A third of the population is still looking for ways to eat healthier, and only one in four Hungarians eats consciously

Nutrition is not only the foundation of proper bodily functions, but also plays a critical role in our mental and cognitive health, as well as in the effective operation of our immune system. One might think that this is common knowledge, given the numerous articles, podcasts, and video content produced in recent years covering the features of healthy eating and the latest scientific findings. Unfortunately, reality tells a different story. Only a quarter of Hungarians can be classified as consciously healthy eaters, while for another third, healthy eating holds virtually no importance — as revealed by the representative eTREND 2025 study conducted by Impetus Research.*

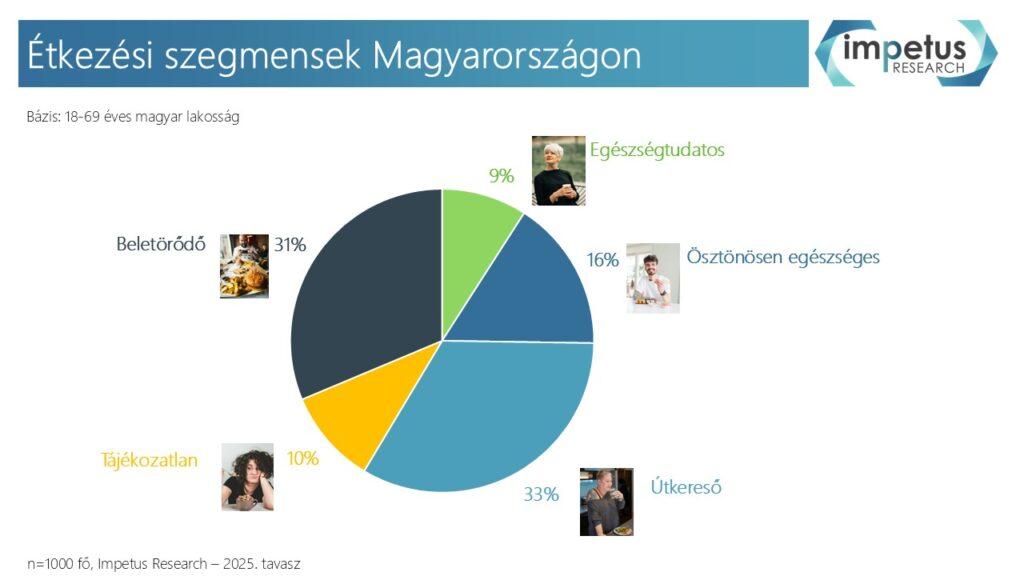

“The research identified five segments within the Hungarian population, only two of which include individuals who eat healthily. Sadly, they represent a minority,” commented Péter Schauermann, Business Development Manager at Impetus Research. The most committed group to healthy eating is the Health-Conscious segment, which comprises only 9% of the population aged 18–69 — approximately 580,000 people. The other group that practices mindful eating is the Instinctively Healthy segment, which accounts for 16% of the population. Together, these two health-focused segments make up 25% of adults, or roughly 1.6 million people.

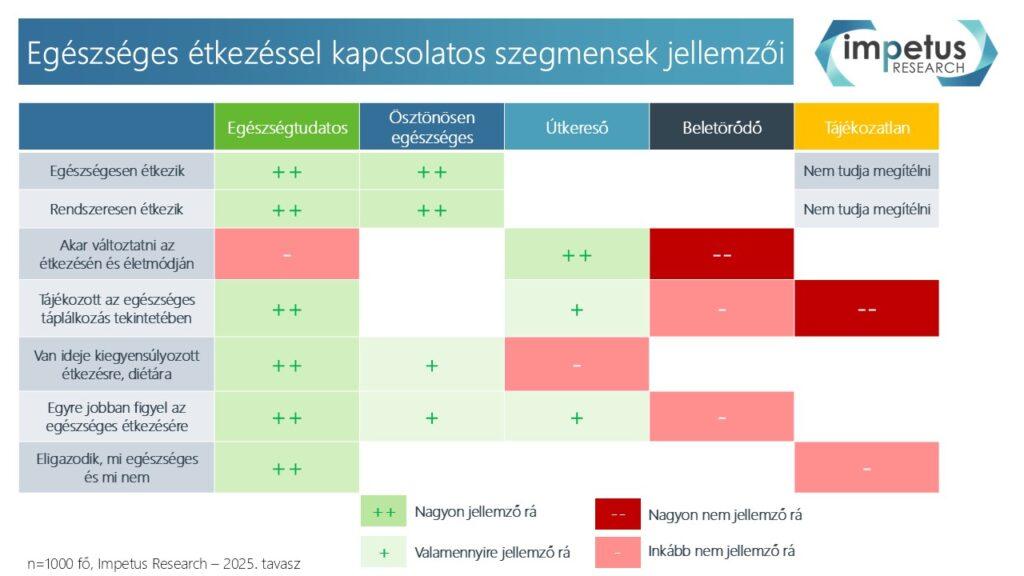

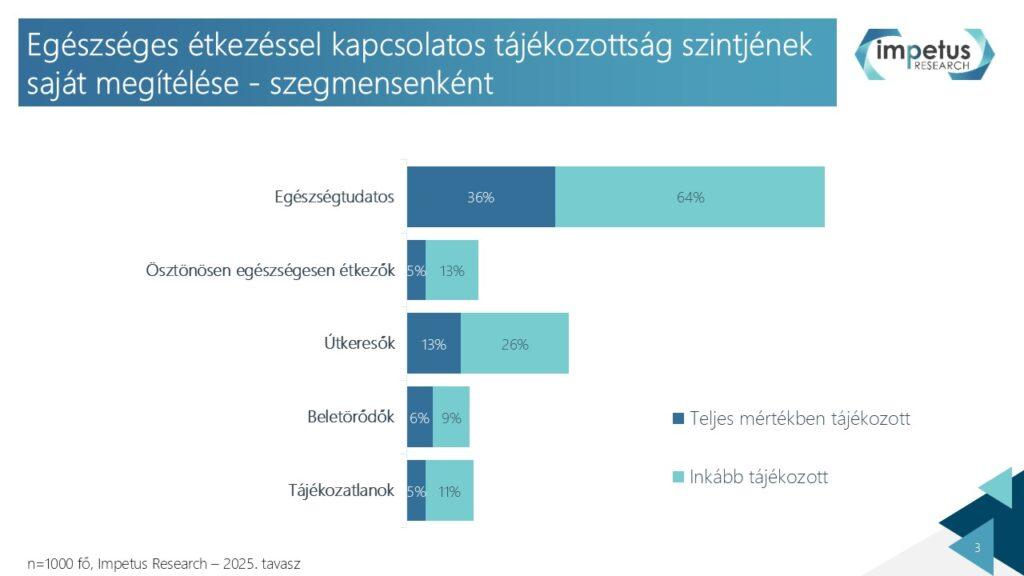

The Health-Conscious segment includes those Hungarians who could be seen as role models in conscious eating. They claim to be highly informed on the topic and frequently seek out information about healthy eating and lifestyle. They not only possess broad knowledge but are also motivated to apply it in their daily lives. They eat regularly, in a varied and healthy manner. They carefully inspect product ingredients when shopping and make informed decisions about quality and content. This segment is the most open to new, healthy, and premium food options. It consists mainly of 55–69-year-olds, urban residents, and university graduates. With above-average income, they represent a primary target group for high-quality, healthy food and drink products — as noted by the Impetus Research expert.

The Health-Conscious segment includes those Hungarians who could be seen as role models in conscious eating. They claim to be highly informed on the topic and frequently seek out information about healthy eating and lifestyle. They not only possess broad knowledge but are also motivated to apply it in their daily lives. They eat regularly, in a varied and healthy manner. They carefully inspect product ingredients when shopping and make informed decisions about quality and content. This segment is the most open to new, healthy, and premium food options. It consists mainly of 55–69-year-olds, urban residents, and university graduates. With above-average income, they represent a primary target group for high-quality, healthy food and drink products — as noted by the Impetus Research expert.

The Instinctively Healthy segment also follows a healthy lifestyle, though they are less informed and conscious about it compared to the Health-Conscious group. They eat regularly and in a balanced way and value the enjoyment of food. They strive to pay attention to what and when they eat, and claim to consume healthy foods and drinks. Their lifestyle often aligns with textbook recommendations: they exercise regularly, and many follow some kind of diet. While they prefer healthy foods — like fish, poultry, and plant-based meals — they are willing to make compromises when it comes to sweets. They are self-critical and admit they are less informed about dietary guidelines and scientific advancements. While they “love life,” they still strive to uphold healthy principles in both diet and lifestyle. Their higher-than-average income allows them to choose healthier products off the shelves.

The Instinctively Healthy segment also follows a healthy lifestyle, though they are less informed and conscious about it compared to the Health-Conscious group. They eat regularly and in a balanced way and value the enjoyment of food. They strive to pay attention to what and when they eat, and claim to consume healthy foods and drinks. Their lifestyle often aligns with textbook recommendations: they exercise regularly, and many follow some kind of diet. While they prefer healthy foods — like fish, poultry, and plant-based meals — they are willing to make compromises when it comes to sweets. They are self-critical and admit they are less informed about dietary guidelines and scientific advancements. While they “love life,” they still strive to uphold healthy principles in both diet and lifestyle. Their higher-than-average income allows them to choose healthier products off the shelves.

One-third of the population would like to eat healthier but are still in the process of learning how. The Seekers segment makes up 33% of the adult population — around 2.1 million people. They honestly admit that they live unhealthily. They try to change from time to time, but struggle to make lasting lifestyle changes. With their busy lives, they lack the time and energy to follow a balanced diet. Many lead sedentary lifestyles and often reward themselves with sweets. They acknowledge that they need to learn more about how to live and eat healthily. Price is a key factor for them — premium products rarely end up in their baskets — though they show significant interest in ready-to-eat or semi-prepared foods. “If this segment receives support through affordable convenience products, they may gradually change their lifestyle. They are particularly open to educational content from brands, which offers a key opportunity for brand engagement,” added Péter Schauermann.

One-third of the population would like to eat healthier but are still in the process of learning how. The Seekers segment makes up 33% of the adult population — around 2.1 million people. They honestly admit that they live unhealthily. They try to change from time to time, but struggle to make lasting lifestyle changes. With their busy lives, they lack the time and energy to follow a balanced diet. Many lead sedentary lifestyles and often reward themselves with sweets. They acknowledge that they need to learn more about how to live and eat healthily. Price is a key factor for them — premium products rarely end up in their baskets — though they show significant interest in ready-to-eat or semi-prepared foods. “If this segment receives support through affordable convenience products, they may gradually change their lifestyle. They are particularly open to educational content from brands, which offers a key opportunity for brand engagement,” added Péter Schauermann.

About 10% of the Hungarian population — roughly 650,000 people — fall into the Uninformed segment. These individuals admit they don’t really know how to eat healthily. Many can’t even tell whether their diet is healthy or unhealthy, as their knowledge is extremely limited. They also lack the motivation to improve their nutrition. Their meals are unbalanced, and they consume the fewest main meals on average. They feel overwhelmed by the flood of dietary information and lack both the time and interest to actively seek out healthy living advice. Although they seem lost, they have not fully resigned, which leaves hope for improvement. Lower-income groups are overrepresented in this segment, making it difficult for them to afford better quality foods, often resulting in cheaper products dominating their purchases.

About 10% of the Hungarian population — roughly 650,000 people — fall into the Uninformed segment. These individuals admit they don’t really know how to eat healthily. Many can’t even tell whether their diet is healthy or unhealthy, as their knowledge is extremely limited. They also lack the motivation to improve their nutrition. Their meals are unbalanced, and they consume the fewest main meals on average. They feel overwhelmed by the flood of dietary information and lack both the time and interest to actively seek out healthy living advice. Although they seem lost, they have not fully resigned, which leaves hope for improvement. Lower-income groups are overrepresented in this segment, making it difficult for them to afford better quality foods, often resulting in cheaper products dominating their purchases.

The Resigned segment — with at least 2 million people — is perhaps the most “left behind.” They pay no attention to their diet, rarely exercise, and are not interested in healthy nutrition. Worse still, they have no intention of changing. They favor traditional Hungarian cuisine and commonly consume white bread, sugary sweets, and carbonated soft drinks. They reject dietary trends and are not open to innovation in flavor or healthier food options. For them, taste, low price, and convenience are the three most important criteria when choosing food. Nutritional value is among the least relevant — if considered at all. Although many have moderate income, they show a high preference for ready-made meals, purchasing them whenever possible. “This group lacks both the financial means and the openness to embrace a healthier lifestyle. If they remain stuck in this pattern, it could lead to serious health issues in the long run,” warned the Impetus Research expert.

The Resigned segment — with at least 2 million people — is perhaps the most “left behind.” They pay no attention to their diet, rarely exercise, and are not interested in healthy nutrition. Worse still, they have no intention of changing. They favor traditional Hungarian cuisine and commonly consume white bread, sugary sweets, and carbonated soft drinks. They reject dietary trends and are not open to innovation in flavor or healthier food options. For them, taste, low price, and convenience are the three most important criteria when choosing food. Nutritional value is among the least relevant — if considered at all. Although many have moderate income, they show a high preference for ready-made meals, purchasing them whenever possible. “This group lacks both the financial means and the openness to embrace a healthier lifestyle. If they remain stuck in this pattern, it could lead to serious health issues in the long run,” warned the Impetus Research expert.

A significant portion of Hungarian society has yet to embark on the path toward healthier eating and living. Even though information is readily available online, low knowledge levels, financial constraints, time scarcity, and — critically — low motivation present major obstacles. Real change will require not only improved circumstances but also a shift in attitudes, openness, and priorities among consumers — concluded Péter Schauermann.

*Impetus Research has been studying Hungarian consumer habits and their changes through the analysis of questionnaire research and other market data since 2019. Its employees are senior research professionals with extensive market research experience and market knowledge gained in many sectors. You can find more information on the website www.impetusresearch.hu.

Related news

World Rare Disease Day: advances in clinical trials and expansion of genetic diagnostics are essential for the development of precision medicine

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Health is decided at the family table – dietitians show the everyday application of the SMART PLATE® nutritional recommendation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >A fruit day doesn’t cure or sustain you – that’s why most corporate well-being programs don’t work

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Schwarz Group Gets Approval For Acquisition Of La Cocoș In Romania

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The 2026 Marketing Diamond Awards have been presented

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >FAO food price index rises again in February after five months

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >