Stable growth with fewer contracts: the leasing market’s adaptability has reached a new level in 2025

On November 13, 2025, the Hungarian Leasing Association organized its annual professional conference, the Leasing Professional Day, at which key players in the domestic and regional markets evaluated and discussed the results achieved in 2025, as well as the expected trends and changes.

The professional forum of the Hungarian Leasing Association held on November 13 provided a great platform for knowledge sharing between industry players and dialogue supporting the competitiveness of the leasing market.

The professional forum of the Hungarian Leasing Association held on November 13 provided a great platform for knowledge sharing between industry players and dialogue supporting the competitiveness of the leasing market.

During the program, Richárd Szabados, State Secretary for the Development of Small and Medium-Sized Enterprises, Technology and the Defense Industry of the Ministry of National Economy, also gave a presentation, highlighting: “The implementation of the Sándor Demján Program is progressing on schedule, with the aim of stimulating corporate credit demand and stimulating economic growth. The number of companies has been stabilized, but there is mostly a waiting period. Companies are currently increasing their liquidity and saving, but are restraining their investments – this market must be supported with programs to avoid a decline. In this economic environment, the program aims to stimulate investment appetite and support the liquidity of companies with targeted financial instruments.”

The schemes offer preferential financing opportunities through several pillars.

Among others, within the framework of the EXIM Bank Future Exporters loan program, the resource limit of which was increased from the previous 50 billion forints to 70 billion forints, and now, based on the announcement of the State Secretary, it has been expanded to 90 billion forints. In addition, the Széchenyi Card Program (SZKP) offers a fixed, 3% interest loan option for domestic small and medium-sized enterprises.

A total of 6,922 applications have been made worth 387 billion forints. The second most popular SZKP product in terms of number of units is Lízing Max+.

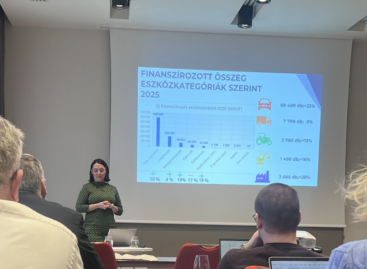

István Zs. Nagy, President of the Hungarian Leasing Association, presented the results of the Leasing Association’s latest report at the event, which summarized the performance of the domestic leasing market in the first three quarters of 2025, as well as the macroeconomic and regulatory factors influencing the growth of the sector.

This is how the domestic leasing market developed in the first three quarters of 2025

The financed amounts increased, while the number of contracts decreased slightly. The corporate sector remains decisive, but the development of the number of residential units – its decrease this year – is largely influenced by promotional financing supported by suppliers. According to the President of the Hungarian Leasing Association, Zs. István Nagy, market processes are significantly influenced by the spread of state and EU-supported leasing structures, which especially help SMEs invest in the high interest rate environment. Car financing remained the driving force of the market, but several sectors – such as agriculture and the construction industry – are also showing strength.

In the first three quarters of 2025, the leasing market increased in terms of the financed amount compared to the same period in 2024, while the number of contracts decreased slightly. The volume of new placements amounted to HUF 728 billion, which represents an annual increase of 6.4 percent. In contrast, the number of concluded contracts decreased by 1 percent, so that a total of 60,413 contracts were in force by the end of the third quarter.

The value of the total leasing portfolio increased by 8.7 percent and reached HUF 2,395 billion. The number of contracts related to the portfolio increased by 8.4 percent compared to the first three quarters of 2024, to 340,530.

The vast majority of the financing volume of leased assets – 91 percent, or HUF 436 billion – was related to enterprises. Based on the amounts, small and medium-sized enterprises make up the majority of the corporate clients of leasing companies with a share of 75 percent, while large companies account for 25 percent.

Fewer deals from importers

The share of the public in the market is much smaller in comparison: only 8.4 percent of the financed stock, i.e. 61.5 billion forints, goes to private individuals. The role of state and other institutional clients is negligible in the segment.

At the same time, István Zs. Nagy drew attention to the fact that “the presence of the public is much more significant in terms of number of units: 17.5 percent of the contracts are related to private customers. In the case of non-fleet car financing, every fourth vehicle was financed by member companies in a private scheme.”

In addition, it is also noticeable that manufacturers and importers offered fewer financing deals in 2025: the number of contracts decreased by 13 percent, while private car sales increased. According to data from the Hungarian Leasing Association, 77 percent of the financed amounts supported the purchase of new vehicles, while 23 percent supported the purchase of used vehicles.

Related news

Companies are waiting, calculating and delivering – new room for manoeuvre on the fleet market

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Festival buzz at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >No matter how much you save, food and gadgets always take the money

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >