More thorough transfer price checks

According to audit and tax consulting firm Baker Tilly Hungária’s latest report, last year the tax authorities performed more transfer price inspections than in the previous years. Transfer price errors often affect corporate tax, VAT and local business tax payment too. Tax authorities don’t simply examine formal elements any more. Mónika Mindszenti, the head of Baker Tilly’s transfer price division told our magazine that National Tax and Customs Administration (NAV) inspectors have greater knowledge on transfer price matters than before. This means that companies need to make sure that they prepare the transfer price registry with the biggest care and accuracy possible. Ms Mindszenti added that in transfer price checks NAV inspectors also examine how realistic transactions are – especially when checking management services (e.g. legal, IT, sales support services provided by the parent company to affiliates)

Related news

Related news

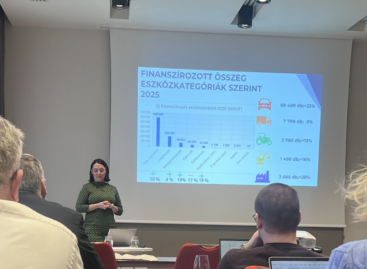

The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >