Investor sentiment is unbroken, but caution is heightened

2022 was a year of geopolitical tensions, high interest rates and runaway inflation around the world, which resulted in a strong decline in the corporate acquisition market after 2021. DLA Piper Hungary’s transaction experts have prepared a summary of the economic factors behind the decline after the most active transaction year of all time.

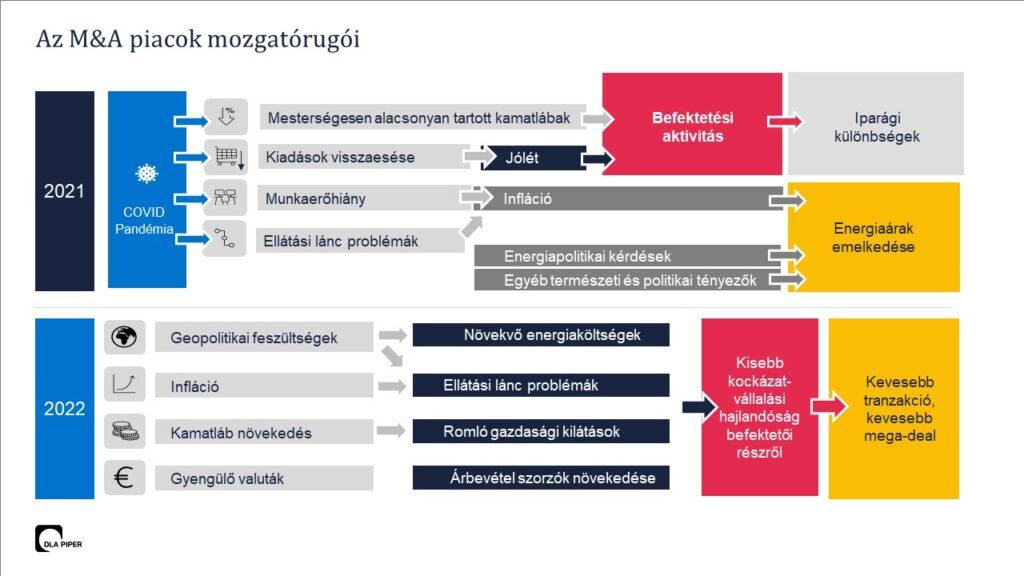

While the year 2021 was mainly about the pandemic, in 2022 geopolitical tensions had the greatest impact on the M&A transaction markets. Regarding the two years, significant differences can be observed in several factors, however, from an economic point of view, last year’s market picture is similar in many respects to the situation caused by Covid-19 a year earlier.

The lockdown associated with the epidemic and the consequent disruptions in supply chains brought with it a decline in consumption. The reduction of expenses in this way, and not for economic reasons, as well as the interest rates, which have been kept low for a long time, resulted in an increase in investment activity. Transaction activity was exceptionally high in some sectors, such as the TMT (technology, media and telecommunications), energy and food-tech sectors.

In 2021, according to previous expectations, the mergers and acquisitions market was characterized by different optimism and accompanying activity depending on the industry, in contrast, in 2022, the desire to invest fell uniformly in all sectors.

Related news

DLA Piper Hungary / Omnibus proposal: necessary simplification or step back in sustainability efforts?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Nearly €6 Billion in GDPR Fines Since 2018

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Consumer protection news: what to expect in 2024?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Research: Coupons don’t determine which brands we stay loyal to

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >