Lidl safeguards its supply lines

Lidl needs to secure its meat supply on the German home market. Meat plants owned by sister banner Kaufland will start supplying part of the discounter’s self-service ranges. Schwarz Produktion, the production arm of Lidl’s parent company Schwarz Group, is expanding its capacities by strategic acquisitions.

Lidl wants to safeguard its supply lines for meat products and increase its independence from price hikes by suppliers. In future the German discounter plans to source part of its meat products from the meat plants of sister company Kaufland. As Lebensmittel Zeitung reports, one respective legal production entity, ‘Kaufland Fleischwaren DC’, was already renamed to the more neutral ‘Fleischwaren Neckarsulm’, which would figure on product packaging supplied to both sales banners.

Most leading retailers in Germany operate their own meat production facilities. According to the meat industry publication allgemeine fleischer zeitung Kaufland’s meat production plants ranked number 13 amongst Germany’s largest meat producers and number 3 amongst German retailers in 2022. The Kaufland meat factories generated an estimated net revenue of 849 million euros. ‘Edeka Südwest Fleisch‘, the meat plants of one of the seven regional cooperative entities of the German grocery market leader, reached a revenue of around 975 million euros in the same period. Rewe Group’s ‘Wilhelm Brandenburg’ took second place with 857 million euros.

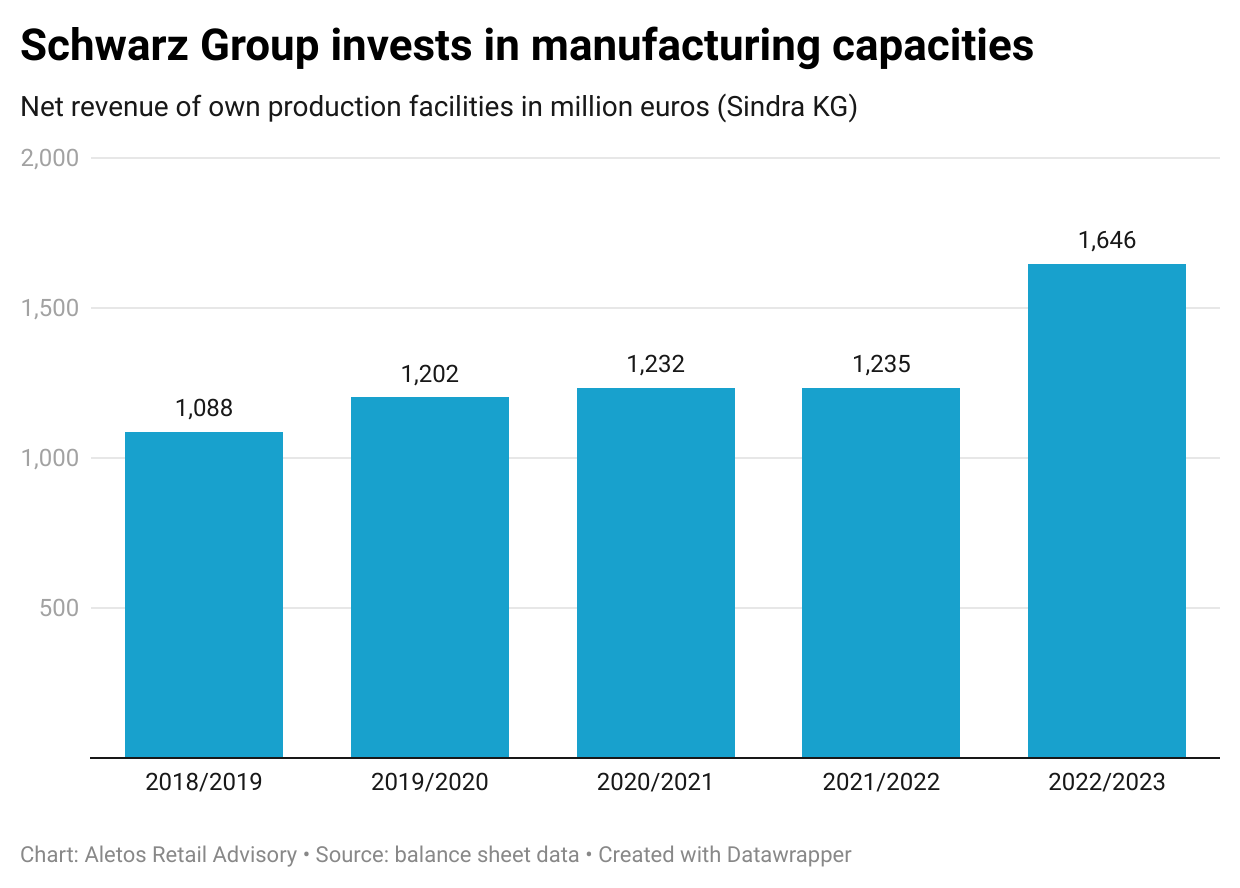

Schwarz Produktion, the production arm of Lidl’s and Kaufland’s parent company Schwarz Group, has massively stepped up its own production capabilities in the recent past. The net revenue of Sindra, the holding company under which most of the retailer’s production facilities are consolidated, in business year 2022/2023 jumped by more than 33% to 1.65 billion euros net revenue, according to balance sheet data. The average annual revenue growth in the previous periods came up to around 5% (see chart). Sindra KG produces chocolate, nuts, dried fruit, baked goods and ice cream.

According to the company’s annual report in business year 2022/2023 the holding expanded its product portfolio with coffee and pasta products.

German retailers increasingly integrate backward into manufacturing to strengthen their competitive position. Market leader Edeka last year alone filed three new deals at the competition agency: An increase of its minority share at the dough producer Panem Backstube GmbH to a majority stake, the takeover of the mineral water bottler Petrusquelle and the acquisition of Italian pasta producer Pasta Rey.

Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >ZEW: Economic expectations worsened in Germany and the euro area in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >