New economic “action plan”: Is it realistic to further increase household loans?

An unfortunate consequence of the domestic housing crisis is that the majority are unable to buy a home on their own, but are forced to take out a loan for this purpose. For this reason, the government wants to encourage the population to take out loans with more and more credit programs (Bababáró, mönkáshitel, CSOK+, village CSOK). The question arises: where is the limit to the expansion of the household loan portfolio?

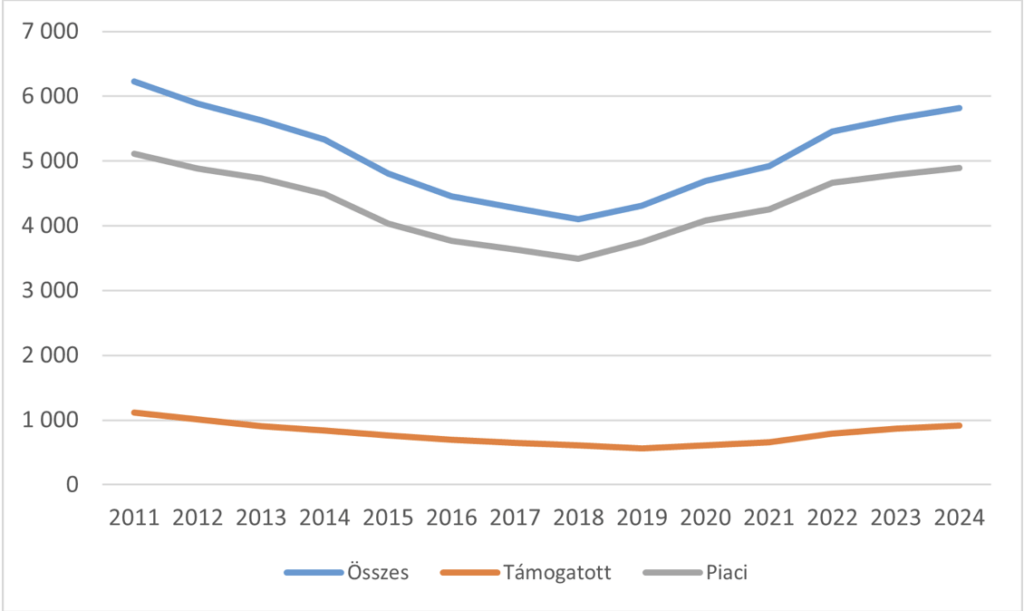

In 2011, 1.25 million of the nearly 4 million households had housing and/or mortgage loans, which decreased to 800,000 by the first quarter of 2024. In addition, 250,000 people took out the baby loan, which can also be used to buy a home.

The number of domestic housing and non-residential mortgage loan contracts

(in the first quarter of the given year, piece)

Source: MNB

An unfortunate consequence of the domestic housing crisis is that the majority are unable to buy a home on their own, but are forced to take out a loan for this purpose. For this reason, the government wants to encourage the population to take out loans with more and more credit programs (Bababáró, mönkáshitel, CSOK+, village CSOK). The question arises: where is the limit to the expansion of the household loan portfolio?

In 2011, 1.25 million of the nearly 4 million households had housing and/or mortgage loans, which decreased to 800,000 by the first quarter of 2024. In addition, 250,000 people took out the baby loan, which can also be used to buy a home.

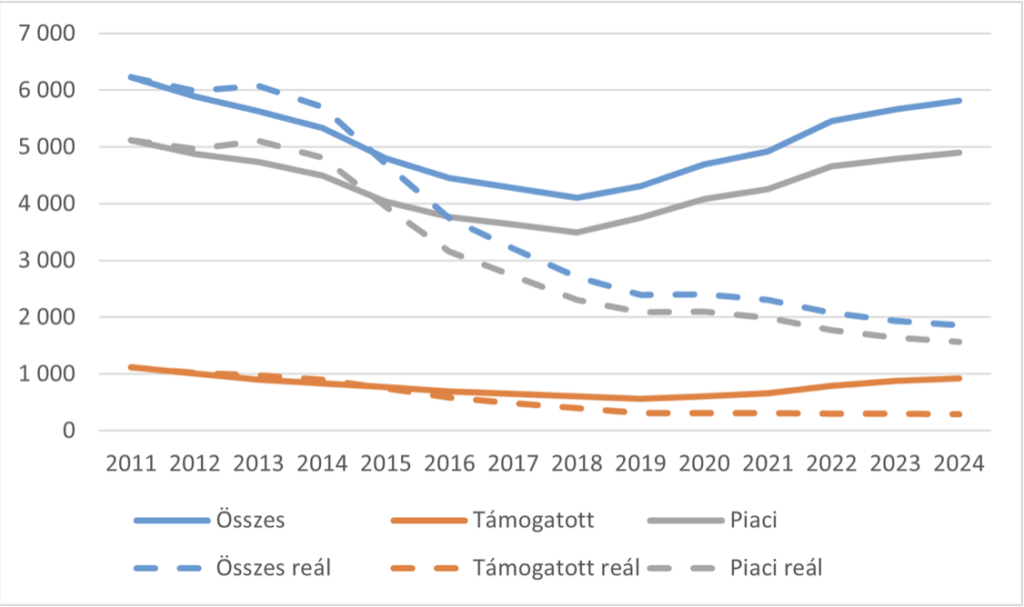

The value and real value of the domestic mortgage loan portfolio

(in the first quarter of the given year, HUF billion)

Source MNB

According to the MNB’s 2020 population survey, 1,400,000 households already had a mortgage or home loan. If we correct this value by the number of mortgage and home loans, which has decreased by 60 thousand since then, we get 1,340,000 household loans, of which 90% are presumably owned by active households (1,200,000 loan contracts).

It is worth comparing this with the number of creditworthy active households. According to the KSH’s 2023 grouping according to per capita income quintiles, there is a good chance that only the top three income quintiles are “eligible for a housing loan”, which means 1,900,000 active households. From this, it is advisable to subtract the households of the top two wealth tenths that did not previously have a loan (400,000 households), who are not in need of borrowing. Thus, approximately one and a half million active households are creditworthy, of which 1,200,000, or 80%, already have real estate or free-use mortgage loans.

In summary, it can be said that approximately 80% of creditworthy Hungarian households already have real estate or personal mortgage loans, which calls into question the usefulness of further loan programs targeting this group. Furthermore, it is important to take into account that we only examined the number of real estate and mortgage loans. Taking additional loans (car, current account, credit card or other) into account, an even larger proportion of society already has loans, which can be barriers to programs encouraging further household borrowing.

Related news

Related news

GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >