Waberer’s may pay dividends from its 2022 earnings record

The management of Waberer’s International may propose a dividend payment of HUF 100 per share, after it closed last year with the highest EBIT (earnings before interest and taxes) of 33.3 million euros (almost HUF 13 billion) since its listing on the stock exchange – read on the website of the Budapest Stock Exchange (BÉT) on Monday in published issuer information.

Compared to 2021, the company increased its EBIT by 22.5 percent, the sales revenue of 675.9 million euros (almost HUF 270 billion) is 14.1 percent higher than the year before. The net result decreased from 18.1 million euros to 16.2 million euros annually, but in the last quarter it increased by 31.8 percent compared to the same period in 2021.

According to the announcement, the 2022 result is outstanding, and moreover, they managed to achieve it under difficult circumstances, since the Russian-Ukrainian war had an unfavorable effect on the company’s operation in several ways. A significant role in overcoming the challenges was played by the fact that a crisis-proof company group structure was created in recent years, they wrote.

Related news

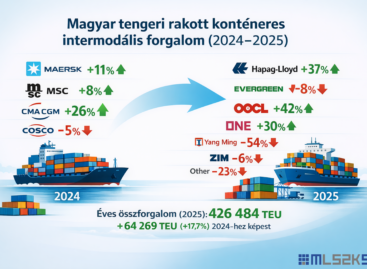

Imports drove growth in sea container traffic in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

ZEW: Economic expectations worsened in Germany and the euro area in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NKFH: inspections focus on discount prices and customer deception

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >