Vendégszerző: Fekete Zoltán főtitkár Magyar Márkaszövetség It is difficult to grow in the shadows

Our magazine asked Zoltán Fekete, secretary general of Branded Goods Association Hungary to briefly assess the past year.

Guest writer:

Zoltán Fekete

secretary general

Branded Goods

Association Hungary

If we wish to better understand the events of last year, it is worth briefly reviewing where we started. In 2021 there was particularly strong growth, with domestic consumers spending 41.2% more money year-on-year. In 2022 purchasing power got another boost from the government, in the form of personal income tax refunds, a 13th monthly pension, etc. But then came the war and the energy crisis – and with these inflation. By the end of the year food volume sales were down 1.6%, while real spending took a 6.8% dive because of the 26% food inflation. In 2023 the real collapse came from this already poor base, with food volume sales plunging by 4.6%.

Inflation cast a long shadow

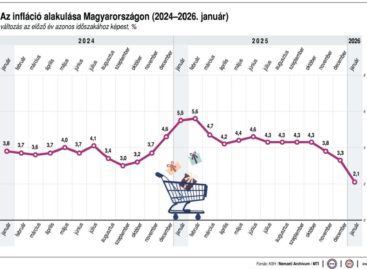

This was the situation in 2024 when domestic retail sales saw a slow, step by step recovery. Inflation slowed down compared to the previous year and consumer confidence returned. According to data from the Central Statistical Office (KSH), the value of domestic retail sales was HUF 19.3tn in 2024, representing a 2.6% increase in volume. At the same time, both cash register data and the practical experience of our member companies indicate: a bounce back and rapid recovery of previous sales levels failed to materialise.

Bence Gerlaki, secretary of state for Tax Affairs, Consumer Protection and Trade of the Ministry of National Economy received Ágnes Fábián, President of the Hungarian Brand Association and Head of Henkel Hungary, at his office

Cautious spending vs. high costs

In 2024 the biggest challenge for brand manufacturers was to overcome consumer cautiousness. Based on feedback from BGA Hungary members, almost everyone did what was required and the targets were basically met, but profitability fell short of previous years. This happened because of a decline in purchasing power and changing consumer habits, plus owing to a significant increase in manufacturing costs. From these EPR and DRS need to be highlighted, which represented a considerable financial burden last year as well. The situation is even more unfortunate because the big FMCG brands all over the world play an active role in the establishment and successful operation of a circular economy. In the past few years BGA Hungary made several recommendations to legislators for improving the EPR situation, but practically to no avail. As regards BGA Hungary, our membership grew last year and we were delighted to welcome Aqua Lorenzo and Ceres to our ranks. Our policy relations have also expanded and strengthened. As an incurable optimist, I believe that every trap can be overcome and every wall can be broken through with a good plan and hard work. We therefore wish BGA Hungary members and retailer partners perseverance and determination, so that together we can overcome the long shadow of inflation and the market can see the light again.

Strong Brands for a Strong Hungary

Established in 1995, BGA Hungary is the collective voice of the local FMCG brands. Our mission is to create for brands an environment of fair and vigorous competition, fostering innovation and guaranteeing maximum value to consumers now and for generations to come. We believe that our brands help create a strong economy, rich culture, and prospering society.

Our members:

Aqua Lorenzo * Bacardi-Martini * Beiersdorf * Bonduelle * Borsodi * British American Tobacco * Brown-Forman * Bunge * Cerbona * Ceres * Coca-Cola * Coca-Cola HBC * Colgate-Palmolive * Coty * Danone * Detki Keksz * Dr. Oetker * Dreher * DunaPro * Ed.Haas * Eisberg * Essity * Ferrero * Freudenberg * FrieslandCampina * GlaxoSmithKline * Globus * Heineken * Hell Energy * Henkel * Hipp * Intersnack * Jacobs Douwe Egberts * Johnson & Johnson * Kaiser * Kométa * Kotányi * L’Oréal * LEGO * Maresi * Marketing Art * Mars * Mary-Ker * Mogyi * Mondelēz * Nestlé * Partner in Pet Food * Pepsi * Pernod Ricard * Philip Morris * Pick * Prémium Kert * Rauch * Red Bull * Roust * Sága Foods * Savencia * Sió-Eckes * Sole-Mizo * Soós Tészta * Szentkirályi * Target Sales Group * Tchibo * Törley * Unilever * Univer * Upfield * Vajda Papír * White Lake * Zwack Unicum

Related news

Inflation has dropped significantly, a cycle of interest rate cuts may begin, while gold soars

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MOHU: 5,200 return points are in operation, but 47 larger settlements still do not have RE points – public “enema” machines may be introduced

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: in January, consumer prices exceeded the values of the same month of the previous year by an average of 2.1 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Tuned to efficiency

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Hygiene on new foundations

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >