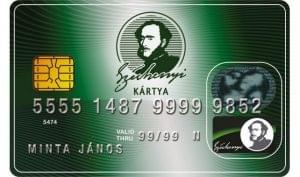

The Széchenyi card program is still decisive in the financing of SMEs

The role of the Széchenyi card program is crucial in the financing of domestic small and medium-sized enterprises (SMEs), which is also confirmed by the statistics of the Magyar Nemzeti Bank (MNB). According to data from the central bank, at the end of June 2024, the loan stock of SMEs exceeded HUF 7,100 billion, which stability is largely due to the support of the Széchenyi card program. Without the program, lending to SMEs would probably have shown a more noticeable decrease.

Although the interest rates on market forint business loans have decreased significantly over the past year, the schemes offered by the Széchenyi card program, available with state support, are still unbeatable. The program’s fixed, favorable interest rates, as well as the predictable terms, ensure that the loan portfolio of SMEs can remain at the same level, while market interest rates are still at a disadvantage – Világgazdaság reports.

Although the interest rates on market forint business loans have decreased significantly over the past year, the schemes offered by the Széchenyi card program, available with state support, are still unbeatable. The program’s fixed, favorable interest rates, as well as the predictable terms, ensure that the loan portfolio of SMEs can remain at the same level, while market interest rates are still at a disadvantage – Világgazdaság reports.

The MAX+ constructions of the Széchenyi card program, which will continue in the second half of 2024, offer a particularly attractive alternative for small and medium-sized enterprises. One of its most important advantages is the low, fixed annual net interest of 5 percent, while it is only 1.5 percent for investment loans financing green credit goals. In addition to the favorable conditions of the program, the fact that it covers a wide range of businesses, including current account, liquidity and investment loans, and even offers leasing structures.

In the case of current account and liquidity-type loans, SMEs can obtain a free-use loan of up to HUF 250 million, with a three-year term. In the case of investment loans, this amount can be up to HUF 500 million, with a term of ten years. With this, the framework of the program fully satisfies the needs of the majority of domestic SMEs.

Related news

New members are flocking to voluntary funds at an unprecedented rate

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >SMEs look to 2026 with positive expectations and growing confidence

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >