Consumption could recover in 2025

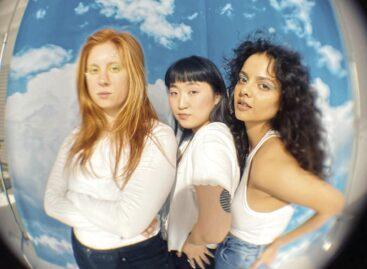

At the end of August the Equilibrium Institute published its quarterly macroeconomic report and PwC partner Gábor Farkas discussed the main points with Ákos Kozák, economic research director of the institute.

This article is available for reading in Trade magazin 2024/10

While household consumption was weak in 2023, leading to a 0.8% GDP drop, it is expected to expand by 1.9% in 2024 and may recover by 2025.

Ákos Kozák (Equilibrium Institute) and Gábor Farkas (PwC)

Hungary is a consumption-driven economy – as reflected in the GDP growth forecast in the previous quarterly report by the institute. It is clear that household consumption – half of which sum is spent in the retail sector – isn’t at its most muscular, and this is also affecting the willingness to invest. It is true that this year’s figures will be better after last year’s dramatic 15% drop in investment, but we are still talking about a 10% plunge, while industrial production continues to struggle.

We are second behind Switzerland in savings

According to Ákos Kozák, domestic e-commerce went above a thousand billion value under COVID, but it failed to transform domestic players into regional players. We are lagging behind the Czech Republic and Poland. Hungarians are more cautious than the European average when it comes to saving, inspired by interest rates in real terms. Hungary is second only to Switzerland when it comes to household savings. It isn’t only high income earners who are saving, but also those who take less home at the end of the month. Low consumer confidence is a typical Hungarian pattern: we don’t buy, we wait and see if we can get what we want cheaper.

Labour market remains a mainstay of the economy

The tight labour market has been loosening slowly in recent months. Unemployment stands at around 220,000-230,000, while the number of vacancies is close to 70,000, suggesting that the tension between labour supply and demand has started to ease. Employment rate remains high, approaching the 5 million level. While the unemployment rate rose to 4.3-4.4% for a few months, the indicator is expected to decline in the longer term, in particular thanks to large investments and foreign capital inflows (FDI) that are creating new jobs. As for the number of foreign workers arriving in Hungary: it has increased significantly in the recent period, with nearly 40,000 new workers. The largest sending countries include Ukraine, the Philippines and Vietnam.

Wage growth and productivity: an outlook for 2024

During the roundtable experts discussed the outlook for wage growth in 2024 and how productivity relates to wage dynamics. In the competitive sector a median gross wage growth of 14% is expected in 2024, in line with the previous quarter’s forecast. At the same time real wage growth is expected to be around 10%, as inflation is will be at 4-4.5%, resulting in high real wage growth for households. Wage growth appears to be outpacing productivity growth: there is a 20% gap between productivity and wage growth. There is also a productivity gap between SMEs and large companies, which in Hungary is three times bigger – this means that an SME produces the same product at three times the cost of a large company, while facing similar competition on wages. //

Related news

Sándor Czomba: net earnings are rising faster than gross earnings

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Generation Z: new rules on the labour market

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Equilibrium Institute: GDP growth this year, but consumption remains the driving force

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) Átadták a SIRHA Budapest 2026 Innovációs Termékverseny díjait

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How does the forint exchange rate affect consumer prices?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >