VAT refunds on vegetables, fruit, and dairy products for pensioners: will it work?

In his annual review speech on Saturday, the Prime Minister announced that in the second half of the year, pensioners will receive a partial VAT refund for purchases of vegetables, fruit and dairy products. He justified the decision by saying that pensioners deserve special attention, as they are particularly sensitive to the rise in food prices. The aim of the measure is therefore to increase the purchasing power of pensioners without the VAT reduction adversely affecting retail trade.

According to the calculations of the Mfor economic portal, the VAT refund amount for an average pensioner could be less than two thousand forints per month. Based on the pensioner price basket survey in early February, a pensioner would receive approximately 1,459 forints of VAT back per month if they shopped in one of the three large domestic hypermarket chains. Due to the higher prices in convenience stores, a slightly larger amount may be refunded here, but in general, it can be said that the amount of the subsidy does not exceed two thousand forints.

According to the calculations of the Mfor economic portal, the VAT refund amount for an average pensioner could be less than two thousand forints per month. Based on the pensioner price basket survey in early February, a pensioner would receive approximately 1,459 forints of VAT back per month if they shopped in one of the three large domestic hypermarket chains. Due to the higher prices in convenience stores, a slightly larger amount may be refunded here, but in general, it can be said that the amount of the subsidy does not exceed two thousand forints.

If we look at the entire pensioner society – around 2.4 million people – the measure would cost the state budget around HUF 50 billion annually.

The Hungarian National Association of Accountants (MKOE) has drawn attention to the fact that implementing the VAT refund could impose a significant administrative burden on both shops and the state. Several questions arise:

How will pensioners be identified during purchases?

How will it be ensured that the refund actually reaches the affected parties?

Which state body will monitor and process the transactions?

One possible form of abuse is for families to make purchases in the pensioner’s name in order to be entitled to the VAT refund. If the pensioner’s personal presence is also required, this could lead to him/her also purchasing the affected products for the family, which are financed by other family members.

Stores will need special software support to handle VAT refunds, and the state will need to designate an organization to perform data verification and payments. There is also the question of whether the refunded amount is considered income, and if so, what tax rules apply to it. Another problem is if the pensioner does not have a domestic bank account, as this makes the processing of payments even more complex.

Visszajelzés küldése

Related news

Róbert Zsigó: The purchasing value of pensions has increased by 25 percent since 2010

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

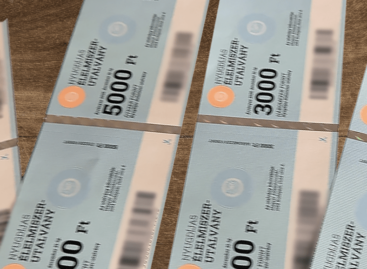

Read more >Delivery of pensioner food vouchers has been completed

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Nestlé to sell remaining ice-cream assets but commits to Froneri venture

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >