The new year started with price increases in Romania, but the prime minister confirmed with a tattoo that VAT will not be increased

In Romania, civil servant salaries, pensions and family allowances have been frozen, several tax breaks have been abolished, dividend tax has been increased and – due to the increase in excise duty – fuel prices will also increase from January 1st, but Prime Minister Marcel Ciolacu has now confirmed in a message tattooed on his arm that VAT will not be increased.

Ciolacu showed the inscription tattooed on his left arm in a short video posted on TikTok on New Year’s Eve, stating that “VAT will not increase!”. According to the caption, the social democratic politician wanted to prove that he was not talking into the air when he tried to disarm journalists who were constantly asking about the expected tax increases and cuts during the election campaign by tattooing the answer on his arm.

Ciolacu showed the inscription tattooed on his left arm in a short video posted on TikTok on New Year’s Eve, stating that “VAT will not increase!”. According to the caption, the social democratic politician wanted to prove that he was not talking into the air when he tried to disarm journalists who were constantly asking about the expected tax increases and cuts during the election campaign by tattooing the answer on his arm.

The G4Media.ro news portal recalled that during his October 28 statement, the Prime Minister not only promised to maintain the 19 percent general sales tax, but also stated that there are no plans to increase the income tax from 10 to 16 percent, since, according to him, Romania still has the highest tax burden on employees (including contributions) for low-income earners in the European Union. According to the newspaper, however, the Prime Minister did not mention that other types of taxes are planned to be increased.

The Agerpres news agency published a summary on Wednesday of the expenses affecting Romanian residents and companies that will increase from January 1.

Among other things, the excise tax on fuels will increase by 25 percent: for unleaded gasoline, it will increase to 2,528 lei (1 lei = 82.42 forints) per 1,000 liters, and for diesel, it will increase to 2,317 lei. Excise duty on beer and sparkling wines will increase by 4 percent.

In the new year, the dividend tax in Romania will increase from 8 percent to 10 percent. The revenue threshold for a company to be classified as a “micro-enterprise”, which entitles it to simplified taxation, will be reduced from the current 500,000 euros to 250,000 euros. Tax breaks for employees in the IT sector, construction, and the agricultural and food industries will be eliminated.

Related news

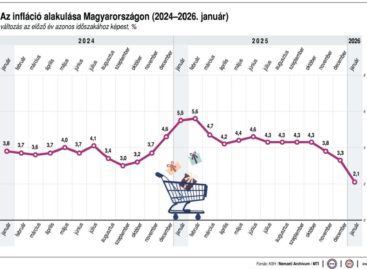

Inflation has dropped significantly, a cycle of interest rate cuts may begin, while gold soars

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >January inflation data paves the way for February interest rate cut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Lidl is building a new administrative and logistics centre in Straubing

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Hygiene on new foundations

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >