Tag "áfa"

The volume of retail sales in Romania increased by four percent

Date: 2015-07-07 11:09:50

The volume of Romanian retail sales increased by 4 percent in the first five months of the year, compared to the same period of last year – the Romanian National...

Read more

VAT on food decreased by 9 percent in Romania

Date: 2015-06-01 11:10:35

The government decree on the extension of the reduced VAT rate entered into force in Romania on Monday. The manufacturer and distributor companies should use a 9 percent VAT rate...

Read more

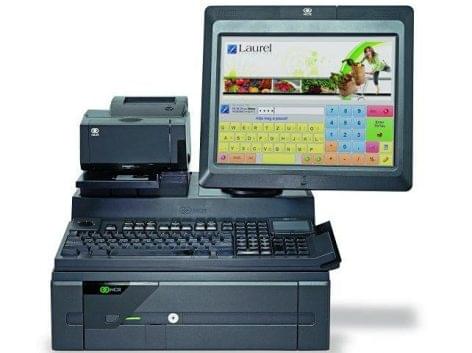

One hundred and fifty billion HUF whiteout in the economy thanks to the online cash registers

Date: 2015-05-27 11:35:24

According to the calculations of the Central Bank’s analysts, the online cash registers whitened the economy in 2014 with about 150 billion HUF – portfolio.hu wrote. The analysts of the...

Read more

Excessive administration against VAT frauds hampers growth

Date: 2015-05-12 11:30:11

VAT frauds cost nearly 200 billion euros for the EU member states every year. In Hungary 25 percent of the VAT is swallowed by the traders. However the increase of...

Read more

The government will continuously monitor the effects of the VAT reduction on pork

Date: 2015-04-24 11:45:36

According to the government spokesman, the effects of the VAT reduction on pork will be continuously monitored. The datas will shop that similar steps may be introduced in other sectors....

Read more

The Poultry Product Council asks for same judgment as the pig sector in taxation

Date: 2015-04-23 11:55:15

The Poultry Product Council (BBT) asks for same judgment as the pig sector in taxation. According to the Poultry Product Council there is no technical reason that while the Value...

Read more

The VAT on pig carcass will be reduced to five percent

Date: 2015-04-21 11:50:06

The proposal causes debates among the domestic players of the meat sector. It proposes to decrease the VAT on pig carcass from 2016 to 5 percent from the current VAT...

Read more

VAT on food to be reduced from June in Romania

Date: 2015-04-07 11:18:09

The VAT on all the food products and non-alcoholic beverages will be decreased to 9 percent from June in Romania – Victor Ponta Prime Minister announced on Tuesday at a...

Read more

The VAT reduction on drinking milk could be an element of utilities reduction

Date: 2015-04-02 11:50:38

The VAT reduction on drinking milk to 5 percent could be an element of utilities reduction – the president of the Milk Marketing Board Interprofessional Organization told in Budapest on...

Read more

The NGM investigates the possible effects of the VAT reduction

Date: 2015-03-25 11:43:35

The Ministry of National Economy (NGM) is examining the financial and real economic impact of the reduction of the value added tax (VAT), but the primary goal is to make...

Read more