New technology supports data-based electronic invoicing

The National Tax and Customs Administration has taken a big step to support the spread of data-based electronic invoicing. The long-awaited invoice visualization tool is ready, with which you can create an invoice image from the online invoice data services available in XML format. According to Grant Thornton’s experts, this is an important step on the way to the transition to electronic invoicing planned by the EU.

NAV XML has now become a national standard for the description of invoice data, which the majority of invoicing and accounting programs used in the country already understand or can be easily adapted to understand.

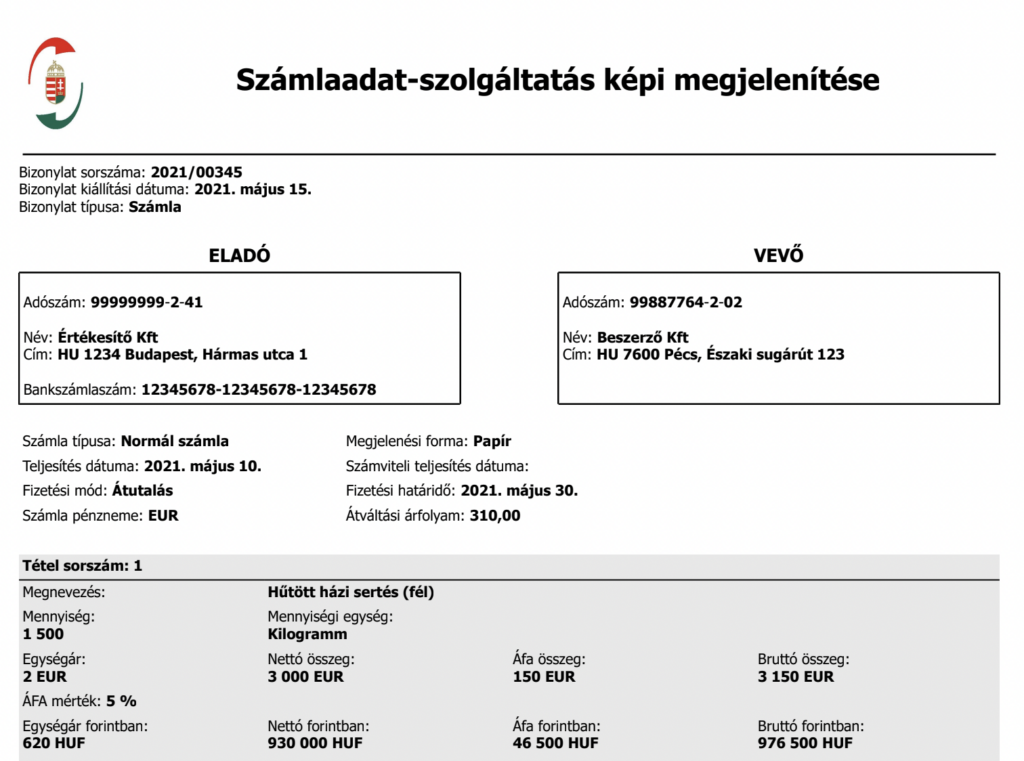

With NAV XSLT, the tax office has released a visualization solution for this data structure, with which it is now possible to unify the invoice images. Thanks to the mandatory online invoice data service, the NAV XML file containing the data is automatically created for every invoice issued domestically, which can be sent to the customer very simply through the tax office’s system. In the traditional invoicing process, the customer looks at the invoice received in image format and records the invoice data, i.e. creates data from the image.

Related news

Webinar: How to Digitize and Automate Your Company’s Invoice Management – November 18

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Medium-sized companies are the new drivers of sustainability

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >BinX and Számlázz.hu would automate the entire Hungarian SME sector

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >