Russian retail looks for growth options

Russian retailers are looking for new ways to increase their market share. Top retailers in the east of Europe are struggling with the same issues as their Western European counterparts: Slowing inflation rates mean that future growth will increasingly have to come from volume sales or sales area expansion. With international growth opportunities limited, not only smaller chains are the victims of increased consolidation on the domestic market.

Growth in the Russian food retail sector is slowing. Market researcher Infoline estimates that the top ten food retailers increased their sales by 14.1% in 2023, down from 21.3% the previous year. As in most European countries, growth in value terms is decelerating. While the inflation rate in Russia at the end of 2022 was 11.9%, according to Tradingeconomics, by the end of 2023 price increases had slowed to 7.4% year-on-year. At the same time, profitable first-tier locations are becoming scarce for bricks-and-mortar businesses, even if the market as a whole is relativelz unconsolidated. With the recent foray into the empty part of the retail map in the Russian Far East, retailers can tap into expansion potential, but risk a decline in store productivity due to stretched supply lines and less dense catchment areas. Market leaders X5 has announced 1,500 new Pyaterochka stores for this year, only 150 of them in the east of the country. At the same time, further penetration of existing territories is largely restricted by national regulations that limit a retailer’s expansion activities to a local market share of 25%.

Consolidation among the top ranks

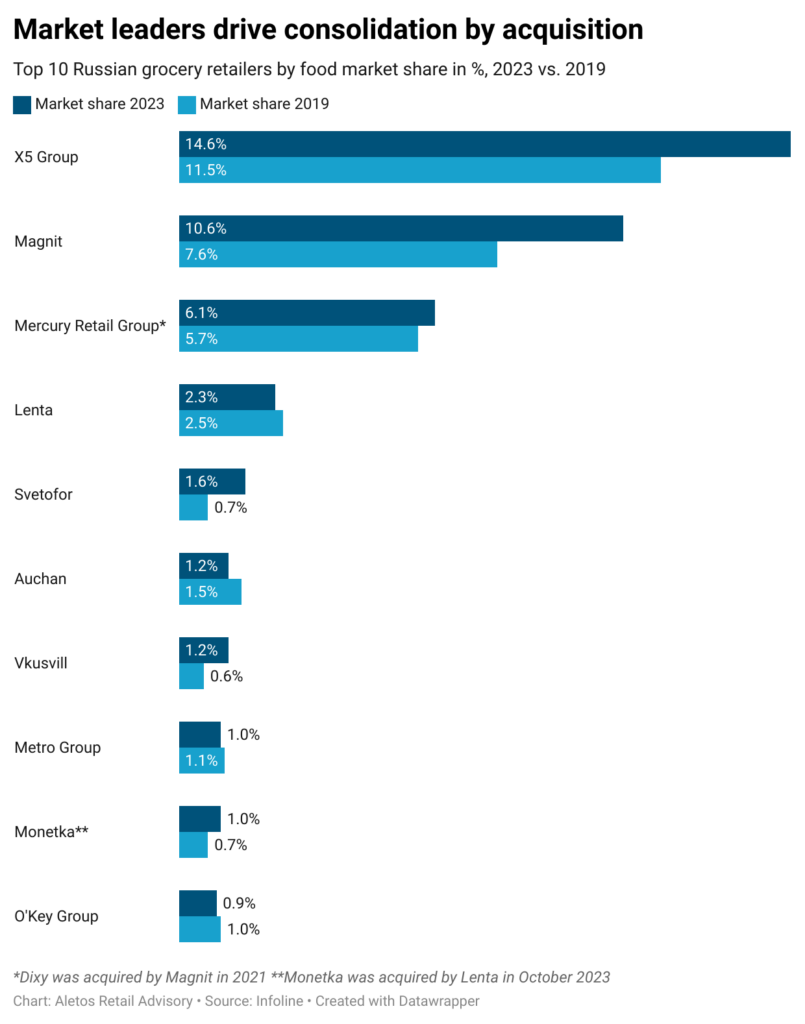

With organic growth limited, the retail giants at the top are using their financial staying power to drive strategic acquisitions. But takeovers are no longer limited to smaller players. Consolidation has also reached the top ten national food retailers. The top five food retailers together currently hold close to 36% of the Russian food retail market. At the end of 2019 the value still stood at less than 29% (see chart).

*A Dixy-t 2021-ben a Magnit vásárolta fel **A Monetkát 2023 októberében a Lenta vette meg

In the recent past, two former national retailers have fallen victim to increased competitive pressure. In 2021, proximity operator Dixy was taken over by Magnit. At the time, Dixy was part of the DKBR retail group, which consisted of Dixy and the Krasnoe & Beloe and Bristol alcomarkets, the number 3 player in Russian retail. In the second half of 2023, Siberian small-format operator Monetka, then the ninth largest national grocer, was acquired by Lenta (Severgroup). Market leader X5 Group has been acquiring regional chains with several hundred stores in recent years.

International expansion so far limited

Room for growth so far has to come from the Russian market. The top national retailers, X5 Group, alcomarket operator Mercury Retail Group and Lenta operate exclusively in their domestic market. The exception is second-placed Magnit, which has been developing its drugstore format M Cosmetic in Uzbekistan since 2022. However, compared to its total store estate of more than 29,000 locations across Russia, the bridgehead of currently 50 stores in Central Asia does not have a significant impact on sales growth. Only the fifth-largest food retailer, hard discounter Svetofor with its European banners Mere and My Price has a noticeable proportion of its store estate outside of Russia. However, most of the 250 internationally operated stores out of an estimated total of 3,000 objects are located in neighboring Belarus.

Related news

From the shopfloor: How to create customer loyalty beyond price competition

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >From the shopfloor: Volkswagen expands its grocery business

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Hard clearance vs. Brand outlet: A closer look at Lidl’s international non food outlet formats

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

A colourful selection of sauces on the Easter table

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >