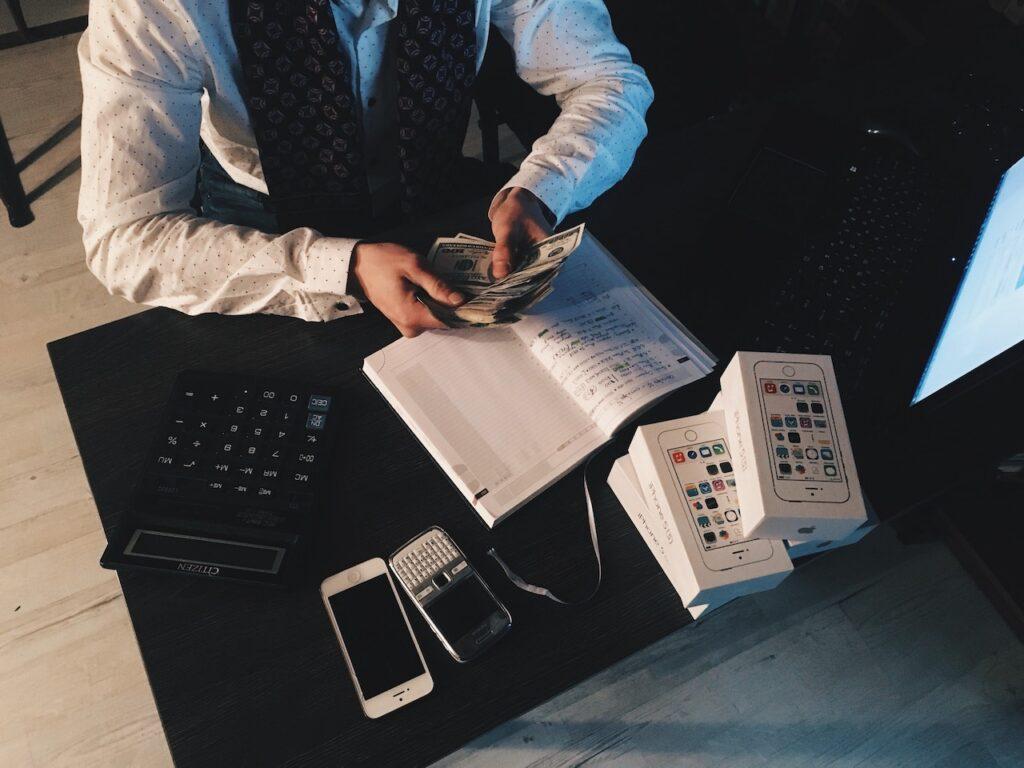

BDO: Money laundering, terrorist financing: let’s avoid even the appearance of it!

A company that does not do everything to eliminate risks related to money laundering and terrorist financing risks a serious penalty of up to hundreds of millions of forints. The legal requirements are extremely strict, and the war situation also imposed new requirements.

Recently, the focus of the tax authority’s audits has been on those actors in the economy who, in the course of their activities, are exposed to the possibility that their services are used to legalize assets derived from crime through money laundering or to support terrorism. Credit institutions, financial service providers or companies providing services related to virtual means of payment are of course such, but the circle is much wider – points out Dr. Ivett Deák, manager of BDO Magyarország KX Tanácsadó Kft. LIII of 2017 on the prevention and prevention of money laundering and terrorist financing. law (hereinafter referred to as Pmt.) lists companies with headquarters, branches or premises in Hungary dealing with real estate distribution or utilization, tax advisors, tax experts, accountants and auditors, lawyers and law firms, trustees and head office service providers, dealers in precious metals or items made from them – in fact, all merchandise dealers who accept cash payments of up to HUF three million.

Related news

SMEs look to 2026 with positive expectations and growing confidence

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Impossible Foods featured on the “Best in Business” list again this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Innovations, success stories and awards on the same stage

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Farewell day at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >