Signs of growth are already visible in the Hungarian retail sector

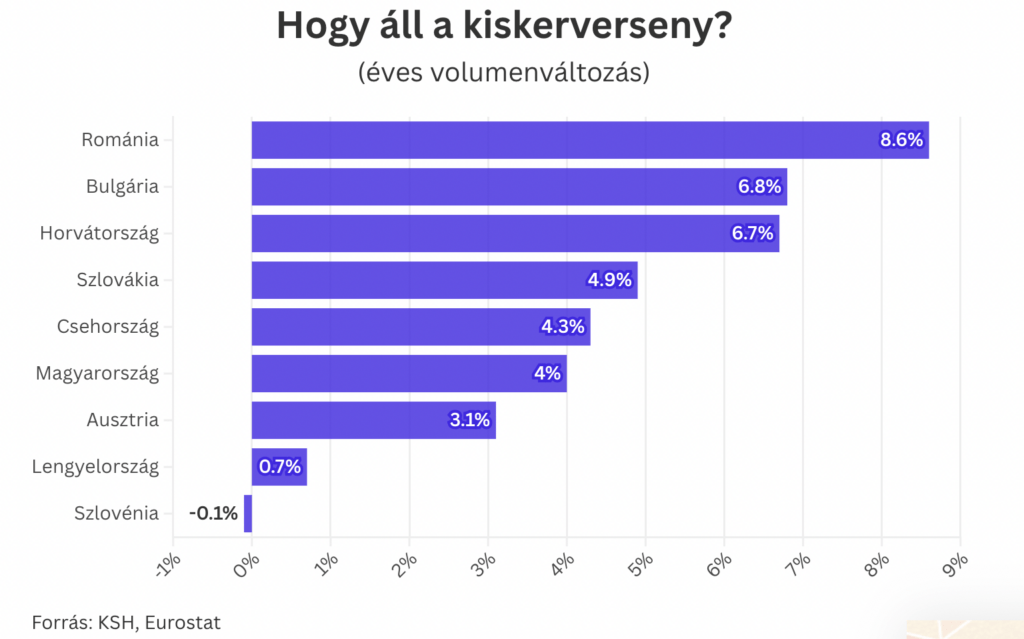

According to the latest statistics, the Hungarian retail sector is already showing signs of growth, but the pace of development lags behind the performance of neighboring countries. While the volume of turnover showed an annual growth of 4% in November 2024, several countries in the region produced much more dynamic results, the MFor article points out.

According to data from the Central Statistical Office and Eurostat, the volume of Hungarian retail turnover increased by 0.7% compared to 2021, exceeding the fluctuating performance of recent years. This is a particularly important result in light of the 3.2% growth measured two years earlier, in November 2022. According to the data, consumer confidence is starting to recover, which can be explained by the stabilization of inflation and the increase in real wages.

International comparison

However, Hungary’s position in regional competition shows a mixed picture. While Romania and Bulgaria recorded outstanding growth of 8.6% and 6.8%, Hungary is in the middle of the pack with a 4% increase. However, the results from Austria (3.1%) and Slovenia (-0.1%) show that the situation of Hungarian consumers is improving compared to neighboring countries.

The slowdown in inflation and the increase in the minimum wage may have a positive impact on retail, but shopping habits remain subdued. Most consumers are focused on basic products, while demand for luxury goods and non-primary necessities remains low.

Outlook for 2025

Based on current trends, slow but stable growth is expected in the retail sector. For Hungary to catch up with the leaders in the region, increasing purchasing power and strengthening consumer confidence are key. In addition, it remains important for stores and economic operators to keep prices competitive and improve the customer experience.

The Hungarian retail sector has started to stabilize, but compared to the results of neighboring countries, there is room for improvement. In the coming period, the decline in inflation and the increase in real wages may offer opportunities for faster expansion, while strengthening customer confidence remains a priority task.

Related news

42 percent of agricultural investments were spent on buildings and structures in 2024

According to preliminary data from the Central Statistical Office, the…

Read more >Eurostat: number of guest nights booked on online platforms shows stable growth in the EU

The number of nights spent in short-term accommodation in EU…

Read more >Low sour cherry harvest expected across Europe this year

Experts are predicting significant crop losses in sour cherry producing…

Read more >Related news

Corporate leaders’ commitment to sustainability at record level

According to the latest data from the K&H Sustainability Index,…

Read more >FAO food price index rose slightly in June due to higher prices of meat, dairy products and vegetable oils

The Food and Agriculture Organization of the United Nations (FAO)…

Read more >What can cause the price of a wine to increase tenfold?

There are fewer of them worldwide than the number of…

Read more >