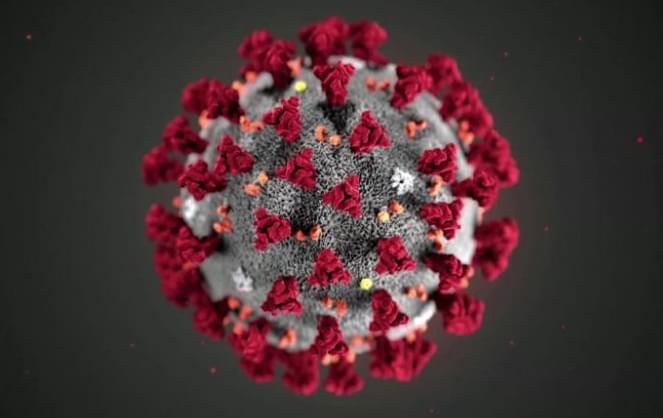

The coronavirus has also affected acquisitions and mergers badly

The acquisition and merger activity was also affected by the coronavirus pandemic, with the U.S. reporting a 83 percent drop in the value of reported transactions in the second quarter, compared to a year before, according to Refinitiv data.

In the United States, 2,064 M&A transactions were announced for the quarter ended June 30, in a total value of 106.4 billion USD. In contrast, there were 2,895 transactions in the second quarter of 2019, with a total value of 622.9 billion USD.

Globally, the value of transactions decreased by 52 percent in the second quarter to 516.6 billion USD, coming from 9,129 transactions. (portfolio.hu, Marketwatch)

Related news

Wizz Air UK receives regulatory approval to operate flights to the United States

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Bottled Topo Chico shortage in the United States: The Coca-Cola Company suspends production until summer

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Aldi: another major American expansion is coming – store openings, logistics and delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Research: Coupons don’t determine which brands we stay loyal to

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >