The industrial real estate market is characterized by stabilizing demand and moderate expansion

According to the latest report of the Budapest Real Estate Advisors’ Negotiation Forum (BIEF/BRF) for the third quarter of 2025, the domestic industrial-logistics real estate market is showing moderate but stable growth. The national modern industrial stock now exceeds 5.9 million square meters, of which 3.9 million m² is located in Budapest and its agglomeration, while 2 million m² is located in regional markets.

During the quarter, four new buildings were completed in the capital area – including the Késmárk Industrial Park and the new Rossmann headquarters – which expanded the speculative supply by 54,770 m². In the countryside, Xanga Park in Debrecen increased its stock by 22 thousand square meters, bringing a total of 76,770 m² of new space to the market.

The vacancy rate in the capital city decreased slightly, standing at 13.1%, which is an improvement of 0.3 percentage points compared to the previous quarter. Nationally, the vacancy rate was 11.8%, which is a sign of slowly stabilizing demand.

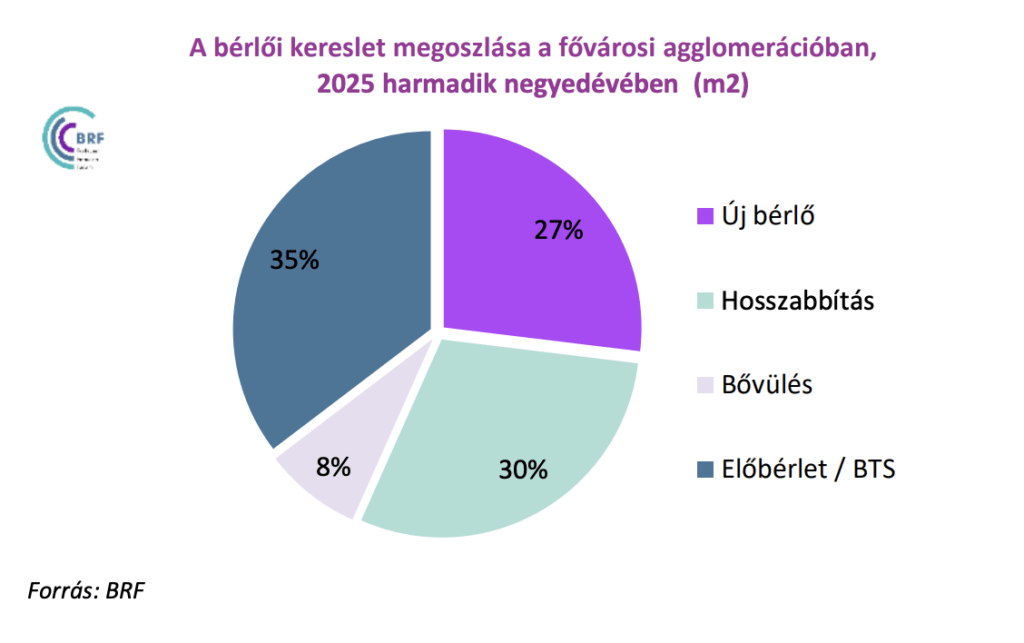

Tenant demand in the Budapest market amounted to 121,850 m², which is 11% higher than a year earlier. 27% of the demand was new leases, 30% extensions, 8% expansions, while 35% was pre-lease agreements. The largest deal was signed at IGPark Nyíregyháza, in the form of a 32,000 m² pre-lease transaction, while a 20,880 m² new lease was signed at Login Business Park in Budapest.

BRF registered a total of 29 lease contracts in the capital agglomeration, the average transaction size was 4,200 m². The net absorption at the national level was 106,080 m², which again shows a positive value – the Budapest area produced an increase of 56 thousand square meters, and the regional markets produced an increase of 50 thousand square meters.

The market therefore continues to expand at a brisk but restrained pace. According to experts, due to the developers’ wait and high financing costs, a balanced but cautious market is expected in the coming quarters, where pre-lease contracts and large logistics parks will remain the most active segments.

Related news

Record investments, new growth paths – Hungary will be present as an attractive investment destination at MIPIM

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Waberer’s will replace around 1,000 devices in its vehicle fleet this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Change in Rossmann Hungary’s leadership: Kornél Németh decided to move towards new challenges in 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >