Inflation moderated to 16.4%, the introduction of the food price cap did not significantly affect it

Inflation decreased to 16.4% in August from 17.6% in July, exceeding expectations, which was primarily caused by the 54.6% increase in sugar prices and the 7.3% increase in pork prices during the removal of price caps, which only was partially offset by the price reduction of several other products. The sharp jump in fuel prices also contributed to higher-than-expected inflation. Due to the strengthening of the forint and the decrease in the prices of manufactured goods, the prices of durable consumer goods and clothing fell. At the same time, the fact that core inflation decreased to 15.2% from the previous month’s 17.5% indicates that inflationary pressure is easing, i.e. the lower-than-expected decrease in inflation was caused by items other than core inflation, writes Gergely Suppan, MBH Bank’s senior analyst.

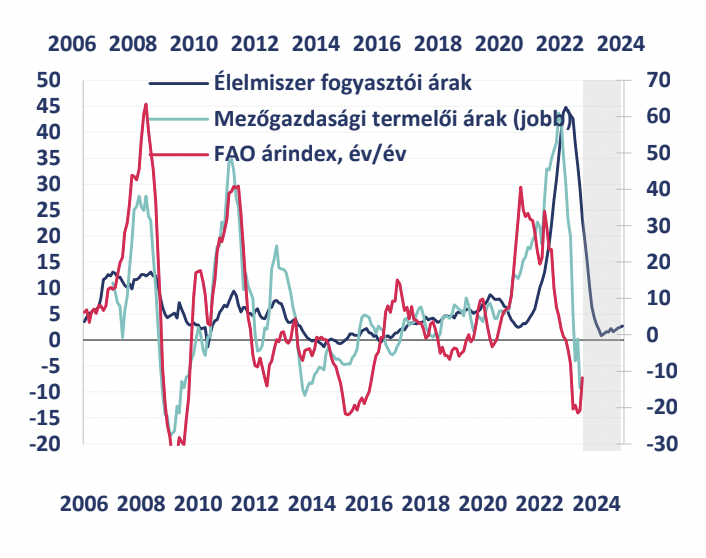

In the rest of the year, we expect a sharp decrease in inflation due to base effects and the increasingly widespread price reductions announced for food products. The base effects can be reinforced by the fact that international raw material, product and energy prices and transport costs have fallen significantly, mostly to 2021 levels, in recent months, so we do not expect new external price shocks, and may even result in further price reductions, bringing the HUF back to last year’s levels and its relative strengthening may also accelerate the moderation of inflation, which can already be clearly observed in the case of consumer durables.

In September, last year’s surge in household energy prices falls out of the base, leading to a further sharp drop in inflation. On the other hand, the rise in fuel prices, the increase in the prices of gambling and some public transport fees in September, as well as the formation of the price-wage spiral observed in some service sectors may slow down the rate of inflation, however, we expect single-digit inflation from November, which may decrease to close to 6% by the end of the year. . Due to the increase in the price of fuels (which is largely caused by production cuts in some oil-producing countries, but other factors also contribute) and the slower-than-expected moderation in the rise in food prices, we are raising our average inflation expectation for this year from 17.5% to 17.8%, while next year’s inflation will be despite the fuel excise tax increase at the beginning of next year, it may decrease to 3.9%.

Related news

Inflation has dropped significantly, a cycle of interest rate cuts may begin, while gold soars

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: in January, consumer prices exceeded the values of the same month of the previous year by an average of 2.1 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >January inflation data paves the way for February interest rate cut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NAK announces digitalization competition for food producers and retailers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >