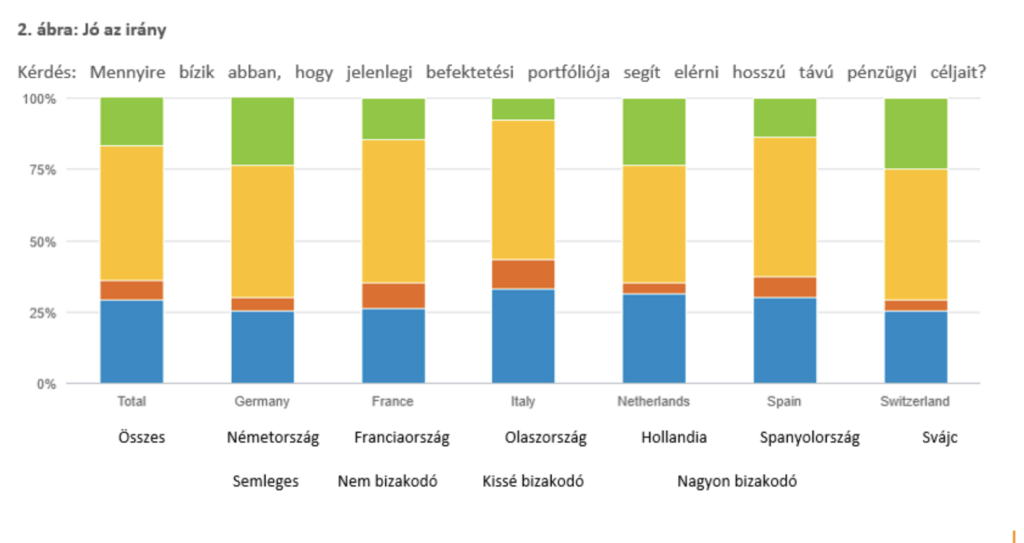

Despite geopolitical and macroeconomic challenges, 44% of European investors surveyed remain optimistic about the market outlook over the next 12 months, while 22% are pessimistic (see Figure 1). Optimism levels, however, vary by country: 52% of Dutch investors are optimistic, compared to only 34% of French investors. Two-thirds of respondents also believe their investment portfolios will achieve their long-term goals. This view is particularly strong among German, Dutch, and Swiss investors, roughly a quarter of whom are “very confident” in reaching their long-term objectives. In contrast, only 8% of Italian respondents say the same (see Figure 2).

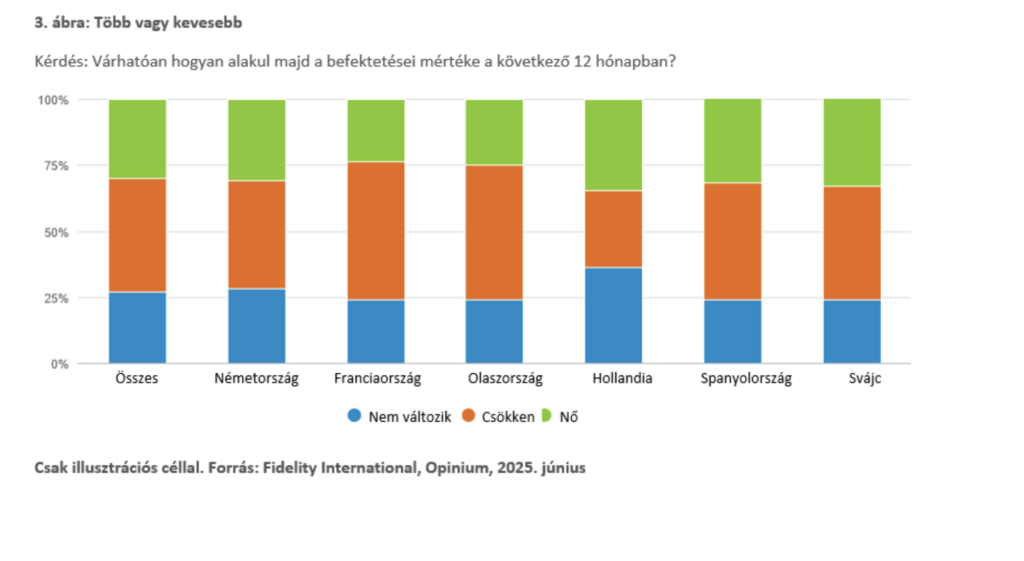

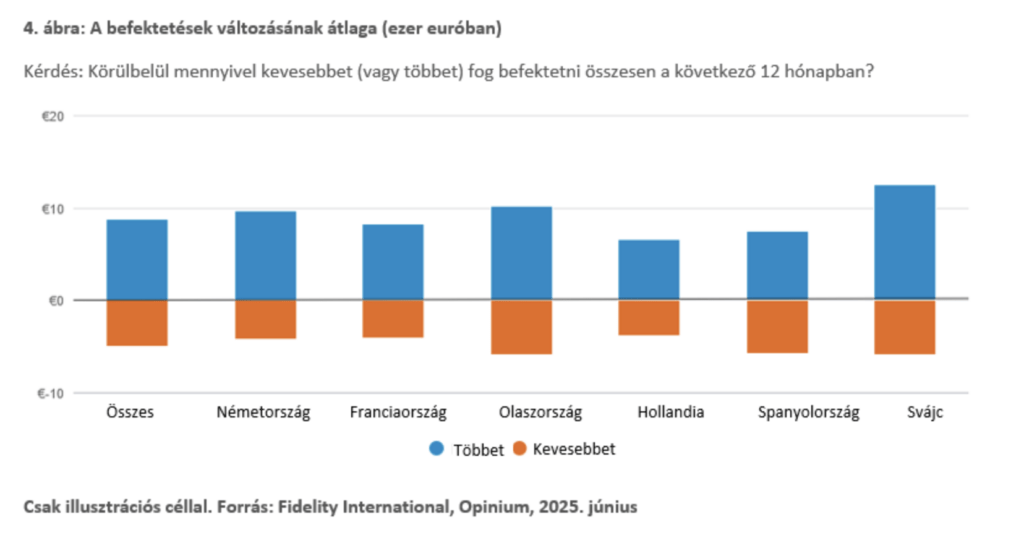

However, behind this confidence lies growing caution, reflected in reduced investment activity and increased concern over the risk/return ratio. For example, more investors plan to reduce the volume of their investments over the next year than those intending to increase it (see Figure 3). Among those planning to invest less, the average reduction amounts to €5,000 (see Figure 4). Dutch investors (35%) are more likely than investors in other surveyed countries to increase their investments over the coming year, with a median increase of €6,500. A similar trend is seen in Switzerland, where 34% of investors – also more optimistic about the stock market outlook – say they are likely to invest more during the same period, with a median increase of €12,500.

Three main reasons are cited by those likely to invest less in the coming year: market uncertainty, geopolitical concerns, and fear of losses – at 37%, 31%, and 25%, respectively. A quarter of respondents would prefer to keep their savings in cash, while around 21% say they will not have sufficient capital to invest during this period. The top four reasons for increasing investment portfolios are: seizing market opportunities (29%); an increase in disposable income (25%); an increase in income (22%); and the intention to achieve longer-term financial goals (22%).

While heightened market uncertainty is unpleasant, as it can lead to unexpected volatility, it is a natural part of investing. The three principles below can help long-term investors stay focused on their goals, even in turbulent times.

First: Investments should be held. It is difficult to time market movements effectively. Rash buying and selling can increase trading costs and result in missed gains during recoveries, while downturns can create new opportunities. Furthermore, in periods of high inflation or persistently low returns, a portfolio overly concentrated in defensive assets may fail to preserve purchasing power or generate the required income level.

Second: Strive for diversification. In volatile markets, where asset prices can move unpredictably and correlations can shift without warning, diversification serves both as a way to spread risk and to stabilise the portfolio.

Third: Market corrections can create attractive opportunities. Volatility, often seen as negative, can sometimes reveal fundamental differences in valuation, liquidity, and investor conviction. Such discrepancies can create opportunities for disciplined investors with sufficient liquidity to take advantage of them.

Navigating Uncertain Markets

“While global markets swing between optimism and pessimism, our survey shows that investors are trying to navigate heightened capital market uncertainty amid increasing tensions.

Most respondents are optimistic about the market outlook and confident in achieving their long-term goals. At the same time, many are likely to invest less over the next year, citing current developments such as geopolitical impacts. Even those who see opportunities in the future and intend to invest more during this period are expected to be highly cautious, with most focusing on their domestic markets.

To navigate the changing investment environment, investors need a clearer understanding of their portfolios’ evolving risk/return characteristics. Increasingly, they must make trade-offs between capital growth and capital preservation. Therefore, it is crucial to consider principles such as holding investments, diversifying portfolios, and seizing new opportunities to achieve desired return targets despite heightened uncertainty,” added István Al-Hilal, Managing Director for Central and Eastern Europe at Fidelity International.

Related news

Related news

Spring whirlwind at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >