Significant tax changes are coming in Slovakia: VAT increase and cuts to reduce the budget deficit

The Slovak government presented its new consolidation package, which fundamentally changes the country’s tax system.

Contrary to Prime Minister Robert Fico’s previous promise, the basic value-added tax (VAT) rate will be increased as part of the package, from 20% to 23%, Infostart reported. At the same time, the VAT on basic foodstuffs is reduced: from 10% to 5%, while a tax rate of 19% applies to other foodstuffs.

Finance Minister Ladislav Kamenický’s 17-point package of measures envisages cuts worth a total of 2.7 billion euros, which includes both spending reductions and revenue increases. The goal is to reduce the budget deficit from 5.6% to 4.7% in 2024.

Related news

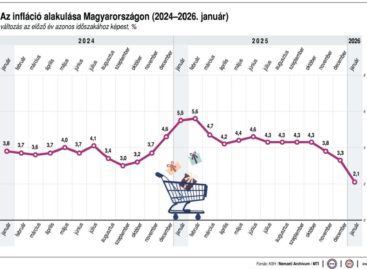

Inflation has dropped significantly, a cycle of interest rate cuts may begin, while gold soars

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: in January, consumer prices exceeded the values of the same month of the previous year by an average of 2.1 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >January inflation data paves the way for February interest rate cut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) Átadták a SIRHA Budapest 2026 Innovációs Termékverseny díjait

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How does the forint exchange rate affect consumer prices?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >HELL CITY has arrived, led by Michele Morrone

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >