Salling Group expands its presence in Northern Europe

Salling Group’s acquisition of over 300 Rimi stores signals a major reshaping of the Baltic and Scandinavian grocery landscape. The deal strengthens Salling’s regional reach and sets the stage for stronger competition with discount powerhouse Lidl. Meanwhile, ICA Gruppen’s withdrawal sharpens its focus on Sweden, where it aims to strengthen its position against local discounter Willys and Lidl – adding further pressure on the discount giant.

Sebastian Rennack

international retail analyst

Aletos Retail

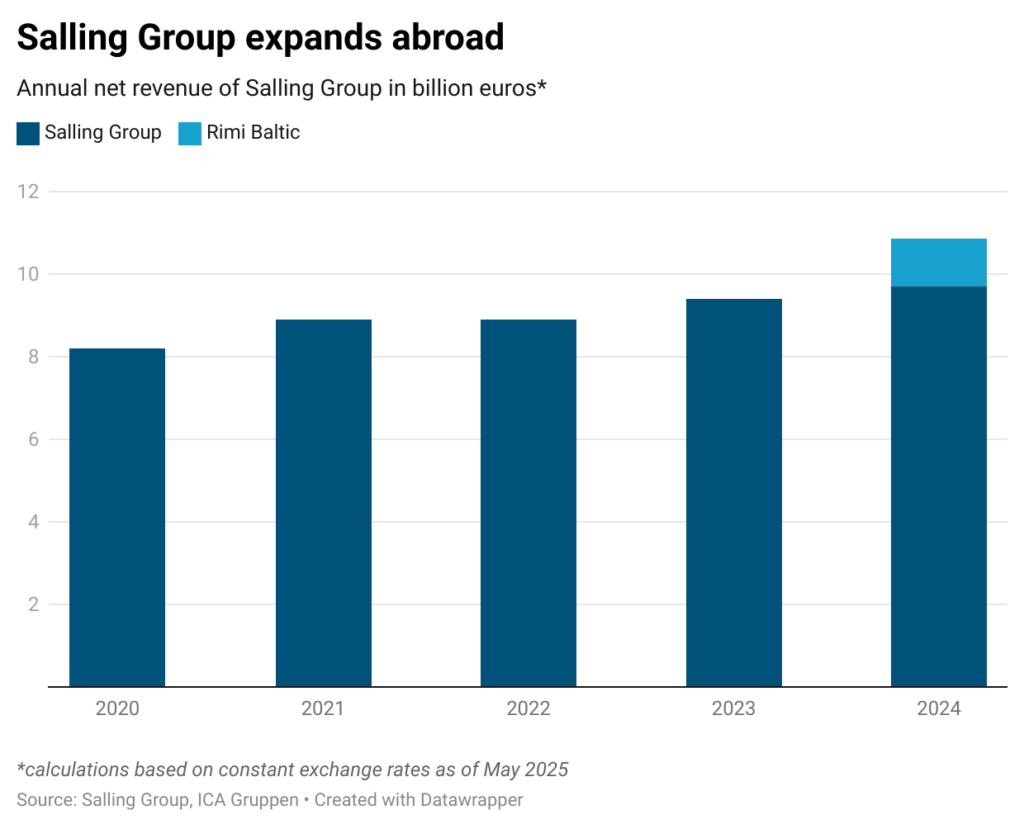

The strategic balance in the Baltic and Scandinavian grocery retail landscape is undergoing a major shift. At the beginning of May, the Danish market leader Salling Group has secured regulatory approval to acquire more than 300 Rimi stores from Swedish grocery giant ICA Gruppen across Estonia, Latvia, and Lithuania. The European Commission has cleared the deal, with completion expected by June. With this acquisition, Salling will not only strengthen its geographic footprint across Northern Europe but also boost group revenue by nearly €2 billion, lifting total turnover to more than €11.5 billion as of reported 2024 revenue. The €1.3 billion acquisition, completed on a debt-free basis, marks Salling’s largest international move to date.

Refocus on domestic operations

ICA Gruppen, meanwhile, is exiting the Baltic market entirely, redirecting capital and management focus to its core Swedish operations, where it generated net revenue of €13.7 billion in 2024. The decision likely stems from years of margin pressure, both in Sweden and the Baltics. In its home market, ICA has faced intensifying headwinds, including inflation, rising operating costs, and growing competition from discounters like Axfood’s Willys and German powerhouse Lidl. ICA’s Swedish operating margin fell from 4.6% in 2020 to 3.6% in 2024 – a massive drop of 1.0 percentage points – highlighting the need to reinforce its market position in its core market that makes up 87% of the group’s revenue.

Lidl’s market entry is tipping the balance

In the Baltics, ICA encountered similar competitive pressures. Rimi Baltic’s market share declined in Latvia from 27% in 2019 to 24% in 2023 and in Estonia from 15% to 13% over the same period. The main disruptor has been Lidl, which entered Lithuania in June 2016, followed by Latvia at the end of 2021 and Estonia in spring 2022. Although Lidl initially planned a synchronized Baltic rollout, stronger-than-expected acceptance in Lithuania prompted the chain to invest in a separate distribution center for Latvia and Estonia.

Prior to Lidl’s arrival, the Baltic grocery landscape lacked a hard-discount format, allowing mid-market players like Rimi to operate without direct price-based disruption. In response to Lidl’s advance, Rimi launched efficiency upgrades, internal cost-cutting, and new work processes starting in 2021. The company also sharpened its price image and invested heavily in value-for-money initiatives. Despite these efforts, the structural challenge from Lidl’s low-price model has proven difficult to fully counter.

Rimi hypermarkets in Latvia, a cornerstone of Salling Group’s Baltic expansion push

Salling Group leverages discount competence

Salling Group’s entry into the Baltics brings a formidable new player with extensive discount experience. As Denmark’s market leader, Salling has built its reputation competing head-to-head with Lidl and Aldi. Its management of the Netto discount chain across Denmark, Germany, and Poland – particularly the 2020 acquisition and integration of Tesco’s Polish operations, totaling 301 stores and two distribution centers – demonstrates both discount expertise and international execution strength.

In addition to its discount credentials, Salling’s hypermarket experience through the Føtex banner strengthens its ability to operate and potentially reposition Rimi Baltic’s larger-format supermarkets and hypermarkets. Given these capabilities, it is highly likely that Salling will integrate discount elements – no matter if customer-facing or just back office streamlining – into the Baltic portfolio. Such moves would significantly raise competitive pressure on Lidl, a rival Salling knows intimately from its home and foreign markets.

Financially, Salling is well prepared for this expansion. In 2019, the company sold its more than 160 Swedish Netto stores to Coop Butiker & Stormarknader, marking its full exit from Sweden. This divestment streamlined Salling’s geographic focus and strengthened its liquidity, providing part of the financial backing now supporting its move into the Baltic region.

International expansion a strategic cornerstone

Importantly, the Rimi Baltic acquisition aligns directly with Salling’s Aspire ’28 strategy. This five-year plan targets an increase in group turnover from DKK 72 billion (9.6 billion euros) to DKK 100 billion (13.4 billion euros) by 2028, driven by a combination of organic growth, acquisitions, and innovation through the Salling Seeds investment fund. The Rimi acquisition alone adds nearly €2 billion in annual revenue, marking a decisive step toward achieving this goal.

Beyond the Baltics, Salling is deepening its commitment to Poland, the group’s largest foreign market. Salling plans to expand its Netto Poland network from more than 660 stores in late 2024 to 1,000 by 2028. This expansion will play a critical role in meeting the company’s revenue targets and reinforcing its position as a major European grocery player.

Scandinavia a challenge for Lidl

Meanwhile, challenger Lidl’s position in Scandinavia tells a cautionary tale. While Lidl has disrupted grocery markets across Europe, its progress in Scandinavia has been comparatively slow. Norway stands out as Lidl’s only European exit; the chain withdrew in 2008, with cultural mismatches, weak store locations, and fierce competition from established local players like Rema 1000 and Coop cited as reasons. This exit remains a rare retreat in Lidl’s European expansion story.

In Denmark, Lidl has yet to break into the top competitive tier, constrained in part by Salling Group’s dominant Netto banner and Coop Danmark’s entrenched position. The Danish grocery market operates as a near duopoly, with Salling Group and Coop Danmark each controlling about 35% market share. Coop Danmark, structured as a consumer cooperative, has overhauled its portfolio in recent years, rebranding the former Fakta stores under the 365discount name to sharpen its price image and respond to shifting consumer demand. Netto, in contrast, in mid-2024 has completed the nationwide upgrade of its stores to the new Netto 3.0 concept, improving fresh focus, store layouts and customer experience.

Lidl, in contrast, has only recently boosted its Danish market share, moving from around 2% five years ago to an estimated 5% today. This gain has come less from organic growth and more from the acquisition of 114 former Aldi stores following Aldi’s exit from Denmark in late 2022. Before the acquisition, Lidl operated around 140 stores in Denmark; post-acquisition, its store count exceeds 250 locations. The Aldi deal has thus been the most significant driver of Lidl’s recent market-share gains in the country.

Related news

Schwarz Group Gets Approval For Acquisition Of La Cocoș In Romania

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Breakfast goes pouch, premium and protein at Lidl Poland

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How Lidl uses Poland’s new deposit system as a loyalty tool

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home or parcel machine? It’s been revealed how Hungarians order and what they fear most about delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Frost, cost shock, generational change: the pálinka sector is cornered on several fronts at once

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >