Lidl optimizes international store network

In the first four months of the current financial year, Lidl’s international store opening rate continued to slow down. The discounter closed stores in several key markets. Poland is the leading country in the Lidl universe in terms of store expansion. Investments are being channeled into measures to increase staff efficiency.

Lidl is testing a checkout line with 20 self-checkout points in one of its Polish stores

Lidl continues to slow down its international expansion. According to company data, from end of February to end of June, the first four months of Lidl’s current fiscal year 2024/2025, the discounter added only a dozen net new stores worldwide. Last year, Lidl had already put the expansion of its sales area on the back burner. After 340 net new stores in 2021/2022, only just over 160 stores were added in 2022/2023.

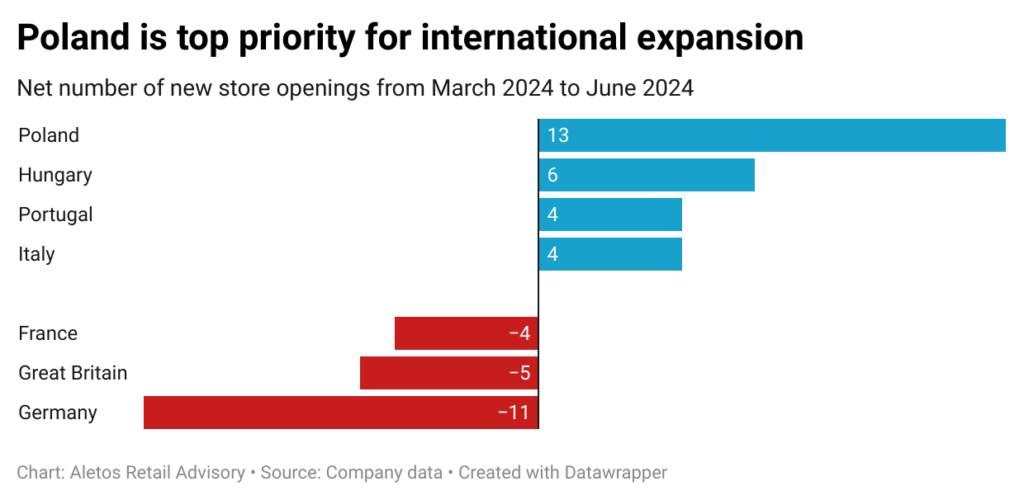

And whereas in the past several new discount stores were opened every year in its home market of Germany, the net number of stores fell by 11 to 3,243 in the analyzed period. In some of its largest international markets, in France and the UK, Lidl has also decided to close selected stores after continuous expansion in previous years. Over the past four months the number in France fell by four locations from 1,600 to 1,596, while in the UK it fell by five from 964 to 959 (see graph). Poland, the largest economy in Lidl’s highly profitable Central and South-Eastern European region, is becoming the retailer’s driving force in terms of store expansion. Lidl Polska, which led all Lidl countries in terms of international expansion with 33 net new stores last year, put 13 new stores on the Polish retail map in the analyzed period. Hungary follows in second place. Despite legal restrictions on store expansion and protectionist tax regulations, Lidl opened 6 net stores in the country in the four-month period.

Investment in boosting store productivity is currently key for Lidl. For the recently completed fiscal year 2023/2024 (end of February), the retailer’s parent company, Schwarz Group, announced that the discounter’s global net sales increased by 9.4% on a euro basis to €125.5 billion, and emphasized that the increase in sales across the group was achieved with the same number of employees as in the previous year.

One area where staff costs can be reduced is at the checkout. Having introduced self-checkouts in all its stores in Poland, the retailer is also investing in redesigning the checkout area in other countries. According to industry estimates, one in five Lidl stores in Europe now has self-checkouts and Lidl plans to roll out up to 10,000 new self-checkouts internationally in the near future. In Germany and Poland, the discounter is currently testing an installation of 16 and 20 self-checkout stations respectively, with only a few traditional checkouts installed.

It remains to be seen whether the expansion of the store network will regain momentum by the end of the year. In the UK, Lidl officially plans to open hundreds more stores. In Germany, too, management has announced plans to open a double-digit number of stores every year in the future. However, this could also include investments in replacing smaller and older stores with new, more modern locations.

Related news

Lidl Magyarország wins Top Employer award once again

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Carrefour Poland Doubles Retail Media Revenue

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lidl is building a new administrative and logistics centre in Straubing

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Store of the Future opens again at the SIRHA Budapest exhibition! (Part 4)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Spring whirlwind at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >