High interest expenses continue to burden Lidl’s profits

Lidl’s international business can slightly increase its profitability in the fiscal year 2023/2024. Skyrocketing interest expenses cancelled out improved gross margin and stable staff costs. Investments in new stores and real estate drop significantly.

Lidl slightly increases profitability. The balance sheet data published this week by Lidl Stiftung & Co. KG for the past fiscal year 2023/2024 (end of February) show that the discounter achieved a higher gross margin in its foreign subsidiaries and was also able to keep personnel costs stable.

The Lidl Foundation increased its international net sales by 8.3% to 88.6 billion euros. The difference to the net sales of 125.5 billion euros announced earlier this year is due to the fact that the German and French operations are only partially included in the financial figures of the Lidl Stiftung.

Despite intensifying price wars in several markets towards the second half of the financial year, Lidl increased its gross profit margin from 23.7% to 24.5%, although this is still below the pre-inflation level of 26.5%, which was also a rough reference point for the five years before that. Despite double-digit wage increases in several countries, personnel costs remained at the same level as the previous year, at 8.4% of net sales. The number of employees on a full-time basis rose only slightly to 184,500, an increase of 0.7%. Staff productivity itself increased significantly from 446 thousand euros net sales per full-time employee in 2022 to 480 thousand euros in 2023.

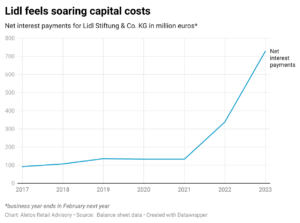

Despite higher gross profit and stable personnel costs, the net profit margin increased only slightly from 2.0% to 2.1%. This is due to interest expenses doubling for the second year in a row. While in 2021 the discounter paid 153 million euros or 0.23% of net sales to service financial liabilities, in 2022 the figure jumped to 360 million euros or 0.44% of sales. In the now published reporting period, the indicator doubled again to 728 million euros or 0.82% of net sales. At the same time, Lidl reduced its net financial liabilities by 15.7% from 14.8 billion euros to 12.5 billion euros.

The higher cost of capital is reflected in the slowdown in new store openings. Lidl put the brakes on its expansion and opened just over 160 stores in the period under review, compared to 340 in the previous year. Mirrored in the financial results, investments in property fell by 32.5% to 2.4 billion euros in the period under review. For the current financial year, the discounter has further slowed down its store opening rate, with only 42 net new stores having been opened six months into the new financial year.