Fidelity: AI is starting to deliver tangible benefits for companies

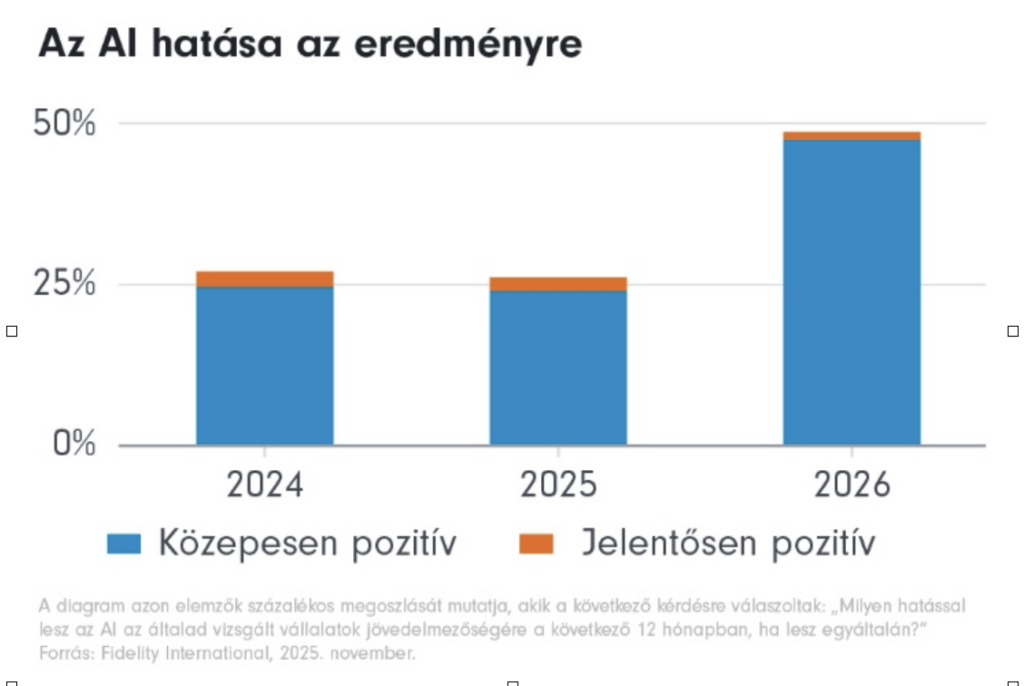

According to a recent survey of Fidelity analysts, the perception of AI in terms of corporate profitability has changed significantly over the past year. While a year ago the majority of them believed that AI would have only a limited impact on corporate results in 2025, now almost half of their analysts expect AI to have a positive impact on the profitability of the companies they follow in 2026. One of the main reasons for the change is that the introduction of AI has now become urgent, and general promises are increasingly being replaced by specific, real-world solutions.

AI applications so far have focused primarily on cost reduction, but there are more and more examples of companies – especially banks – already developing revenue-generating functions. In addition to new sales and trading solutions, AI is also appearing in retail banking, wealth management, customer service and fraud prevention, often through personalized offerings.

Analysts say the financial sector could be one of the biggest AI winners in the next 12 months, alongside communications services. For telecom companies, AI can increase efficiency by optimizing energy use, while other sectors – such as oil and gas, mining, retail and consumer goods – are also increasingly identifying practical benefits.

Secondary Impact No. 1: Data Center Expansion

One of the most tangible and impactful consequences of the spread of AI is not directly in software, but in physical infrastructure. The construction of data centers to power AI models is triggering a wave of investment that extends beyond the technology sector and affects a wide range of energy, raw materials and industrial companies.

The energy requirements of data centers serving AI exceed those of traditional IT infrastructure by orders of magnitude. The large computing capacity, continuous training and inference require 0-24 hour operation, which requires extremely stable and predictable power supply. This not only increases energy consumption significantly, but also significantly increases the demand for the raw materials needed for this, especially copper. Copper plays a key role in both the internal infrastructure of data centers and the expansion of electrical grids, so AI indirectly creates structural demand for the mining sector.

From an energy perspective, the load profile of data centers is fundamentally different from what renewable energy sources can effectively serve in their current form.

The intermittent nature of solar and wind energy poses limitations even with advanced battery storage, especially when the maximum storage capacity is only sufficient for a few hours. In contrast, data centers require continuous, uninterrupted operation, which is more favorable for traditional, stable baseload power plants – gas, nuclear and in some cases coal-based generation.

This dynamic explains why there has been a renewed interest in power plants capable of stable electricity generation, especially in North America.

According to experts, the demand for green energy sources cannot be met due to a lack of capacity, so natural gas must be used to generate electricity. This is why there has been a renewed interest in power plants capable of stable electricity generation. The capacity inherent in green energy alone will not be enough to meet the additional demand generated by AI, which forces a pragmatic, economic approach to energy production.

The spread of data centers is therefore not just a technological issue, but has broader economic and investment consequences. It also affects energy prices, the demand for raw materials and the direction of industrial investment. This means that the AI value chain extends well beyond software developers and big tech companies: the sectors that provide the underlying infrastructure could also be winners.

Related news

Technological response to the global environment: AI as a new pillar of growth

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >AI has left the chat window: in 2026 it will be booking, shopping and making decisions for us

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Twenty-eight out of a hundred Hungarians would let their brains be directly connected to the internet

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home or parcel machine? It’s been revealed how Hungarians order and what they fear most about delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Frost, cost shock, generational change: the pálinka sector is cornered on several fronts at once

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >