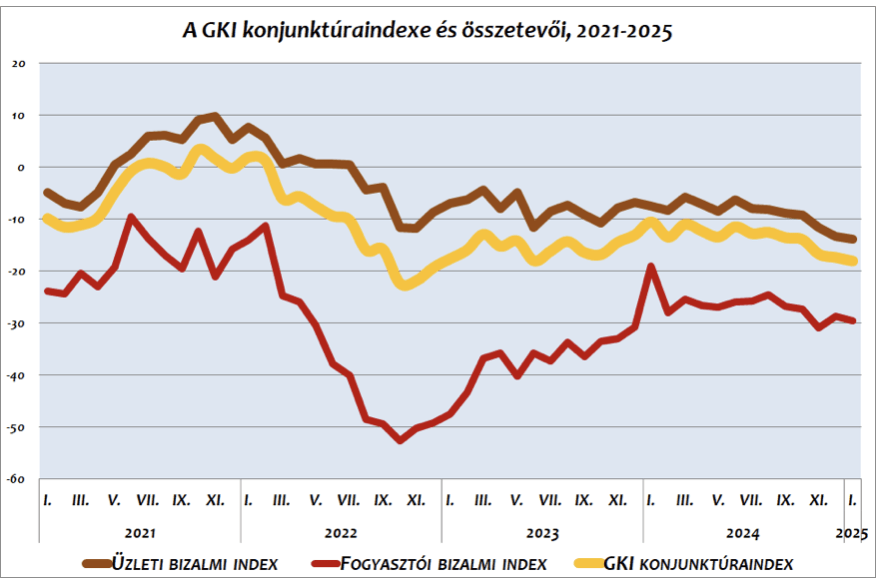

GKI business climate index at nineteen-month low

The slightly negative trend continued in the first month of this year: according to a survey by GKI Economic Research Ltd. – conducted with the support of the EU – the business sector and consumer prospects have also deteriorated compared to December, although in both cases only within the statistical margin of error. The GKI business confidence index still fell to a 19-month low. However, the predictability of the business environment has improved slightly.

The GKI business confidence index fell within the statistical margin of error in January, but also fell to a 50-month low. The industrial and construction confidence indices rose within the margin of error compared to the previous survey. At the same time, the trade index fell slightly, and the confidence indicator of business service providers fell significantly. Trade remains the least optimistic sector and business services the most optimistic.

The employment indicator, which indicates the aggregate willingness of enterprises to employ, fell slightly in January compared to December, and this indicator fell to a 19-month low. Employment intentions in industry, construction and services deteriorated compared to the previous month, while trade showed an improving outlook. In the next three months, 9% of companies are planning to increase their workforce, while 14% are planning to lay off workers.

After two months of deterioration, the assessment of the predictability of the business environment improved noticeably in January compared to December.

The price indicator, which summarizes the pricing plans of the business sector into a single number, decreased slightly in the first month of this year compared to the previous month. Price increase intentions strengthened only in trade, while they weakened in the other sectors. Half of the companies would like to increase prices in the next three months, while only 5% are planning to reduce prices.

Related news

GKI economic sentiment index begins 2026 with a small decline

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The GKI business climate index started 2026 with a minimal decline

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Tourism Business Index: improving sentiment, but the sector remains in the red

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lamb Days – Gastronomic Adventure is coming again on March 28–29!

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >