Marked improvement in operating conditions amid strong demand conditions

August PMITM data from IHS Markit signalled a marked improvement in the health of the U.S. manufacturing sector. Although slightly softer than that seen in July, the expansion was supported by steep upturns in production and new orders. Nevertheless, output growth was reportedly hampered by capacity constraints and material shortages. Lead times for inputs extended further as cost burdens soared, with the pace of inflation reaching a fresh series high. Although output expectations strengthened, employment growth eased as firms struggled to retain staff and find suitable candidates for current vacancies. The seasonally adjusted IHS Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) posted 61.1 in August, down from 63.4 in July, and broadly in line with the earlier released ‘flash’ estimate of 61.2. The latest improvement in operating conditions was the softest for four months, but nonetheless among the strongest seen in the over 14-year series history. Contributing to overall growth was a sharp expansion in production during August, albeit the slowest for five months. Where an increase was reported, it was generally linked to a further upturn in new orders and firm demand conditions. The softer expansion of output was due to capacity constraints including material shortages, according to panellists. New orders continued to increase midway through the third quarter, as client demand rose markedly. Alongside greater customer spending, some companies noted that stockpiling efforts at clients drove new sales. The rate of growth was the slowest since March, however. At the same time, growth in new export orders also softened and was the slowest for eight months. Manufacturers commonly reported that material shortages hampered output growth, as supplier delivery times increased markedly and to one of the greatest extents on record. Longer lead times were attributed to greater global demand for inputs and capacity issues at supplier

Related news

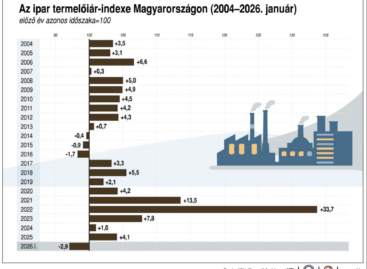

KSH: In January 2026, industrial producer prices were on average 2.9 percent lower than a year earlier and 0.9 percent higher than the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The GKI business climate index rose in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Innovations, success stories and awards on the same stage

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: The volume of exports of food, beverages and tobacco decreased by 5.7 percent, while imports decreased by 13 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >