Lidl’s international business improves profitability

Lidl has strengthened its profitability despite slowing sales growth. The discounter’s international operations increased their net margin to 2.4 percent and achieved a record net profit of 2.3 billion euros in 2024/2025. Rising gross margins and lower debt offset pressure from higher labour and financing costs. Central and Southeast Europe emerged as Lidl’s most profitable region, generating nearly half of total earnings.

Sebastian Rennack

international retail analyst

Aletos Retail

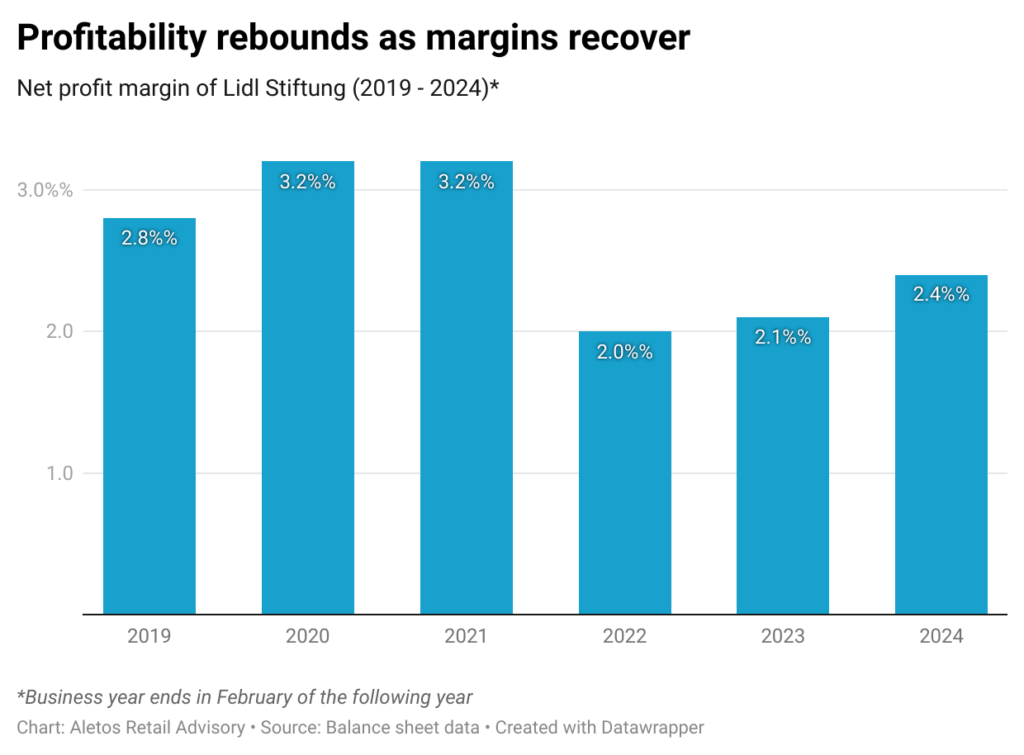

Lidl has returned to higher profitability. After two turbulent years, Lidl is back on a firmer financial footing. As the recently published balance sheet data of Lidl Stiftung for the business year 2024/2025 (ending February) show, the Schwarz discounter increased its net profit margin from 2.1 to 2.4 percent in the reported period. In absolute terms the net profit rose by more than 400 million to 2.3 billion euros.

Net revenue grew by 6.9% to 94.7 billion euro, marking the slowest increase since the onset of inflation in the business year 2022/2023. The total figures are lower than the Schwarz Group’s consolidated net revenue of 132.1 billion euros, because Lidl Stiftung does not include the full operations of Germany and France.

Profitability rebounds as margins recover

Behind the numbers lies a quiet turnaround in two critical areas. One of the two cost factors that had weighed on profitability in recent years, the gross margin, improved by 0.7 percentage points from 24.5 to 25.2 percent – expanding nearly twice as fast as net revenue. Before the onset of inflation in 2021, the figure had stood at 26.5 percent.

The second factor, net interest payments on credits, has stabilised at a high level. Consolidated net interest expenses plateaued at 762 million euros, after 752 million euros the previous year. However, these financing costs still weigh heavily on earnings, consuming around 600 million euros of potential profit, up sharply from just above 150 million euros in 2021 and earlier. In this area, Lidl has taken strong corrective action: the discounter reduced its net debt by 20 percent, from 12.5 billion euros in 2023/2024 to 9.9 billion euros in the past business year.

Closely linked to interest payments is the capital bound in stock. Lidl has also worked on improving its stock rotation. Although year-end inventories increased by around 15 percent, suggesting slower turnover, the company notes in its report that ‘the average stock level declined by 6.9 percent, and the average inventory turnover rose to 11.3,’ indicating tighter flow management despite higher closing balances.

Rising wages test Lidl’s efficiency drive

On the cost side, the positive effects of a higher merchandise margin were partly offset by a noticeable rise in personnel expenses, which increased by 0.4 percentage points to 8.8 percent of revenue. Nevertheless, the previous level of 8.4 percent had been Lidl Stiftung’s best result in recent years. In 2021, personnel costs had still accounted for 9.4 percent of net revenue.

Since 2023, statutory and collectively agreed minimum wages have risen faster than shelf prices in many European markets, structurally increasing labour costs across the industry. Lidl, however, has continued to implement cost-control measures. During the reporting period, the discounter expanded the rollout of electronic shelf labels and self-service checkouts across Europe to enhance operational efficiency. The company’s improved profitability therefore stems primarily from strict operational discipline rather than labour efficiency gains.

Central and Southeast Europe remains a key pillar of profitability

Beyond the group-level improvement, Lidl’s profitability is anchored in Central and Southeast Europe, with the analyzed region stretching from Lithuania and Poland down to Serbia. The nine markets included in the analysis generated 25.2 billion euros in net revenue, an increase of 10.9 percent based on average annual euro exchange rates, representing 26.6 percent of Lidl Stiftung’s consolidated sales. Their combined net profit of 1.0 billion euros accounted for nearly 44 percent of total earnings. With a net margin of 4.0 percent, almost double the group average of 2.4 percent, the region clearly stands out as Lidl’s profit engine within the international portfolio.

In reality, the weight of Europe’s emerging markets in Lidl’s operations would be even higher. The Czech Republic, typically a key contributor to Lidl’s CSEE operations, is excluded from the 2024 analysis because Lidl Česká republika legally changed its company form in 2023, which was accompanied by a shift in the reporting period and resulted in a shortened ten-month financial year. Full-year 2024 data are not yet available. If the 2022 Czech results were used as a proxy, the region’s share of Lidl Stiftung’s consolidated revenue would rise to almost a third and net profit to more than half of total profit – further underlining the strategic importance of these markets within Lidl’s European network.

Poland leads the region

Poland is Lidl’s largest market in the region and the fourth-largest operation within the group overall, behind Germany, the United Kingdom, and France. The country generated a recalculated 9.6 billion euros in net revenue, representing an 8.9 percent increase in local currency, and achieved a net profit of 390 million euros, corresponding to a 4.1 percent margin.

Romania follows with nearly 5 billion euros in sales, expanding revenue by 10.5 percent, and posting a net profit of 245 million euros. With a 4.9 percent margin, Romania, together with Croatia, ranks among Lidl’s most profitable subsidiaries.

The other markets included in the analysis, Slovakia, Slovenia, Croatia, Serbia, and Lithuania, all display solid profitability and steady revenue development. While Lidl has scaled back investments in store network expansion in some of these countries in recent years, Hungary and Bulgaria still achieved double-digit growth rates in local currencies, underscoring the region’s continuing momentum.

Related news

Mere in Lithuania: Rapid growth and a hard discount niche left open by Lidl

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lidl Netherlands Aims For 46% Healthy Food Sales By 2030

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

EY Businessman of the Year: Tibor Veres is the grand prize winner, six special awards were also given out

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >dm’s Together for Babies program continues this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >