Retail investments are entering a new era

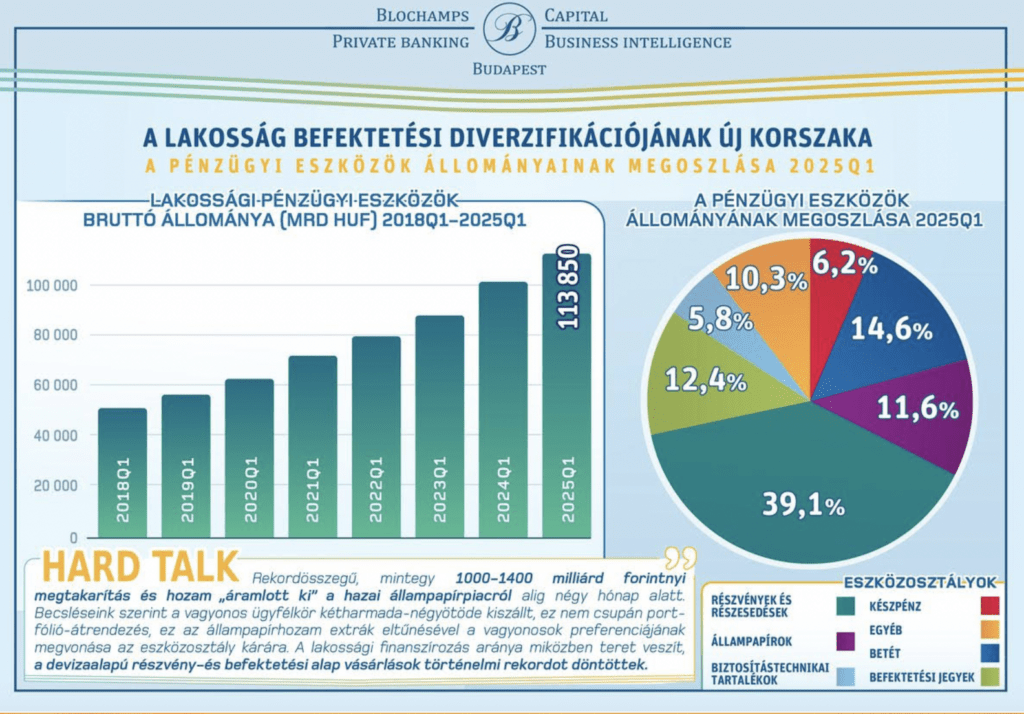

“The private banking client has long stopped thinking like a housewife,” says István Karagich, CEO of Blochamps Capital. According to the company’s data, the premium segment still holds the majority of its assets in cash, investment funds and deposits, while private banking clients diversify in a much more complex and conscious manner. According to Karagich, however, the expansion of real equity exposure could not realistically be expected for many years, as long as the state offered bond-based, secure returns with distorted market advantages.

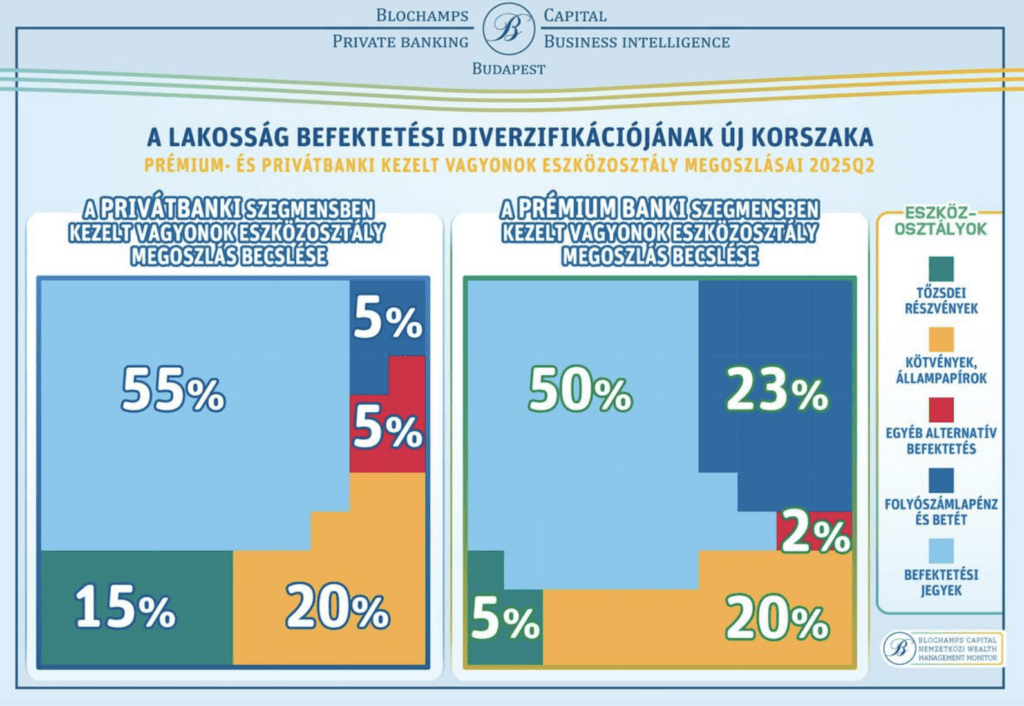

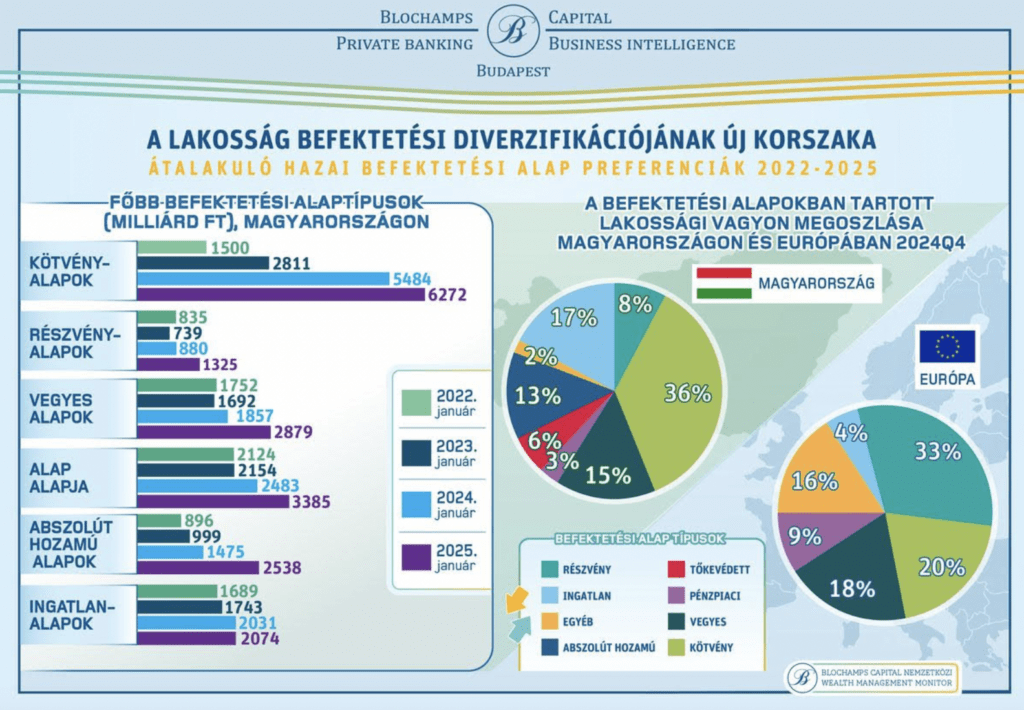

The asset management strategies of Hungarian private banking and premium banking clients differ dramatically – especially in the management of liquid assets, such as cash and current account deposits. According to Blochamps Capital’s latest analysis for the second quarter of 2025, while a significant portion of private banking (PB) clients consciously stay away from immediately accessible, but typically low-yielding assets, premium clients tend to follow the retail pattern and keep their liquidity reserves mainly in “parking” assets. The good news is that the trend is changing, and the winner of the change is the investment fund asset class in all asset segments!

Retail thinking is clearly reflected in premium accounts

According to Blochamps data, only 5 percent of private banking clients’ assets are parked in current accounts or deposits, and only 5 percent are so-called “other”, typically cash-type assets. In contrast, these figures show a dramatic difference for premium clients: 23 percent are deposits, and over 20 percent are “other” assets, i.e. current account money and cash are actually considered liquid elements. This clearly shows that the premium segment still follows the classic retail logic – seeking security, immediate accessibility, complete risk aversion – while private banking clients understandably have a much higher level of financial awareness and portfolio-based thinking. According to István Karagich, CEO of Blochamps Capital, this difference leads to the fact that, with a slight exaggeration, the clear negative outcome of the past 20 years is that the upper middle class, which represents premium and affluent clients, can only grow slowly, so their hands are tied in their financial thinking and they must continue to think like housewives and savers. Private banking clients, who make up the top 1% of wealth, on the other hand, are among the European leaders not only in terms of structuring their assets, but also in terms of their investor needs, awareness and logic.

Blochamps Capital – Hungary’s leading private banking analyst firm – can draw a more accurate picture of the asset allocation of wealthy clients based on the data and projections it collects than other estimates-based reports. According to the company, analyses often cited in the market (which typically follow the methodology of the Hungarian National Bank) assume significant cash holdings in the private banking and premium segments, even though in reality clients do not usually entrust these amounts to bank asset management. Thus, service providers can only have an uncertain picture of the amount of cash based on client statements, points out István Karagich.

Related news

KSH: industrial production in January fell by 2.5 percent compared to the same period of the previous year, and increased by 1.5 percent compared to the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >OTP Deputy CEO: After a strong year, they are successfully progressing with the strategy

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MKIK seeks partnerships with businesses and government

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NAK announces digitalization competition for food producers and retailers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home or parcel machine? It’s been revealed how Hungarians order and what they fear most about delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >