The unexpectedly low inflation in June surprised analysts

The Hungarian inflation data published this week caused a pleasant surprise: according to the Central Statistical Office (KSH), consumer prices in June 2024 were on average 3.7% higher than a year earlier. After the release of the latest numbers, several analysts modified their expectations for the rate of monetary deterioration this year, and significantly deviated from the government’s original 6% annual inflation forecast, Portfolio wrote.

The rate of monetary deterioration surprised everyone, so much so that the Ministry of National Economy stated in its reaction on Monday that the decrease in inflation in June exceeded all expectations. In June 2024, consumer prices were on average 3.7% higher than a year earlier. Compared to May, prices did not change on average, food prices fell by 0.3%. It is worth recalling that the government originally calculated an average annual inflation of 6% for 2024, when this year’s budget was submitted to the parliament a year ago. From the domestic inflation data published so far, it could already be guessed that this year’s inflation will be far from 6%, and the new data strengthens these expectations even further.

OTP Bank’s analysts, for example, further reduced their forecast for this year’s annual inflation: they now expect an average price increase of only 3.7% this year, compared to the previously expected 3.8%. They also lowered their inflation expectations for 2025: from the previous 4% to 3.8%. This was primarily explained by the decrease in price dynamics in terms of agri-food prices. They also noted that risks are on the upside, especially after the government announced tax-raising measures, which could increase inflation next year.

Péter Virovácz, senior economist at ING Bank, also highlighted in his evaluation that the downward trend in June inflation caused a surprise compared to the market consensus.

As an outlook, he drew attention to the fact that a more serious level jump in inflation is expected from October, when the inflation rate can already be substantially above 4%. Observing the current basic processes, he sees that the inflation rate may rise above 5% again by December 2024.

The performance of the Hungarian economy seems weak based on the newly received data. In the short term, significant inflationary pressure can hardly be expected from the side of internal demand. In contrast, the labor market remains strong; wage outflows may be higher than expected, which may put additional pressure on the price of services. In addition, the recent government announcements and tax increases will probably find their way sooner or later in the form of price increases. All of these appear as two-sided risks in the inflation outlook, with somewhat more upward risks, he said.

Related news

Spring brought an increase in the price of business invoices

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

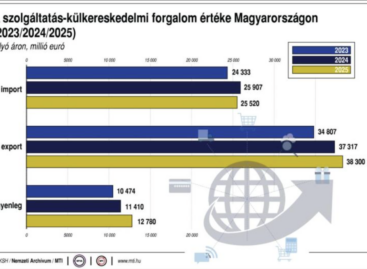

Read more >KSH: The foreign trade surplus in services was 3.1 billion euros in the fourth quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Horseradish export volume has fallen, but its value has increased in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

KSH: retail turnover in January exceeded the same period of the previous year by 3.5 percent and the previous month by 0.5 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >A magyar csapat március 15-én lép színpadra a Bocuse d’Or Európai Válogatóján

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >REGIO Játék: 25.4 billion forints in sales and international opening

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >