The developer has revealed new details about the recently launched qvik payment system

The qvik payment service has been introduced in certain Príma stores, part of one of Hungary’s most significant domestic retail chains. Initially, the retail chain enables the implementation of qvik in select stores where the self-checkout system is supported by Raiffeisen Bank’s financial acceptance service.

As of January, customers can use their mobile phones and mobile banking app approval to pay at self-checkouts in select Príma stores, adding to the range of available payment options. Qvik is a domestically developed mobile payment solution that is available free of charge to all retail customers. Since September 1, 2024, the service has been accessible via any mobile banking app in Hungary, eliminating the need for users to download an additional app to utilize qvik payments.

How does payment work?

- qvik – instant payment

The customer scans the products as usual at the self-checkout and selects qvik instant payment from the available options.

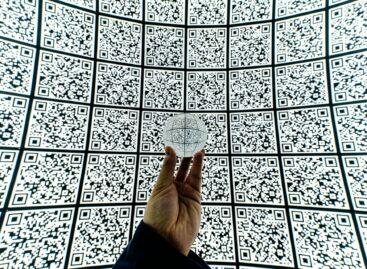

- QR code

They scan the displayed QR code with their mobile phone.

- Approval

Using the mobile banking app that opens on their phone, they approve the payment details.

CBA is no stranger to QR code-based payments, as the retail chain quickly adapted the new payment solution on a trial basis following the introduction of the Instant Payment System. Based on previous positive experiences and the September regulation by the National Bank of Hungary (MNB), qvik-QR payments are poised for renewed momentum.

“Our network’s goal is to be an innovative player in the retail competition, not only in terms of products sold but also in introducing modern and secure payment solutions. The introduction of qvik mobile payments is another step in this direction.”

— stated Vilmos Lázár, President of CBA.

The MNB has set a strategic goal to establish a fast, secure, and cost-effective electronic payment solution for merchants. Since January, CBA has been one of the first to offer this innovative payment option. Merchants can now provide customers with a simple and automatically accessible payment method. Customers only need to scan the QR code displayed on their phones and approve the payment, making qvik not only fast but also highly secure.

The National Bank of Hungary welcomed the launch of qvik acceptance services by Raiffeisen Bank in September 2024. Besides the retail chain, Raiffeisen Bank has enabled qvik payments in several smaller commercial units, where transaction numbers continue to grow. Significant emphasis is placed not only on solutions integrated into cash register systems in cooperation with Laurel Ltd. but also on its own Scan&Go mobile payment app, which could serve as an excellent acceptance solution for smaller players.

Both customers and merchants benefit from this technology, which is also of national strategic importance. Hungary is a pioneer in this field in Europe, but qvik is expected to become mandatory across the EU shortly.

“Over the past three decades, Laurel has always been at the forefront of introducing new retail payment solutions, and this is no different with qvik, considered an advanced version of the Instant Payment System (AFR) 1.0 launched in 2022.”

— explained Attila Bessenyei, CEO of the company.

The qvik payment system debuted at the Príma store located in Munkásotthon Street in District IV, Budapest, under the aegis of CBA L&F Ltd., and will initially be available in nine stores within the domestic chain. This is an entirely new technology, independent of other payment systems. On the customer side, a Hungarian bank account and mobile banking app are required, while merchants need a service provider to handle payment transactions. It is noteworthy that the pending PSR EU regulation will mandate this payment system for banks and payment service providers operating within the EU.

The qvik payment system debuted at the Príma store located in Munkásotthon Street in District IV, Budapest, under the aegis of CBA L&F Ltd., and will initially be available in nine stores within the domestic chain. This is an entirely new technology, independent of other payment systems. On the customer side, a Hungarian bank account and mobile banking app are required, while merchants need a service provider to handle payment transactions. It is noteworthy that the pending PSR EU regulation will mandate this payment system for banks and payment service providers operating within the EU.

For qvik acceptance services, the MNB encourages all retailers to follow CBA’s example and introduce this safe and cost-effective domestic payment solution in their stores or online shops. Merchants and entrepreneurs can find more information on the MNB’s official website via the following link:

https://mnb.hu/qvik/vallalkozoknak

.

Related news

Free qvik for customers has been launched

K&H Bank also launched qvik, the QR code mobile payment…

Read more >In the CBA Príma stores, the purchase of price-capped eggs is already restricted

Another response to the widening of the price cap has…

Read more >AKI monitors prices in ever more places

The market price information system (PÁIR) of the Institute of…

Read more >Related news

Trump’s tariffs could have serious consequences

Donald Trump’s latest tariff hike plans could have even more…

Read more >Albanian cabbage dumping in Eastern Europe – exports increased by 71% at the beginning of the year

Albanian cabbage exports to Eastern Europe have increased dramatically in…

Read more >Croatia is expecting a record summer

The 2025 summer season promises unprecedented air traffic in Croatia,…

Read more >